Your rewards card might not be worth it

The average rewards card is delivering just enough to buy a movie ticket, but definitely not a choc-top, new analysis has revealed.

The average return enjoyed by Aussie rewards card-holders has plummeted 70 per cent in the last two years, with the average fee on one third of cards now outweighing the value of rewards.

That’s according to analysis by comparison service, Mozo.

Also read: How to save $600 a year (by pressing a button)

Released on Friday, the research found the typical cardholder spending $20,000 on their card is now earning just $21 after annual fees are factored in.

Additionally, across Mozo’s database, the average rewards credit card annual fee is $182 – nearly four times the fee on the average non-rewards card.

“Credit card providers do a good job of marketing rewards cards with promises of island getaways, iPads and toasters – and we’re buying it. Four in 10 Aussies still have at least one rewards credit card in their wallet,” Mozo director, Kirsty Lamont said.

“Unfortunately, high fees and plummeting rewards value mean the average rewards card holder is only earning the equivalent of an adult movie ticket every year.”

Also read: The new Facebook chatbot that’ll revamp your finances

Two thirds of card holders have noticed their falling benefits, but 70 per cent haven’t switched to a lower-cost card.

That’s despite the average cardholder hoping to score a $100 gift card required to spend $22,461 – up from $19,300 two years ago. One card requires cardholders spend a staggering $83,000 to earn enough points for a $100 gift card.

“The message for cardholders is clear – if you aren’t a big spender, it’s time to review the value your rewards card is really delivering,” Lamont said.

Why the drop in value?

The Reserve Bank of Australia introduced new regulation in July 2017 capping interchange fees. This left lenders unable to fund expensive rewards programs without sacrificing margins. As such, card providers slashed the value of rewards cards.

Also read: What $1 million buys you around Australia

However, “It’s not all gloom and doom for rewards cardholders,” Lamont said.

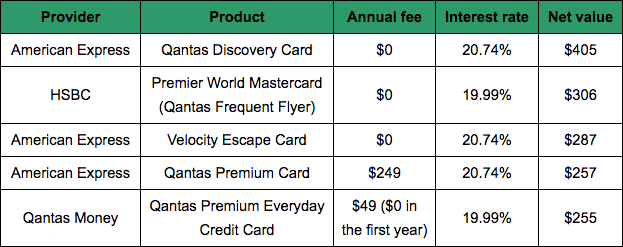

“Shopping around for a better value rewards card could get a typical rewards cardholder over $400 worth of real rewards value every year. This is almost 20 times the average return of $21.”

According to the corporate watchdog, ASIC, those considering a rewards card need to ask themselves these five questions:

Will I use my card enough to qualify for the rewards?

Will I need to make unnecessary purchases to earn the rewards?

Will my rewards card dissuade me from shopping around?

Will my card charge a fee to redeem rewards?

Do I need to redeem my rewards within a certain time?

“Don’t be taken in by the promise of a ‘free’ reward. You are paying for it with higher interest rates and fees,” ASIC warned.

Also read: Aussie property hotspots where demand is set to ‘rocket’

Mozo’s analysis backs this up. Even its top five rewards cards, based on rewards net value, come with interest rates of around 20 per cent.

Yahoo Finance

Yahoo Finance