Roblox Corp (RBLX) Q1 2024 Earnings: Misses Revenue Estimates and Reports Increased Net Loss

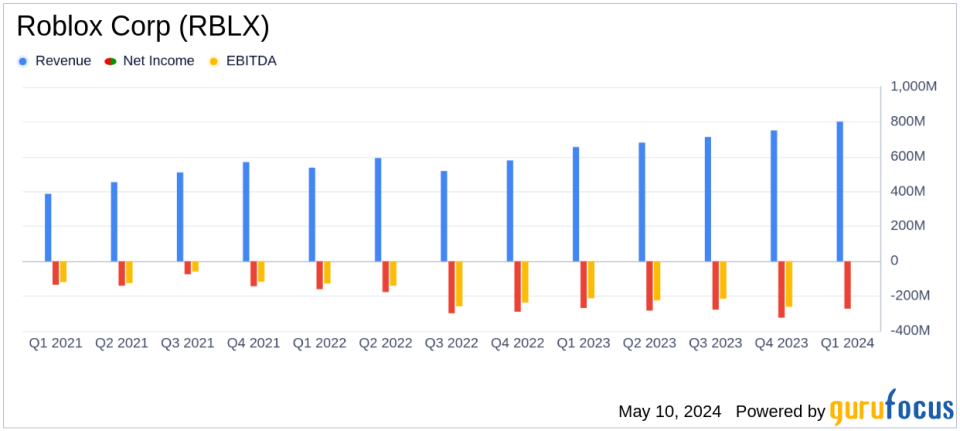

Revenue: Reported at $801.3 million, up 22% year-over-year, below estimates of $922.98 million.

Net Loss: Consolidated net loss was $271.9 million, above the estimated net loss of $335.53 million.

Free Cash Flow: Achieved a record $191.1 million, marking a 133% increase year-over-year.

Average Daily Active Users (DAUs): Increased by 17% year-over-year to 77.7 million.

Bookings: Totaled $923.8 million, up 19% from the previous year.

Adjusted EBITDA: Recorded at -$6.9 million, reflecting adjustments for deferred revenue and costs.

Operational Efficiency: Capital expenditures reduced by nearly 50% compared to the same quarter last year.

On May 9, 2024, Roblox Corp (NYSE:RBLX) disclosed its first quarter financial results for 2024, revealing a mix of setbacks and significant cash flow improvements. The company reported revenue of $801.3 million, a 22% increase year-over-year, yet fell short of the expected $922.98 million. The net loss widened to $271.9 million from the previous year, missing the estimated net loss of $335.53 million. Roblox's detailed financial performance can be accessed through its 8-K filing.

Roblox operates a unique platform that combines gaming and social interaction, allowing users to create and monetize content. This quarter, the platform saw a 17% increase in daily active users and a 15% rise in engagement hours, highlighting its growing appeal. Despite these gains, the company's losses have expanded, underscoring the high costs associated with maintaining and expanding its user base and infrastructure.

Financial Highlights and Strategic Initiatives

The company's bookings stood at $923.8 million, indicating a robust 19% growth, driven by an increase in monthly unique payers and a higher average booking per user. Notably, net cash provided by operating activities surged by 37% to $238.9 million, and free cash flow impressively grew by 133% to $191.1 million. These figures reflect Roblox's enhanced operational efficiency and optimized cost management strategies over the quarter.

Roblox's strategic initiatives this quarter focused on refining user experience and platform monetization. CEO David Baszucki highlighted efforts to enhance the platform's AI-driven discovery algorithms and reintroduce major events, which have started to positively impact user engagement metrics. CFO Michael Guthrie noted the reduction in infrastructure and safety costs and a nearly 50% cut in capital expenditures compared to last year, contributing to the record free cash flow.

Operational and Liquidity Status

Roblox reported a solid liquidity position with $2.5 billion in net liquidity, ensuring ample flexibility for future investments and operational needs. The balance sheet remains robust with significant increases in cash and short-term investments, totaling over $2.4 billion.

Outlook and Forward Guidance

Looking ahead to Q2 2024, Roblox expects revenue between $855 million and $880 million and bookings potentially reaching up to $900 million. The company also projects a consolidated net loss in the range of $265 million to $267 million and an adjusted EBITDA of up to $38 million. For the full year, Roblox anticipates revenue up to $3.525 billion and bookings as high as $4.1 billion, alongside a significant improvement in adjusted EBITDA, reflecting ongoing operational optimizations.

Conclusion

While Roblox faces challenges in narrowing its net losses, the company's strong growth in user engagement and successful cash flow management highlight its potential resilience and strategic adaptability. Investors and stakeholders will likely watch closely to see if these positive trends can eventually translate into sustained profitability.

For detailed insights and ongoing updates, stakeholders are encouraged to follow Robloxs financial developments through its investor relations site and upcoming earnings calls.

Explore the complete 8-K earnings release (here) from Roblox Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance