The Resurgence of Retail Real Estate: Three Companies to Watch

Key Highlights:

U.S. retail vacancy rates hit a 15-year low at 6.1% in Q2, with increased rents.

More stores opened than closed in the U.S. for the first time since 1995.

Brookfield Asset Management predicts 2,600 new stores requiring 23 million sq ft.

The recent data point to a significant revival in the retail real estate market. According to a Wall Street Journal report, U.S. retail vacancy rates fell to 6.1% in the second quarter, the lowest in at least 15 years, with asking rents for U.S. shopping centers in the same quarter 16% higher than five years ago. For the first time since 1995, more stores opened than closed in the U.S. last year, a trend that is expected to continue despite looming recession fears. The real estate firm Brookfield Asset Management anticipates that the net new 2,600 stores will require an estimated 23 million square feet of space.

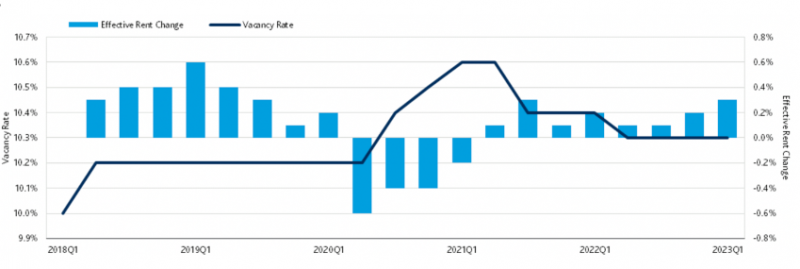

Moody’s data supports this, indicating an improvement in retail REITs, fueled by robust consumer spending and shifts in consumer behavior post-COVID-19.

Against this backdrop, there are a number of leading companies that are set to benefit from these market shifts. Three prominent ones that investors may want to keep their eye on are Walmart, G City, and FedEx.

Walmart Inc. (NYSE: WMT)

Global retail giant Walmart has long understood the importance of physical retail space as part of its business model. The company’s extensive footprint, coupled with the recent trend of decreasing retail vacancies and increased foot traffic, presents an opportunity for amplified in-store sales.

Walmart’s successful “omnichannel” strategy – a blend of digital and physical retail experiences – is particularly well-suited to the evolving retail landscape. The Wall Street Journal report notes that many consumers, after the experience of the pandemic, appreciate the convenience of online shopping but also enjoy shopping in physical stores. Walmart’s strengths in both online and in-person retailing could enhance its competitive advantage in the recovering retail real estate market.

G-City (TASE: GCT)

A leading real estate firm, G-City, is poised to profit from the burgeoning retail real estate market. Its diverse portfolio of retail properties, situated in high-traffic areas, provides compelling investment opportunities. Moody’s data and the Wall Street Journal report signal a promising future for retail spaces, and with its history of managing and developing high-quality retail spaces, G-City could see growth in leasing activities, rental income, and property valuations.

G-City has long capitalized on market trends, identifying growth opportunities and strategically diversifying its assets to ensure sustained returns. The revival of the retail real estate sector could serve as a significant catalyst for G-City’s growth trajectory, given its portfolio and expertise.

FedEx Corporation (NYSE: FDX)

As a leading global courier delivery services company, FedEx plays a critical role in the retail ecosystem. The resurgence of physical retail, coupled with the increase in consumer spending and store openings, boosts demand for FedEx’s logistics and delivery services.

Moreover, the evolution of retail, which increasingly blends e-commerce and brick-and-mortar elements, underlines the importance of reliable logistics providers like FedEx. According to Moody’s report, e-commerce continues to grow, but at a more moderate pace, indicating that people still want to shop in person. This trend towards an integrated shopping experience could fuel demand for FedEx’s services, enabling it to leverage its expansive logistics network and adaptability to benefit from the retail real estate revival.

In conclusion, the revival of the retail real estate sector brings interesting investment opportunities. G-City, Walmart, and FedEx, with their strategic positioning and innovative approaches, are poised to capture these opportunities. As the retail real estate sector recovers, these companies stand out for their potential for significant gains.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance