Revisiting Pandemic Winners: Any Juice Left?

A handful of stocks benefited massively during the pandemic. It was an interesting time to be an investor, to say the least, and those who targeted the stay-at-home stocks were rewarded handsomely with considerable gains.

A few of those stocks include Shopify SHOP, Zoom Video Communications ZM, and Peloton Interactive PTON. Since then, many of these former beloved stocks have fallen out of favor, causing many to abandon them entirely.

It raises a valid question: are these former winners still worth investors’ attention? Let’s take a closer look.

Zoom Video Communications

Zoom Video Communications’ cloud-native unified communications platform combines video, audio, phone, screen sharing, and chat functionalities. It’s easy to understand why shares were so beloved during the period, as many were forced to use the platform.

Since making their all-time high in October 2020, ZM shares are down 88%, reflecting a nasty reversal. Better-than-expected quarterly results haven’t done much to comfort the market, with few positive reactions post-earnings.

The green arrows in the chart below represent quarterly releases in which Zoom exceeded the Zacks Consensus EPS Estimate.

Image Source: Zacks Investment Research

In addition, it’s worth noting that ZM shares have gotten considerably cheaper during the sell-off, currently trading at a 4.4X forward price-to-sales ratio (F1). While the value is undoubtedly steep, it’s still well beneath highs of 72.3X in 2020 and 13.5X in 2023.

Image Source: Zacks Investment Research

The company raised its current year outlook following its most recent quarterly release, now expecting higher sales and improved free cash flow. Impressively, Zoom’s operating cash flow improved 67% year-over-year to $493.2 million throughout its latest quarter.

While share performance has been rough, quarterly results still overall reflect positivity surrounding the company.

Shopify

Shopify shares have been monster performers in 2023, up more than 100% amid a broader rebound for growth stocks overall. The company’s platform gained widespread attention during the period, particularly as consumers shifted to online shopping.

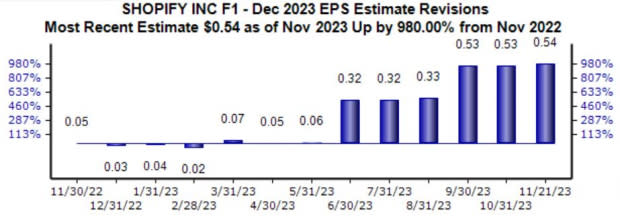

The company has seen positive earnings estimate revisions across multiple timeframes, with the revisions trend particularly notable for its current fiscal year, up a staggering 980% to $0.54 per share over the last year.

Image Source: Zacks Investment Research

Shopify’s growth expectations are impossible to ignore, with consensus expectations for its current year (FY23) suggesting 1250% earnings growth on 25% higher sales. Peeking ahead to FY24, consensus estimates allude to a further 50% earnings growth paired with a 20% sales bump.

SHOP’s revenue growth has been remarkable, as we can see below. Please note that this is an annual chart, with the 2023 figure on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Peloton Interactive

It’s also easy to understand why Peloton enjoyed positive price action during the period, as many stuffed their fitness products into their houses while gyms were closed. The company offers other fitness offerings through iOS and Android as well.

Since making their all-time high, it’s been anything but fun for PTON shares, slashed by 97%. A string of falling short of consensus earnings expectations has seemed to weigh on share performance, as we can see below by the red arrows.

Image Source: Zacks Investment Research

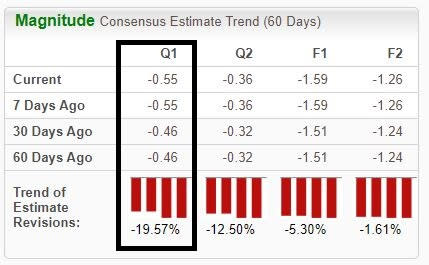

Analysts have lowered their expectations across multiple timeframes over the last several months, with the trend particularly potent for its upcoming quarterly release expected in February.

Image Source: Zacks Investment Research

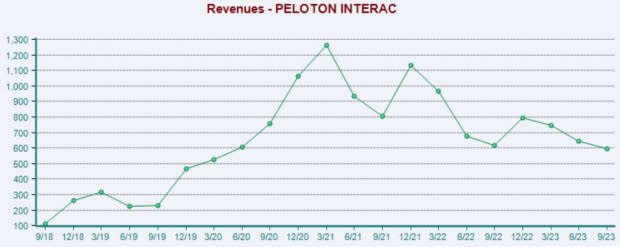

The company fell short of the Zacks Consensus EPS Estimate by 22% in its latest release while posting a modest revenue surprise. Peloton’s revenue growth has visibly cooled post-pandemic, as seen in the quarterly chart below.

Image Source: Zacks Investment Research

Bottom Line

The pandemic was an exciting time to be a trader, with volatility widespread. Still, several of those once-beloved pandemic winners have since fallen out of favor, with many seemingly forgotten about entirely.

All three stocks above – Shopify SHOP, Zoom Video Communications ZM, and Peloton Interactive PTON – reflect a few of these pandemic winners.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

Peloton Interactive, Inc. (PTON) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance