RenaissanceRe (RNR) Stock Down 11% Despite Q2 Earnings Beat

Shares of RenaissanceRe Holdings Ltd. RNR declined 11.1% since it reported second-quarter 2022 results on Jul 25. The quarterly results were hurt by escalating expenses and decline in underwriting income at the RNR’s Property segment. Nevertheless, the downside was partly offset by solid underwriting results in the Casualty and Specialty segment, improved net investment income and a growing Capital Partners business.

Q2 Results

RenaissanceRe reported second-quarter 2022 operating earnings per share (EPS) of $5.51, which beat the Zacks Consensus Estimate by 9.1% but fell short of our estimate of $5.82. The bottom line fell 2.3% year over year.

Total operating revenues climbed 22.8% year over year to $1,565 million. However, the top line missed the consensus mark by 2.4% and our estimate of $1,622.9 million.

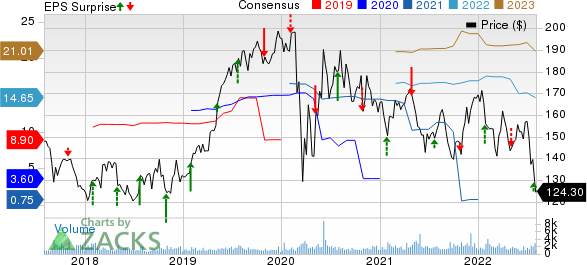

RenaissanceRe Holdings Ltd. Price, Consensus and EPS Surprise

RenaissanceRe Holdings Ltd. price-consensus-eps-surprise-chart | RenaissanceRe Holdings Ltd. Quote

Quarterly Operational Update

Gross premiums written of $2,464.6 million improved 17.7% year over year in the quarter under review. The figure was lower than our estimate of $2,614 million.

Net premiums earned surged 22.1% year over year to $1,456.4 million. The figure lagged the Zacks Consensus Estimate of $1,523 million and our estimate of $1,533 million.

Net investment income of $107.2 million advanced 32.5% year over year in the second quarter, courtesy of higher interest rates in the fixed maturity trading and short-term investment portfolios of RenaissanceRe coupled with increased average invested assets and returns in the catastrophe bond and equity trading investment portfolios. The figure outpaced the Zacks Consensus Estimate of $90 million and our estimate of $89 million.

Total expenses escalated 31.4% year over year to $1,164.2 million due to increased net claims and claim expenses incurred, operational costs and acquisition expenses. The figure was lower than our estimate of $1,227.9 million.

Underwriting income of RNR totaled $316.4 million, which declined 3.8% year over year in the quarter under review. The figure was lower than our estimate of $339 million.

The combined ratio of 78.3% deteriorated 590 basis points (bps) year over year in the second quarter. The figure was lower than the Zacks Consensus Estimate of 82% but came in higher than our estimate of 77.9%.

Quarterly Segment Update

Property Segment

Gross premiums written improved 2.9% year over year to $1,218.3 million in the second quarter, thanks to rate increases.

The segment’s underwriting income of $264.5 million tumbled 16.1% year over year. The figure lagged our estimate of $313.6 million. The combined ratio deteriorated 1,380 bps year over year to 57.6%, which came lower than the Zacks Consensus Estimate of 67% but higher than our estimate of 53.9%.

Casualty and Specialty Segment

Gross premiums written of the segment amounted to $1,246.3 million, which climbed 36.9% year over year in the quarter under review. The upside can be attributed to rate increases and growth in new and existing businesses within the current and previous periods.

The segment delivered an underwriting income of $51.9 million in the second quarter, which increased nearly four-fold year over year. The figure surpassed our estimate of $25.4 million.

The combined ratio of 93.8% improved 400 bps year over year, the metric being lower than the Zacks Consensus Estimate of 96% and our estimate of 97%.

Financial Position (as of Jun 30, 2022)

RenaissanceRe exited the second quarter with cash and cash equivalents of $1,398.1 million, which slumped 24.8% from the 2021-end level. Total assets of $35 billion increased 3.2% from the figure at the 2021 end.

Debt increased marginally from the 2021-end level to $1,169.4 million.

Total shareholders’ equity of $5,738.7 million fell 13.4% from the figure as of Dec 31, 2021.

Book value per share decreased 18.4% year over year to $113.69.

Annualized operating return on average common equity came in at 18.4% during the second quarter, up 160 bps year over year.

Capital Deployment Update

RenaissanceRe bought back shares worth $44.1 million in the second quarter.

On Aug 2, 2022, management announced a quarterly dividend of 37 cents per common share. The dividend will be paid out on Sep 30, 2022, to shareholders of record as of Sep 15.

It also announced that its share buyback program received approval for renewal from its board of directors. Following the renewal of the buyback program, the total fund for repurchases increased to $500 million.

2022 Outlook

RenaissanceRe anticipates net premiums earned of around $3.4 billion in its Casualty and Specialty segment this year, out of which roughly $1.7 billion is likely to be reported in the second half of the year.

Zacks Rank

RenaissanceRe carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

Of the insurance industry players that have reported second-quarter results so far, the bottom lines of Chubb Limited CB, Aflac Incorporated AFL and First American Financial Corporation FAF beat the respective Zacks Consensus Estimate for earnings.

Chubb Limited’s second-quarter 2022 core operating income of $2.40 per share outpaced the Zacks Consensus Estimate by about 17%. The bottom line improved 16% from the year-ago quarter. Net premiums written of Chubb improved 7.9% year over year to $10.3 billion in the quarter. CB’s adjusted net investment income was a record $950 million, up 0.5%.

Aflac reported second-quarter 2022 adjusted EPS of $1.46, which beat the Zacks Consensus Estimate by 13.2%. The bottom line, however, declined 8.2% year over year. Total revenues of Aflac amounted to $5,400 million, which decreased 2.9% year over year in the second quarter. Yet, the top line surpassed the consensus mark by 12.3%. AFL’s adjusted net investment income of $920 million fell 6.4% year over year in the quarter under review.

First American Financial’s second-quarter 2022 operating income per share of $1.97 beat the Zacks Consensus Estimate by 21.6%. Also, the bottom line declined 7.5% year over year. First American Financial’s revenues of $2.1 billion declined 9.3 year over year due to lower direct premiums and escrow fees, and net investment losses. The top line missed the Zacks Consensus Estimate by 4%. Net investment income of FAF decreased 5.4% to $53 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance