Robinhood (HOOD) Launches its Crypto Trading App in the EU

Robinhood Markets, Inc. HOOD introduced the Robinhood Crypto application for eligible iOS and Android customers throughout the European Union (EU). The platform enables customers to trade more than 25 cryptocurrencies including Bitcoin, Ether and Solana’s SOL. This is in line with HOOD’s plans to expand globally.

This is the first ever custodial crypto platform where the customers would be entitled to receive a percentage of their trading volumes back every month in the form of Bitcoins. Also, new customers would earn up to 1 Bitcoin when they sign up for this account and make a trade of at least €10. Further, existing customers could win 1 Bitcoin for each approved referral if the referred person trades €10 of crypto. This is however, a limited time offer.

Johann Kerbrat, general manager of Robinhood Crypto stated, “We believe crypto is the financial framework for tomorrow and that it plays a significant role in our mission to democratize finance for all”.

He added, “For this reason, we’re thrilled to expand crypto trading to customers throughout the EU, enabling them to buy and sell their favorite tokens safely and securely. The EU has developed one of the world’s most comprehensive policies for crypto asset regulation, which is why we chose the region to anchor Robinhood Crypto’s international expansion plans”.

Along with having low cost Robinhood Crypto trading platform provides a mechanism where customers can see that there are no hidden fees involved in the transactions. Also, HOOD displays the spread on application, showing the rebate that it receives on sell and buy orders. Thus, the process of revenue generation by the company is made transparent for the customers.

About a month ago, HOOD was planning to start its cryptocurrency trading in the EU, as more banks and financial institutions started embracing cryptocurrencies after witnessing increased demand for the emerging market.

Though the company’s third-quarter crypto-related revenues fell almost 55% from the prior-year levels to $23 million primarily due to a slowdown in trading activity, we believe that the market has great potential for growth in the upcoming-period.

Apart from expanding operations in the crypto market, Robinhood is growing its international presence. In line with this, it rolled out brokerage services in the U.K. earlier this month. Notably, this will be its third attempt to enter the U.K. market.

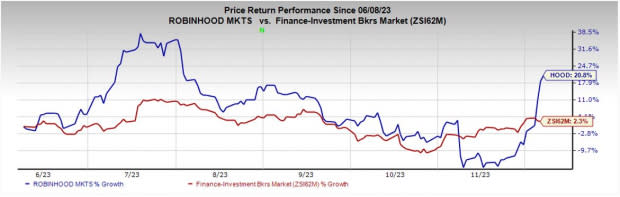

Over the past six months, shares of Robinhood have gained 20.8% compared with 2.3% growth of the industry.

Image Source: Zacks Investment Research

Currently, HOOD carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

This week, Itau Unibanco Holding S.A ITUB introduced a cryptocurrency trading service for its clients, thus expanding the scope of its product offerings. This was first reported by Reuters.

ITUB would initially permit trading of bitcoin and Ethereum, and depending on the evolution of the crypto regulation in Brazil, other cryptocurrencies will be added under its trading service. Guto Antunes, head of digital asset stated, "It starts with bitcoin, but our overarching strategic plan is to expand to other crypto assets in the future".

Interactive Brokers Group, Inc. IBKR expanded cryptocurrency trading to retail investors in Hong Kong. The automated broker-dealer has become the first SFC-licensed securities broker to be approved to allow retail clients to trade cryptocurrencies in Hong Kong.

David Friedland, the head of APAC for IBKR, stated, “As demand for cryptocurrency exposure as a means of diversification continues to rise, we are pleased to offer investors in Hong Kong a straightforward and cost-effective way to allocate a portion of their portfolio to digital assets”.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance