Rockwell Automation (ROK) Earnings Meet Estimates in Q1

Rockwell Automation Inc. ROK reported adjusted earnings of $2.11 in first-quarter fiscal 2020 (ended Dec 31, 2019), which met the Zacks Consensus Estimate. However, the bottom line declined 5% from the prior-year quarter figure of $2.21. Lower organic sales, higher investment spending, and unfavorable mix, partially offset by a lower share count and lower tax rate, led to the overall decline in earnings.

Including one-time items, the company’s earnings came in at $2.66 per share compared with 66 cents reported in the year-ago quarter.

Total revenues came in at $1,684.5 million, up 2.6% compared with the prior-year quarter. Moreover, the top line figure outpaced the Zacks Consensus Estimate of $1,625 million. Organic sales in the quarter were down 1%, while foreign-currency translations had a negative impact of 0.9%. However, acquisitions contributed 4.5% to sales.

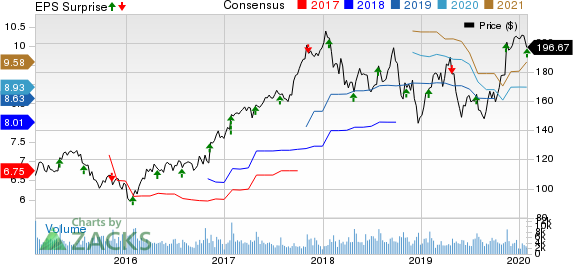

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Rockwell Automation, Inc. price-consensus-eps-surprise-chart | Rockwell Automation, Inc. Quote

Operational Update

Cost of sales rose 9% year over year to $982 million. Gross profit decreased 5% to $703 million from the year-ago quarter’s $739 million. Selling, general and administrative expenses rose 4% year over year to $403 million.

Consolidated segment operating income totaled $339 million, down 10% from the prior-year quarter’s figure of $375 million. Segment operating margin was 20.1% in the fiscal first quarter compared with the prior-year quarter’s 22.8%.

Segment Results

Architecture & Software: Net sales declined to $752 million in the fiscal first quarter from the $753 million in the prior-year quarter. While organic sales were up 0.7%, currency translation had a negative impact of 1%. However, acquisitions contributed 0.1%. Segment operating earnings came in at $224 million compared with the $237 million reported in the prior-year quarter. Segment operating margin contracted 29.8% in the quarter compared with 31.5% in the comparable period last year, thanks to higher investment spending.

Control Products & Solutions: Net sales increased 5% year over year to $933 million in the reported quarter. Organic sales declined 2.5%, while currency translation reduced sales by 0.8%. Inorganic investments increased sales by 8.2%. Segment operating earnings plunged around 17% to $1115 million from the year-ago quarter. Segment operating margin was 12.4% compared with the prior-year quarter’s 15.5% on account of Sensia one-time items, unfavorable mix, and lower organic sales.

Financials

As of Dec 31, 2019, cash and cash equivalents totaled $926 million, down from $1,018 million as of Sep 30, 2019. As of Dec 31, 2019, total debt was $2,278 million, up from $2,257 million as of Sep 30, 2019.

Cash flow from operations in first-quarter fiscal 2020 was $231 million compared with the $212 million generated in the prior-year quarter. Return on invested capital was 33% as of Dec 31, 2019, compared with 39% as of Dec 31, 2018.

During first-quarter fiscal 2020, Rockwell Automation repurchased 0.5 million shares for $100 million. As of the quarter end, $1 billion was available under the existing share-repurchase authorization.

Fiscal 2020 Guidance

The company anticipates fiscal 2020 adjusted earnings per share in the band of $8.70-$9.10. The mid-point of the guided range suggests year-over-year growth of 3%. Organic sales growth is expected in the range of negative 1.5% to positive 1.5%. Inorganic sales growth is expected at around 4% for the year while currency translation impact is expected to be a negative 0.5%.

Share Price Performance

In a year’s time, Rockwell Automation’s shares have gained 13.3% compared with the industry’s growth of 5.6%.

Zacks Rank & Stocks to Consider

Rockwell Automation carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are DXP Enterprises, Inc. DXPE, SPX FLOW, Inc. FLOW and Cintas Corporation CTAS. While DXP Enterprises and SPX Flow sport a Zacks Rank #1 (Strong Buy), Cintas carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

DXP Enterprises has an estimated earnings growth rate of 10.5% for the ongoing year. In a year’s time, the stock has appreciated 13.6%.

SPX FLOW has a projected earnings growth rate of 9.1% for 2020. The company’s shares have gained 38.6% in the past year.

Cintas has an expected earnings growth rate of 15.7% for the current year. The stock has surged 48.9% over the past year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Cintas Corporation (CTAS) : Free Stock Analysis Report

SPX FLOW, Inc. (FLOW) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance