RenaissanceRe (RNR) Rises 17.5% Despite Q3 Earnings Miss

RenaissanceRe Holdings Ltd.’s RNR shares jumped 17.5% since it reported third-quarter earnings. Its weak third-quarter earnings were caused by escalating expenses and a rise in underwriting loss at the RNR’s Property segment. Catastrophic events like Hurricane Ian also affected RenaissanceRe’s results. Nevertheless, investors might have been impressed by its Casualty and Specialty performance.

Solid underwriting results in the Casualty and Specialty segment, improved net investment income and a growing Capital Partners business partly offset the negatives in the third quarter.

It reported a third-quarter 2022 operating loss per share of $9.27, which missed the Zacks Consensus Estimate by 24.9%. The bottom line deteriorated from a loss of $8.98 per share a year ago.

Total operating revenues climbed 21.5% year over year to $1,928 million. The top line beat the consensus mark by 13.5% and our estimate of $1,675.6 million.

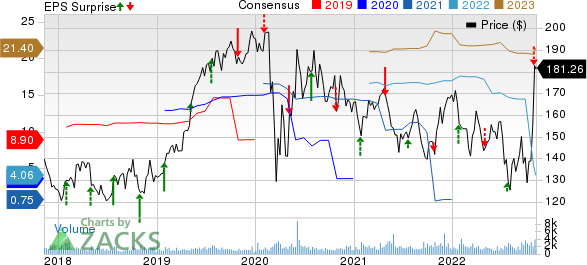

RenaissanceRe Holdings Ltd. Price, Consensus and EPS Surprise

RenaissanceRe Holdings Ltd. price-consensus-eps-surprise-chart | RenaissanceRe Holdings Ltd. Quote

Quarterly Operational Update

Gross premiums written of $2,220.7 million improved 25.2% year over year in the quarter under review. The figure was a little lower than our estimate of $2,244.5 million.

Net premiums earned increased 17.3% year over year to $1,767 million. The figure beat the Zacks Consensus Estimate of $1,529.9 million and our estimate of $1,588.8 million.

Net investment income of $157.8 million advanced 101.6% year over year in the third quarter, courtesy of higher interest rates in the fixed maturity trading and short-term investment portfolios of RenaissanceRe, coupled with increased average invested assets. The figure outpaced the Zacks Consensus Estimate of $101.9 million and our estimate of $84 million.

Total expenses escalated 12% year over year to $2,472.6 million due to increased net claims and claim expenses incurred, operational costs and acquisition expenses. The figure was higher than our estimate of $1,738.7 million.

Underwriting loss totaled $683.1 million, which deteriorated 0.6% year over year in the quarter under review.

The combined ratio of 138.7% improved 640 basis points (bps) year over year in the third quarter. The figure was higher than the Zacks Consensus Estimate of 91.1% but came in higher than our estimate of 107.6%.

Book value per share decreased 26.7% year over year to $94.55. Annualized operating return on average common equity was negative 34.8% during the third quarter, down 870 bps year over year.

Segment Update

Property Segment

Gross premiums written improved 3.4% year over year to $800.3 million in the third quarter, thanks to growth within its catastrophe class of business.

The segment’s underwriting loss of $722.6 million widened from $681.9 million a year ago. The combined ratio deteriorated 250 bps year over year to 186%, which came higher than the Zacks Consensus Estimate of 92.5% and our estimate of 118.3%.

Casualty and Specialty Segment

Gross premiums written of the segment amounted to $1,420.3 million, which climbed 42% year over year in the quarter under review and beat our estimate of $1,018.5 million.

The segment delivered an underwriting income of $39.5 million in the third quarter, which increased from $3.1 million a year ago. The figure surpassed our estimate of $37.6 million.

The combined ratio of 95.7% improved 390 bps year over year. The metric was higher than the Zacks Consensus Estimate of 94.9% and our estimate of 94.8%.

Financial Position (as of Sep 30, 2022)

RenaissanceRe exited the third quarter with cash and cash equivalents of $1,204.2 million, which declined from the 2021-end level of $1,859 million. Total assets of $35.9 billion increased from the $34 billion figure at the 2021 end.

Debt increased marginally from the 2021-end level of $1,168.4 million to $1,169.9 million.

Total shareholders’ equity of $4,881.9 million fell from the $6,624.3 million figure as of Dec 31, 2021.

Net operating cash flows in the first nine months of 2022 were at $870.5 million, up from $801.9 million a year ago.

Capital Deployment Update

RenaissanceRe bought back shares worth $25.3 million in the reported quarter. At the third quarter-end, it had $500 million in its share buyback program.

Zacks Rank & Key Picks

RenaissanceRe currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader finance space are American Financial Group, Inc. AFG, StoneX Group Inc. SNEX and FlexShopper, Inc. FPAY, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Headquartered in Cincinnati, OH, American Financial is a major insurance holding company. The Zacks Consensus Estimate for AFG’s 2022 bottom line is pegged at $11.66 per share, which witnessed two upward estimate revisions in the past 60 days against none in the opposite direction.

New York-based StoneX Group works as a global financial services network. The Zacks Consensus Estimate for SNEX’s 2022 bottom line indicates 54.8% year-over-year growth.

Based in Boca Raton, FL, FlexShopper is a leading e-commerce marketplace operator. The Zacks Consensus Estimate for FPAY’s 2022 earnings is pegged at 70 cents per share, signaling a massive jump from 4 cents reported a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

FlexShopper Inc. (FPAY) : Free Stock Analysis Report

StoneX Group Inc. (SNEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance