RenaissanceRe (RNR) Prices Senior Notes Offering Worth $750M

RenaissanceRe Holdings Ltd. RNR recently priced a public offering of senior notes worth $750 million in aggregate principal amount. The underwritten public offering, which is made to support its Validus acquisition, is expected to close on Jun 5.

The senior notes carry an interest rate of 5.750% and are scheduled to mature in 2033. The transaction proceeds will primarily be used for financing a part of the cash consideration for the Validus acquisition from American International Group, Inc. AIG. RNR is buying Validus Re, AlphaCat and the Talbot Treaty reinsurance unit from AIG, which is expected to be completed in the fourth quarter of 2023.

The acquisition price for the AIG assets was set at $2.985 billion, which will be paid by RenaissanceRe partly in cash, amounting to $2.735 billion, while the remaining balance will be paid through its common shares. RNR even announced an underwritten public offering of 6,300,000 common shares earlier, linked to this acquisition.

RenaissanceRe expects the senior notes to have a rating of A3 by Moody’s Investors Service. Now, the question arises if moves like this will inflate its financial obligations and whether RNR can take it.

The company exited the first quarter with a debt of $1,141 million, which decreased 2.5% from the figure as of Dec 31, 2022. It doesn’t have any additional debt maturing until 2025. Its total debt to total capital of 16.3% is lower than the industry average of 19.7%.

It had cash and cash equivalents of $1,063.7 million at first quarter-end. Times interest earned, the metric reflecting a company’s ability to meet interest payments, stands at 2.74X for RenaissanceRe. The figure is higher than the industry average of 2.34X. Its solid liquidity and sustained cash-generating abilities position it well to service debt uninterruptedly.

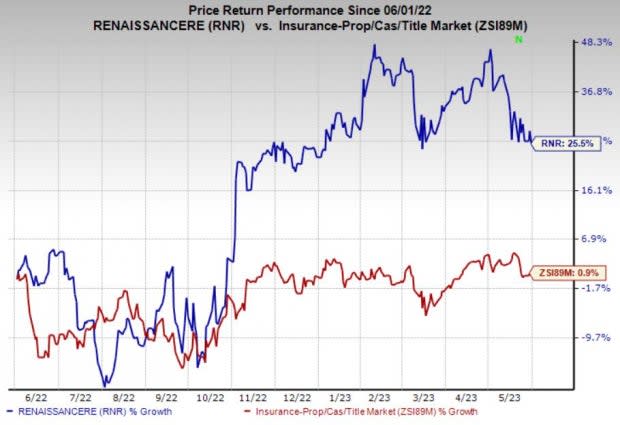

Price Performance

Shares of the company have gained 25.5% in the past year compared with the 0.9% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

RenaissanceRe currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader finance space are Ambac Financial Group, Inc. AMBC and Lemonade, Inc. LMND, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ambac Financial’s 2023 earnings has improved 68% over the past 30 days. During this time, AMBC has witnessed one upward estimate revision against none in the opposite direction.

The Zacks Consensus Estimate for Lemonade’s 2023 earnings suggests 15.9% year-over-year growth. Also, the consensus mark for LMND’s 2023 revenues implies a 53.6% year-over-year rise.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

Ambac Financial Group, Inc. (AMBC) : Free Stock Analysis Report

Lemonade, Inc. (LMND) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance