Returns On Capital At Hasbro (NASDAQ:HAS) Paint A Concerning Picture

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after briefly looking over the numbers, we don't think Hasbro (NASDAQ:HAS) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Hasbro is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = US$747m ÷ (US$8.9b - US$1.9b) (Based on the trailing twelve months to April 2023).

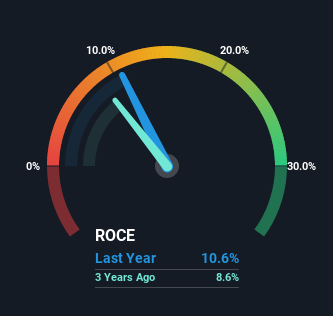

Therefore, Hasbro has an ROCE of 11%. In absolute terms, that's a pretty standard return but compared to the Leisure industry average it falls behind.

See our latest analysis for Hasbro

In the above chart we have measured Hasbro's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Hasbro here for free.

So How Is Hasbro's ROCE Trending?

When we looked at the ROCE trend at Hasbro, we didn't gain much confidence. Around five years ago the returns on capital were 18%, but since then they've fallen to 11%. Given the business is employing more capital while revenue has slipped, this is a bit concerning. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

In Conclusion...

We're a bit apprehensive about Hasbro because despite more capital being deployed in the business, returns on that capital and sales have both fallen. Investors haven't taken kindly to these developments, since the stock has declined 19% from where it was five years ago. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 4 warning signs for Hasbro (of which 2 are concerning!) that you should know about.

While Hasbro may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance