Robert Olstein Bolsters Portfolio with a 1% Stake in The Middleby Corp

Insights from the Olstein Financial Alert Fund's Latest 13F Filing

Renowned for his forensic accounting expertise, Robert A. Olstein, Chairman and CIO of the Olstein Financial Alert Fund, has disclosed his first-quarter investment moves for 2024. Olstein, who co-founded the "Quality of Earnings Report" in 1971, is a venerated figure in financial analysis, emphasizing a "defense first" approach to investing. His strategy focuses on companies with strong cash flows, conservative accounting, solid balance sheets, and those trading below private market value. Olstein's investment decisions are driven by a meticulous examination of financial statements, seeking to minimize downside risk while identifying undervalued stocks.

Summary of New Buys

Robert Olstein (Trades, Portfolio)'s portfolio welcomed four new stocks in the latest quarter:

The Middleby Corp (NASDAQ:MIDD) emerged as the standout addition with 38,000 shares, making up 1% of the portfolio and valued at $6.11 million.

Aptiv PLC (NYSE:APTV) followed, comprising 0.55% of the portfolio with 42,000 shares, totaling $3.35 million.

General Dynamics Corp (NYSE:GD) was the third significant new holding, with 11,000 shares accounting for 0.51% of the portfolio, valued at $3.11 million.

Key Position Increases

Olstein also augmented his stakes in 18 existing holdings, with notable increases in:

WESCO International Inc (NYSE:WCC), where he added 30,000 shares, boosting the total to 65,000 shares. This represents an 85.71% increase in share count and a 0.84% portfolio impact, with a total value of $11.13 million.

UnitedHealth Group Inc (NYSE:UNH) saw an addition of 7,000 shares, bringing the total to 14,500. This adjustment marks a 93.33% increase in share count, valued at $7.17 million.

Summary of Sold Out Positions

Olstein exited two positions entirely in the first quarter of 2024:

McDonald's Corp (NYSE:MCD) was sold off completely, with all 4,000 shares liquidated, impacting the portfolio by -0.2%.

Marsh & McLennan Companies Inc (NYSE:MMC) also saw a complete sell-out of 6,000 shares, affecting the portfolio by -0.19%.

Key Position Reductions

Portfolio adjustments included reductions in 52 stocks, with significant cuts in:

General Motors Co (NYSE:GM) by 100,393 shares, resulting in a -35.73% decrease in shares and a -0.61% portfolio impact. GM traded at an average price of $38.75 during the quarter and has returned 19.95% over the past three months and 18.59% year-to-date.

Delta Air Lines Inc (NYSE:DAL) by 72,000 shares, leading to a -30% reduction in shares and a -0.49% portfolio impact. DAL's average trading price was $41.35 for the quarter, with returns of 29.03% over the past three months and 19.57% year-to-date.

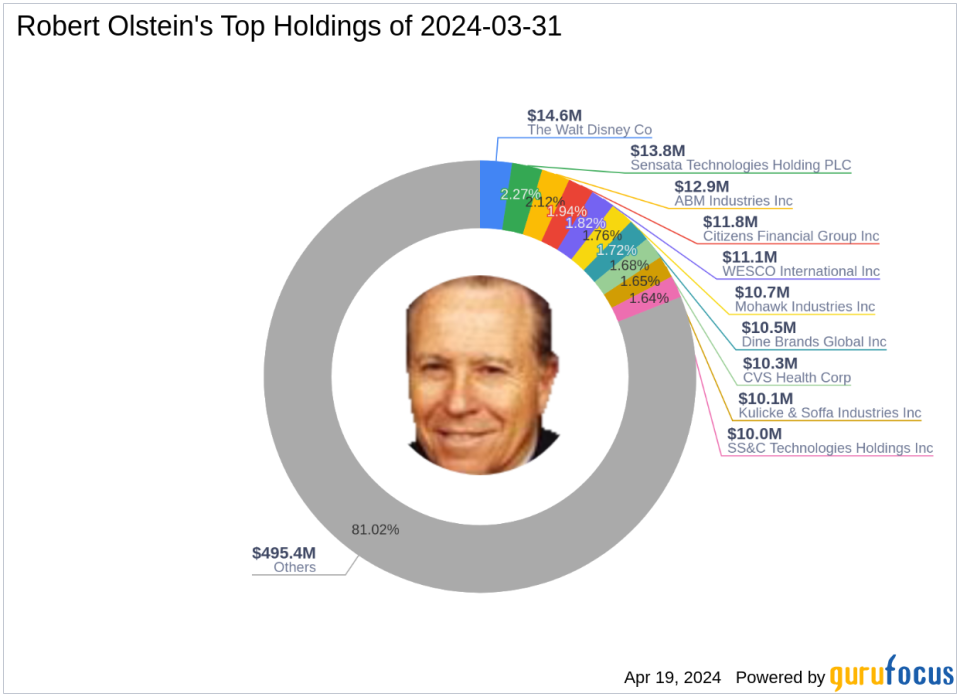

Portfolio Overview

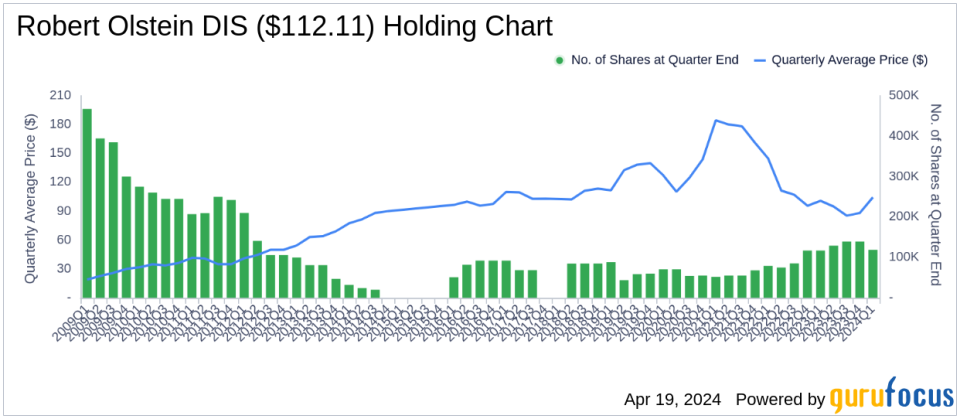

As of the first quarter of 2024, Robert Olstein (Trades, Portfolio)'s portfolio comprised 98 stocks. The top holdings included 2.38% in The Walt Disney Co (NYSE:DIS), 2.27% in Sensata Technologies Holding PLC (NYSE:ST), 2.12% in ABM Industries Inc (NYSE:ABM), 1.94% in Citizens Financial Group Inc (NYSE:CFG), and 1.82% in WESCO International Inc (NYSE:WCC). The investments span across 10 of the 11 industries, with a focus on Industrials, Financial Services, Healthcare, Technology, Consumer Cyclical, Communication Services, Basic Materials, Consumer Defensive, Real Estate, and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance