Rio Tinto (RIO) Invests in R&D Facility for BioIron Testing

Rio Tinto RIO announced that it will invest $143 million to develop a research and development facility in Western Australia to test the effectiveness of its breakthrough low-carbon ironmaking process, BioIron.

BioIron uses raw biomass material produced from agricultural by-products instead of metallurgical coal and is heated using a combination of gas released by the biomass and high-efficiency microwaves powered by renewable energy, which turns the iron ore into metallic iron. This process uses approximately 65% less electricity during steel making compared with other green hydrogen technologies.

Per Rio Tinto’s projections, when combined with renewable energy and carbon-circulation by fast-growing biomass, BioIron has the potential to reduce carbon dioxide emissions by up to 95% compared with the current blast furnace method.

The initiative to build the research and development facility follows successful trials of BioIron in a small-scale pilot plant in Germany. The new facility will include a pilot plant that will be 10 times the size of the German plant and capable of producing one ton of direct reduced iron per hour. The BioIron process will be tested for the first time at a semi-industrial scale. The plant will provide the required data to assess further scaling of the technology to a larger demonstration plant.

The plant has been designed in collaboration with the University of Nottingham, Metso Corporation and Western Australian engineering company Sedgman Onyx. Fabrication of the equipment is set to begin this year, with commissioning expected in 2026.

Industry-Wide Efforts to Lower Emissions

Steelmaking is responsible for around 8% of the world’s carbon emissions. Most of these emissions are created during the industrial process of transforming the raw material, iron ore into steel. Miners, through individual research and partnerships, are working on developing technologies and solutions to reduce the greenhouse gas (GHG) emission intensity of the steelmaking process.

Steelmaking accounts for 66% of Rio Tinto’s Scope 3 emissions. It has targeted reductions in Scope 1 and 2 carbon emissions of 15% by 2025 and 50% by 2030, relative to 2018 levels. The company expects to achieve net zero emissions from its operations by 2050.

In 2023, RIO achieved a 5.5% reduction in Scope 1 and 2 GHG emissions, which was below its 2018 baseline. The company spent $425 million on decarbonization efforts in 2023. It has budgeted a total capital spending of $5–$6 billion over the 2022–2030 period, including $1.5 billion cumulative spending over the 2024–2026 period.

Rio Tinto’s peer Fortescue Ltd FSUGY has set a target to reach net zero Scope 3 emissions by 2040. The steelmaking process is the largest source of its Scope 3 emissions, accounting for 98% of emissions.

Fortescue has identified solutions to eliminate approximately 90% of its carbon dioxide equivalent terrestrial emissions associated with its Australian iron operations by 2030. In September 2022, the company committed $6.2 billion to achieve this plan.

Another big miner, BHP Group BHP is also pursuing its long-term goal of net zero Scope 3 GHG emissions by 2050. The company expects to cut down operational GHG emissions by at least 30% from 2020 levels by 2030.

In fiscal 2023, BHP spent $122 million on initiatives associated with emission reductions, in areas such as steelmaking and shipping. From fiscal 2024-2030, BHP expects to spend around $4 billion on operational decarbonization, with plans reflecting an annual capital allocation between approximately $250 million and $950 million per year over the next five years.

Another iron miner, VALE S.A VALE plans to invest at least $2 billion to reduce its direct and indirect carbon emissions (Scopes 1 and 2) by 33% by 2030 compared with its emissions in 2017. It will also help reduce its suppliers’ emissions (Scope 3) by 15% by 2035 compared with the emission level in 2018. Vale aims to become carbon neutral by 2050.

Price Performance & Zacks Rank

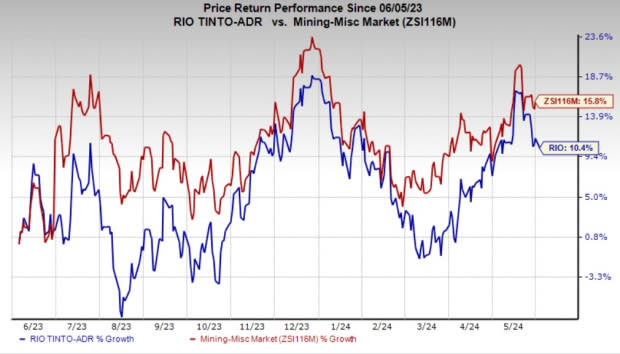

In the past year, shares of Rio Tinto have gained 10.4% compared with the industry’s 15.8% growth.

Image Source: Zacks Investment Research

Rio Tinto currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BHP Group Limited Sponsored ADR (BHP) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Rio Tinto PLC (RIO) : Free Stock Analysis Report

Fortescue Ltd. Sponsored ADR (FSUGY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance