Repligen's (RGEN) Q4 Earnings and Revenues Beat Estimates

Repligen Corporation RGEN reported fourth-quarter 2022 adjusted earnings per share (EPS) of 68 cents, beating the Zacks Consensus Estimate and our estimate of 55 cents. Earnings declined 16% year over year.

Total revenues of $187 million also surpassed the Zacks Consensus Estimate of $185 million and our estimate of $183.2 million. Sales were essentially flat during the fourth quarter but up 5% on a constant currency basis. This was due to major growth in the company’s filtration and chromatography franchises, and robust demand across its core monoclonal antibody and gene therapy markets.

Excluding the impact of currency and acquisitions/divestitures, Repligen’s organic revenues increased 35% year over year in the fourth quarter of 2022.

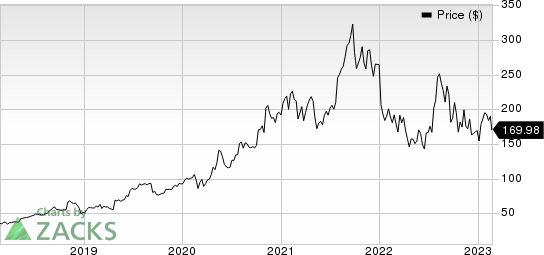

Shares of Repligen have dropped 1% in the past year compared with the industry’s 7% decline.

Image Source: Zacks Investment Research

Quarter in Details

In the fourth quarter, Repligen reported product revenues of $187 million. The company reported royalty and other revenues of $0.24 million.

Repligen’s base business revenues were up 35% year over year on an organic basis and 39% for full-year 2022.

We note that Repligen’s base business can be categorized mainly under four franchises — namely filtration, chromatography, protein and process analytics.

Repligen’s filtration and chromatography businesses were major growth drivers in the reported quarter. The uptick in these two business franchises offset the decline in COVID revenues.

Repligen’s chromatography business performed well with growth of more than 75% in the reported quarter. The growth was driven by increased demand for OPUS pre-packed columns as resin demand improved. The company anticipates its chromatography business to witness a 10% growth rate in 2023.

The filtration franchise declined 10% due to a drop in COVID revenues year on year. However, base filtration business was up 38%, driven by strength in systems, alternating tangential flow (ATF) and hollow fiber consumables.

Repligen’s process analytics franchises had a soft quarter as well as year. Repligen anticipates 15-20% growth rate in its process analytics business for 2023.

Revenues from the protein franchise were down 8% in the fourth quarter, driven by decreased demand from Cytiva. The decline in protein revenues was partially offset by a strong demand for NGL ligands, which Repligen supplies to Purolite. Repligen expects the protein business growth to be flat in 2023.

The gene-therapy business rose 36% in the quarter.

Adjusted gross profit was $96.1 million, down 9% from the year-ago quarter. Adjusted gross margin was 51.5%, down 490 basis points (bps) year over year due to increased material cost, currency headwinds and a less favorable product mix.

For the reported quarter, adjusted research and development expenses were $11.0 million, up 27% from the year-ago quarter.

Adjusted selling, general and administrative expenses were $44 million, up 8.1% year over year.

Adjusted operating income was $41.1 million, down 26% year over year. Adjusted operating margin was 22%, down 800 bps year over year.

As of Dec 31, 2022, Repligen had cash and cash equivalents worth $623.8 million compared with $573. million on Sep 30, 2022.

Results 2022

For 2022, Repligen generated revenues of $801.5 million, indicating 22% organic growth year over year and 25% growth at constant currency.

The company reported earnings of $3.28 per share, up 7% year over year.

2023 Guidance

For 2023, Repligen expects revenues in the range of $760-$800 million. The Zacks Consensus Estimate stands at $796.1 million. The new revenue guidance indicates decreased expectations for COVID-related revenues. It anticipates base business revenue growth of 11-16% on a reported basis and 12-16% on an organic basis.

COVID-related revenues are expected at a year-over-year decrease of $100-$110 million.

Repligen anticipates increased projected demand for products sold under its base business. However, RGEN expects the rise in revenues to be offset by dampened COVID-related sales due to slowing vaccination rates.

Gross margin is anticipated to be in the range of 52.5-53.5%. The company expects margins to improve with higher volumes through the second half of 2023.

Adjusted operating income is anticipated in the $176-$182 million range. Adjusted net income is now projected in the $149-$154 million band.

Adjusted EPS is anticipated in the $2.61-$2.69 range. The Zacks Consensus Estimate for earnings stands at $2.93 per share.

Repligen Corporation Price

Repligen Corporation price | Repligen Corporation Quote

Zacks Rank & Stocks to Consider

Currently, Repligen has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector include Allogene Therapeuctics ALLO, BeiGene BGNE and Arcus Biosciences RCUS. Allogene Therapeuctics, BeiGene and Arcus Biosciences all hold a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Allogene Therapeuctics’ loss per share estimates for 2023 has narrowed from $2.84 to $2.83 in the past 30 days.

Earnings of ALLO beat estimates in all the last four quarters, the average surprise being 9.44%. The stock has declined 26.5% in the past year.

BeiGene’s loss per share estimates for 2023 has narrowed from $12.60 to $12.06 in the past 30 days. The stock has risen 11.6% in the past year.

BGNE’s earnings missed estimates in three of the last four quarters and beat the mark once, the average negative surprise negative 21.98%.

Arcus Biosciences’ loss per share estimates for 2023 remained constant at $4.57 in the past 30 days. The stock has declined 36.2% in the past year.

RCUS’ earnings beat estimates in two of the last four quarters, met the mark once and missed in another, the average surprise being 56.74%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Repligen Corporation (RGEN) : Free Stock Analysis Report

BeiGene, Ltd. (BGNE) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance