Results: Autodesk, Inc. Exceeded Expectations And The Consensus Has Updated Its Estimates

A week ago, Autodesk, Inc. (NASDAQ:ADSK) came out with a strong set of quarterly numbers that could potentially lead to a re-rate of the stock. Autodesk beat earnings, with revenues hitting US$843m, ahead of expectations, and earnings per share outperforming analyst reckonings by a solid 10%. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest forecasts to see what analysts are expecting for next year.

View our latest analysis for Autodesk

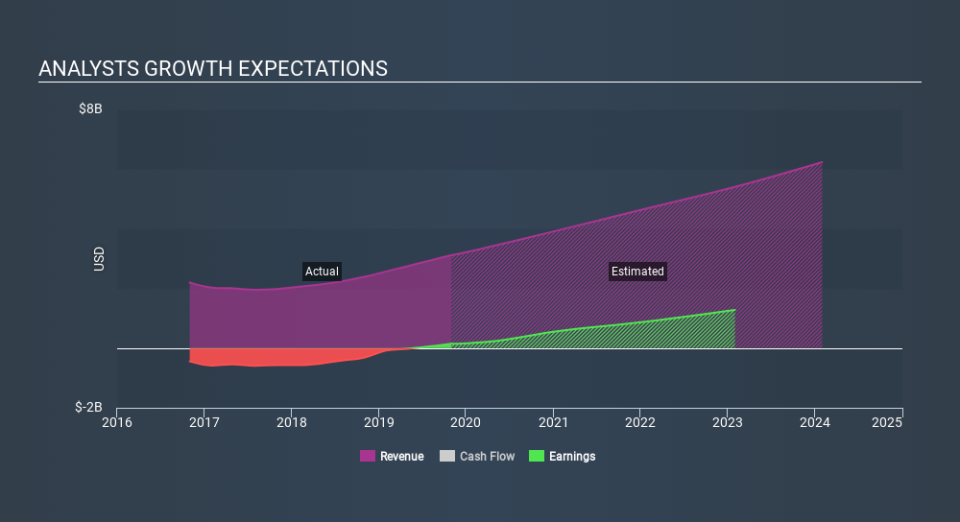

Following the latest results, Autodesk's 23 analysts are now forecasting revenues of US$3.97b in 2021. This would be a sizeable 27% improvement in sales compared to the last 12 months. Earnings per share are expected to soar 297% to US$2.67. In the lead-up to this report, analysts had been modelling revenues of US$3.96b and earnings per share (EPS) of US$2.91 in 2021. Analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share forecasts for next year.

Although analysts have revised their earnings forecasts for next year, they've also lifted the consensus price target 7.6% to US$186, suggesting the revised estimates are not indicative of a weaker long-term future for the business. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Autodesk at US$210 per share, while the most bearish prices it at US$117. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Another way to assess these estimates is by comparing them to past performance, and seeing whether analysts are more or less bullish relative to other companies in the market. Analysts are definitely expecting Autodesk's growth to accelerate, with the forecast 27% growth ranking favourably alongside historical growth of 1.7% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 12% per year. It seems obvious that, while the growth outlook is brighter than the recent past, analysts also expect Autodesk to grow faster than the wider market.

The Bottom Line

The biggest highlight of the new consensus is that analysts have reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Autodesk. Fortunately, analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - and our data does suggest that Autodesk's revenues are expected to grow faster than the wider market. There was also a nice increase in the price target, with analysts feeling that the intrinsic value of the business is improving.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Autodesk going out to 2024, and you can see them free on our platform here..

You can also view our analysis of Autodesk's balance sheet, and whether we think Autodesk is carrying too much debt, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance