Shock rate decision: Reserve Bank of Australia issues ‘death knell’ for country’s savers

The Reserve Bank of Australia has cut the official interest rate to a record low of 0.75 per cent today, as the Australian property market consolidates its rebound.

The 0.25 percentage point cut brings Australia’s official interest rate to a new low, following consecutive cuts in June and July this year.

Related story: Aussie homeowners to pocket $54,856 from RBA’s 2019 rate cuts

Related story: Cash rate dropped to 0.75 per cent: Has your bank passed the October rate cut on?

Related story: Has Australia had a hidden recession? Peter Costello thinks so

The move was forecast by only 55 per cent of Finder’s panel of experts, with many arguing a ‘hold’ verdict was more appropriate.

“Reducing the cash rate may have little effect in the current economic conditions and uncertainty. The RBA may want to keep it on hold for the time being - essentially holding it in reserve for a more opportune time,” RMIT University’s Sveta Angelopoulos said.

Speaking at the Yahoo Finance All Markets Summit, Australia’s longest-serving treasurer, Peter Costello said structural, not monetary policy was what was required to boost the Australian economy.

“Now, what will a rate cut do for the economy? In my view, not much,” he said.

“We've already got a cash rate of 1 per cent; suppose it goes to 0.75, suppose it goes to 0.5.

“Take 25 basis points off, [is that] going to make a big difference? I don't think so. It's also what we call the law of diminishing returns.

“Every rate cut brings a little less of a return than the one before.”

Speaking at the same summit, independent economist, Stephen Koukoulas, said the opposite, arguing the RBA should have cut rates earlier, describing the economy as “pretty sick at the moment”.

Property price surge

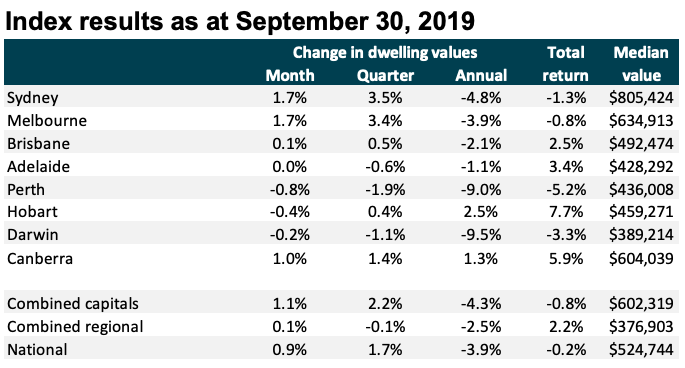

According to fresh property figures from CoreLogic today, the Australian property market saw growth of 0.9 per cent in September, with Sydney and Melbourne both surging 1.7 per cent over the month.

However, CoreLogic research said that growth wasn’t enough to “stave off a rate cut”.

“A trend towards higher unemployment and a slowdown in jobs growth were likely the primary factors in the RBA’s decision to cut rates to a new low, as well as concerns around persistently weak household spending, subdued wages growth and low inflation,” Lawless said.

“Lower interest rates together with a subtle loosening in credit policies and improved housing sentiment has seen national housing values recover 1.7 per cent of the 8.4 per cent peak to trough decline in value, with a substantially larger bounce in Sydney and Melbourne.

Related story: Did our parents actually have it easier buying property? Expert weighs in

Related story: Is this the answer to Australia’s slow wage growth and economic woes?

“The rebound in housing conditions should help to support an improvement in economic conditions as higher housing prices translate to a wealthier and more confident household sector who will hopefully be inclined to spend more.”

Chief economist at realestate.com, Nerida Conisbee, also pinpointed unemployment as the big problem the RBA has been tasked with solving.

“The Australian economy remains lacklustre and there was a slight lift in the unemployment rate in August to reach a 12-month high, which isn’t a good sign. As a result, the RBA has cut rates in October,” she said.

“It was expected that interest rate cuts and the midyear tax cuts would stimulate retail spending, but this doesn’t appear to be happening. As a result, employment in retail has also been lacklustre.”

‘Death knell’ for country’s savers

While an interest rate cut is generally considered good news for homeowners - provided their lender passes along the cut, it’s the opposite for the country’s savers.

According to an analysis by financial comparison site, Mozo, the cut would see the average interest rate for savings accounts plummet to 0.90 per cent - well below 1.60 per cent inflation.

“While RBA cuts are welcome news for homeowners, they’re a terrifying prospect for the nation’s savers,” said Mozo director Kirsty Lamont.

“Following the first two rate cuts, ANZ cut 30 basis points off its average at call savings rates, CommBank 35 basis points, Westpac 35 basis points and NAB 45 basis points.”

Mozo also found the Big 4 banks’ average savings rates were just 0.74 per cent, 0.41 per cent below the market average.

“A 25 basis point cut next week could sound the death knell for some of the most popular standard savings accounts in the country.”

Statement by Philip Lowe, Governor: Monetary Policy Decision

At its meeting today, the Board decided to lower the cash rate by 25 basis points to 0.75 per cent.

While the outlook for the global economy remains reasonable, the risks are tilted to the downside. The US–China trade and technology disputes are affecting international trade flows and investment as businesses scale back spending plans because of the increased uncertainty. At the same time, in most advanced economies, unemployment rates are low and wages growth has picked up, although inflation remains low. In China, the authorities have taken further steps to support the economy, while continuing to address risks in the financial system.

Interest rates are very low around the world and further monetary easing is widely expected, as central banks respond to the persistent downside risks to the global economy and subdued inflation. Long-term government bond yields are around record lows in many countries, including Australia. Borrowing rates for both businesses and households are also at historically low levels. The Australian dollar is at its lowest level of recent times.

The Australian economy expanded by 1.4 per cent over the year to the June quarter, which was a weaker-than-expected outcome. A gentle turning point, however, appears to have been reached with economic growth a little higher over the first half of this year than over the second half of 2018. The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, signs of stabilisation in some established housing markets and a brighter outlook for the resources sector should all support growth. The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending.

Employment has continued to grow strongly and labour force participation is at a record high. The unemployment rate has, however, remained steady at around 5¼ per cent over recent months. Forward-looking indicators of labour demand indicate that employment growth is likely to slow from its recent fast rate. Wages growth remains subdued and there is little upward pressure at present, with increased labour demand being met by more supply. Caps on wages growth are also affecting public-sector pay outcomes across the country. A further gradual lift in wages growth would be a welcome development. Taken together, recent outcomes suggest that the Australian economy can sustain lower rates of unemployment and underemployment.

Inflation pressures remain subdued and this is likely to be the case for some time yet. In both headline and underlying terms, inflation is expected to be a little under 2 per cent over 2020 and a little above 2 per cent over 2021.

There are further signs of a turnaround in established housing markets, especially in Sydney and Melbourne. In contrast, new dwelling activity has weakened and growth in housing credit remains low. Demand for credit by investors is subdued and credit conditions, especially for small and medium-sized businesses, remain tight. Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.

The Board took the decision to lower interest rates further today to support employment and income growth and to provide greater confidence that inflation will be consistent with the medium-term target. The economy still has spare capacity and lower interest rates will help make inroads into that. The Board also took account of the forces leading to the trend to lower interest rates globally and the effects this trend is having on the Australian economy and inflation outcomes.

It is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board will continue to monitor developments, including in the labour market, and is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance