Is Ridley (ASX:RIC) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Ridley Corporation Limited (ASX:RIC) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Ridley

What Is Ridley's Debt?

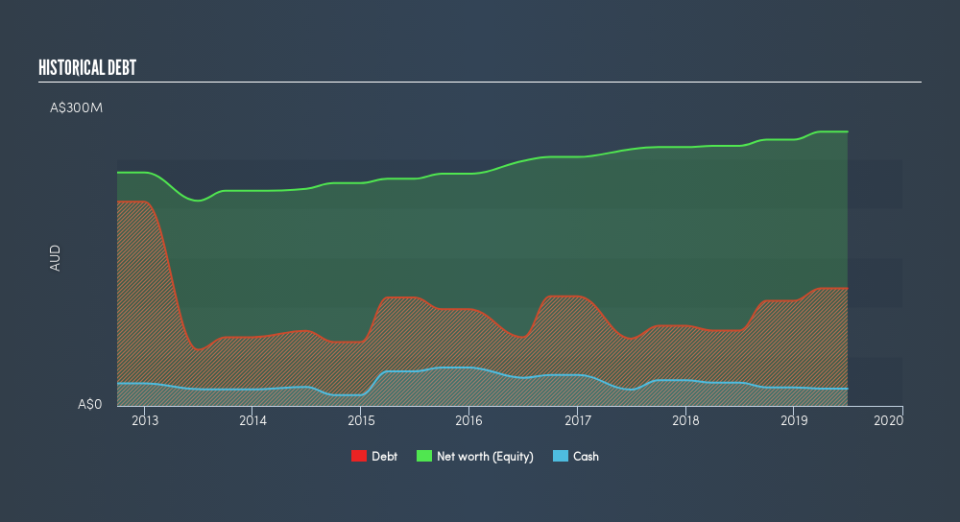

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Ridley had AU$118.9m of debt, an increase on AU$76.2m, over one year. However, it does have AU$17.5m in cash offsetting this, leading to net debt of about AU$101.4m.

A Look At Ridley's Liabilities

We can see from the most recent balance sheet that Ridley had liabilities of AU$176.8m falling due within a year, and liabilities of AU$119.4m due beyond that. On the other hand, it had cash of AU$17.5m and AU$108.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$170.6m.

While this might seem like a lot, it is not so bad since Ridley has a market capitalization of AU$306.6m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Ridley's net debt is sitting at a very reasonable 2.2 times its EBITDA, while its EBIT covered its interest expense just 4.9 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Unfortunately, Ridley's EBIT flopped 11% over the last four quarters. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Ridley's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Ridley saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Mulling over Ridley's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. Looking at the bigger picture, it seems clear to us that Ridley's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Ridley's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance