Rithm Capital (RITM) to Post Q1 Earnings: What to Expect

Rithm Capital Corp. RITM is set to report its first-quarter 2023 results on May 4, before the opening bell.

In the last reported quarter, the leading capital provider reported adjusted operating earnings per share of 33 cents, beating the Zacks Consensus Estimate by 13.8% due to the strength witnessed in its mortgage company. Also, its credit performance metrics were strong during the quarter.

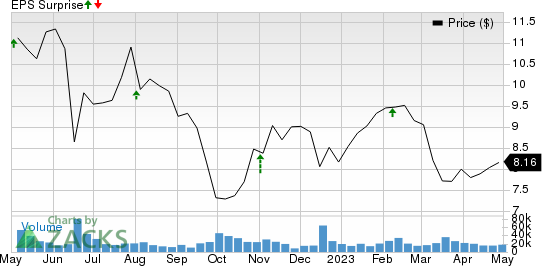

Earnings Surprise History

Rithm Capital’s earnings beat the consensus estimate in all the prior four quarters, with the average being 14.4%. This is depicted in the graph below:

Rithm Capital Corp. Price and EPS Surprise

Rithm Capital Corp. price-eps-surprise | Rithm Capital Corp. Quote

Let’s see how things have shaped up prior to the first-quarter earnings announcement.

Factors to Note

The Zacks Consensus Estimate for first-quarter interest income indicates 51.4% year-over-year growth. The increased interest rate environment is expected to have helped Rithm Capital generate higher returns from some of its investments and consumer loans. Also, its hedging arrangements are likely to have protected it from growing interest expenses.

Higher fees and various acquisitions like its Caliber buyout are expected to have supported its revenues. These are likely to have positioned the company for massive revenue growth. The consensus estimate for Rithm Capital’s first-quarter revenues of $807.9 million indicates a significant rise from the year-ago reported figure of $225.4 million.

However, the Zacks Consensus Estimate for net gain on originated residential mortgage loans, held-for-sale, indicates a 73.3% year-over-year decline for the first quarter. Moreover, the consensus mark for first-quarter net servicing revenues predicts a 64.6% fall from the prior-year figure.

The rising inflation level is also expected to have led to higher expenses for RITM, likely affecting its profits in the quarter under review. This is expected to have led to a year-over-year decline in earnings and made an earnings beat uncertain.

The Zacks Consensus Estimate for first-quarter earnings per share of 32 cents has witnessed no movement in the past week. The estimated figure projects a decrease of 13.5% from the prior-year reported number.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Rithm Capital this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The company has an Earnings ESP of 0.00%. The Most Accurate Estimate is currently pegged at 32 cents per share, in line with the Zacks Consensus Estimate.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Rithm Capital currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for Rithm Capital, here are some companies in the broader Finance space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Unum Group UNM has an Earnings ESP of +0.30% and a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for UNM’s bottom line for the to-be-reported quarter is pegged at $1.65 per share, suggesting a 21.3% jump from the year-ago figure. Unum beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 32.3%.

Owl Rock Capital Corporation ORCC has an Earnings ESP of +0.47% and is a Zacks #2 Ranked player.

The Zacks Consensus Estimate for Owl Rock Capital’s bottom line for the to-be-reported quarter is pegged at 43 cents per share, implying a 38.7% jump from the year-ago figure. ORCC beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 2.1%.

RenaissanceRe Holdings Ltd. RNR has an Earnings ESP of +3.37% and a Zacks Rank of 3.

The Zacks Consensus Estimate for RenaissanceRe’s bottom line for the to-be-reported quarter is pegged at $7.34 per share, suggesting a 109.7% year-over-year increase. RNR beat earnings estimates in two of the past four quarters and missed on the other two occasions.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

Owl Rock Capital Corporation (ORCC) : Free Stock Analysis Report

Rithm Capital Corp. (RITM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance