RingCentral (NYSE:RNG) shareholders have endured a 89% loss from investing in the stock three years ago

Every investor on earth makes bad calls sometimes. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of RingCentral, Inc. (NYSE:RNG), who have seen the share price tank a massive 89% over a three year period. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 72% lower in that time. Furthermore, it's down 20% in about a quarter. That's not much fun for holders. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for RingCentral

Because RingCentral made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, RingCentral grew revenue at 27% per year. That's well above most other pre-profit companies. So why has the share priced crashed 24% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

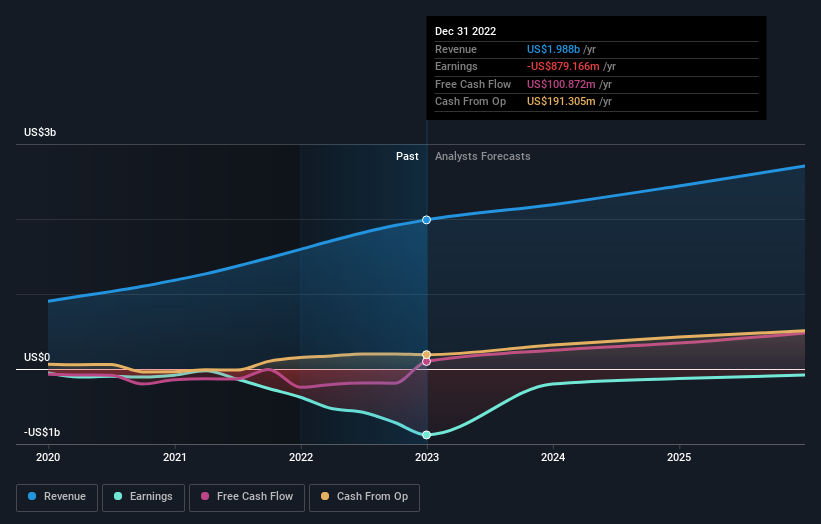

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling RingCentral stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market lost about 6.1% in the twelve months, RingCentral shareholders did even worse, losing 72%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for RingCentral (1 can't be ignored) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance