Republic Services (RSG) Rises 28% in Six Months: Here's How

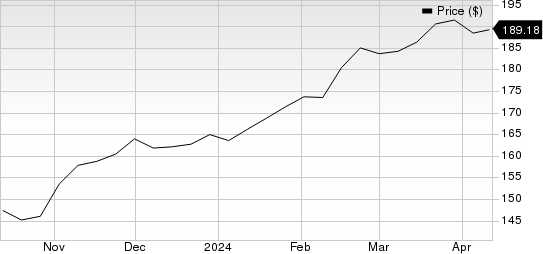

Republic Services, Inc. RSG has had an impressive run over the past six months. The stock has gained 28%, outperforming the 27% growth of the industry it belongs to and the 20% rise of the Zacks S&P 500 composite.

Reasons for the Upside

The services that Republic Services provides usually cannot be delayed and are required on a scheduled basis, allowing the company to achieve a steady flow of revenues.

Republic Services, Inc. Price

Republic Services, Inc. price | Republic Services, Inc. Quote

The company delivered better-than-expected earnings and revenue performance in the past four quarters. It continues to benefit from increasing environmental concerns, rapid industrialization and an increase in population.

The demand environment for this leading waste disposal companyis currently good across all its services. Revenues increased 10.8% year over year in 2023. Services — Collection, Transfer, Landfill and Environmental Solutions — registered 9.7%, 7.9%, 7.6% and 34.8% growth, respectively.

RSG is focused on increasing its operational efficiency and reducing fleet operating costs by shifting to compressed natural gas (“CNG”) collection vehicles. In 2023, around 20% of the company’s recycling and solid waste collection fleet operated on CNG and 13% of its replacement recycling and solid waste vehicle purchases were CNG vehicles.

Commitment to shareholder returns makes RSG a reliable way for investors to compound wealth over the long term. In 2023, 2022 and 2021, it paid $638.1 million, $592.9 million and $552.6 million in dividends and repurchased shares worth $261.8 million, $203.5 million and $252.2 million, respectively.

Zacks Rank and Stocks to Consider

Republic Servicescurrently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are Core & Main CNM and Barrett Business Services BBSI.

Core & Main currently sports a Zacks Rank of 1 (Strong Buy). It has a long-term earnings growth expectation of 12.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

CNM delivered a trailing four-quarter earnings surprise of 1.5%, on average.

Barrett Business Servicescurrently carries a Zacks Rank of 2 (Buy). BBSI has a long-term earnings growth expectation of 14%.

BBSI delivered a trailing four-quarter earnings surprise of 77.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

Core & Main, Inc. (CNM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance