Relaxing the Lockdown: Move Slowly, Stay Nimble

Mentioned: Moderna Inc (MRNA), Regeneron Pharmaceuticals Inc (REGN), Gilead Sciences Inc (GILD), Johnson & Johnson (JNJ), Pfizer Inc (PFE), Sanofi SA (SNY), Roche Holding AG (RHHBY), AstraZeneca PLC (AZN)

Editor’s note: This is the first of two updates to Morningstar's COVID-19 forecast. We also explore the outlook for a potential vaccine. Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it. |

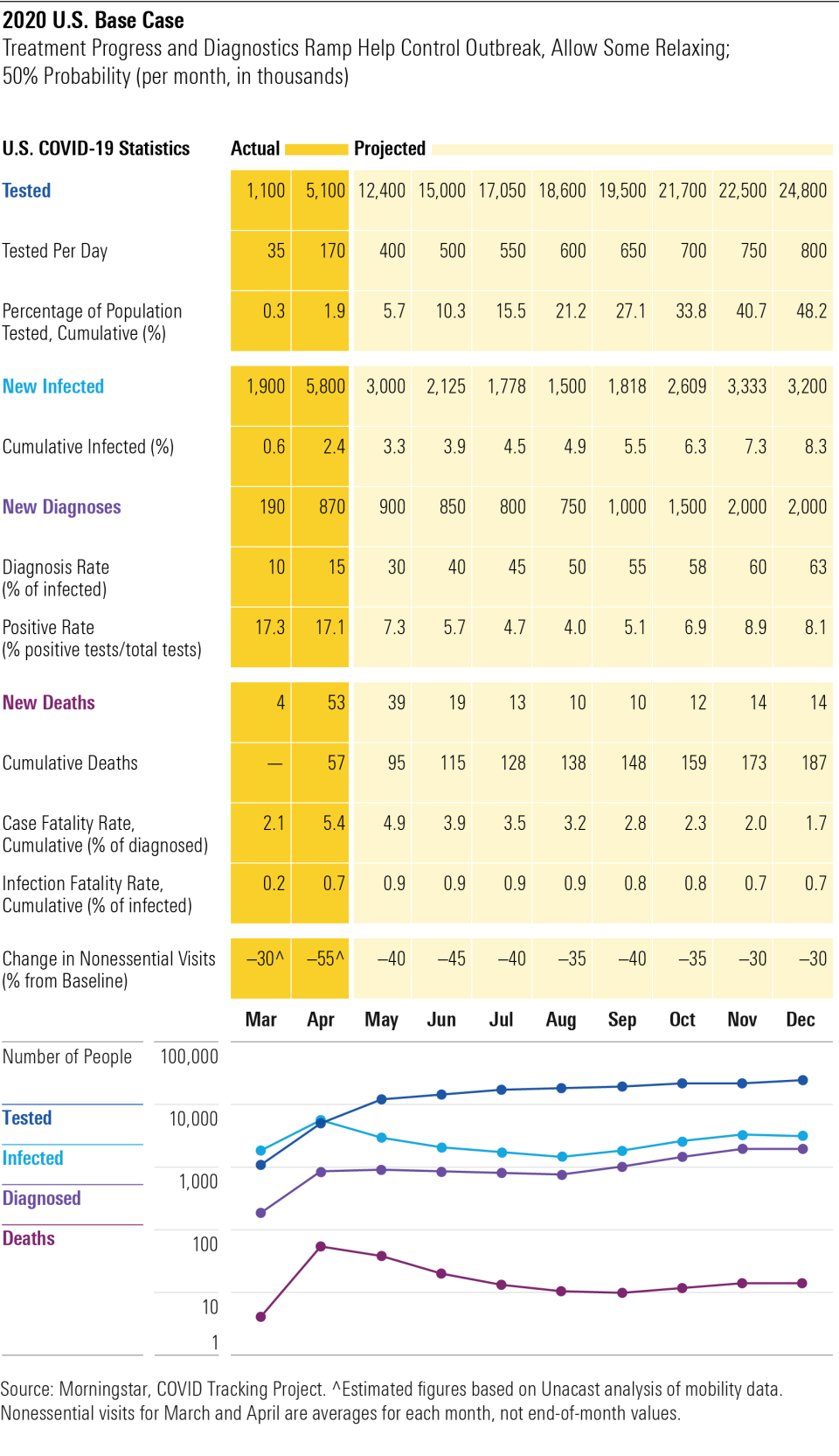

COVID-19, the disease caused by SARS-CoV-2 (coronavirus), has spread across the globe, and as we enter May, several countries and U.S. states are testing ways to relax lockdowns and begin paving the way for economic recovery. While we don’t think U.S. states will follow federal guidelines for reopening, we expect the transition to be gradual and that they will quickly reverse any moves that lead to a spike in new cases. Diagnostic testing has improved more rapidly than we anticipated, to around 250,000 a day, and we think a combination of continued social distancing (masks and six-foot rule), steady improvement to 800,000 tests per day by the end of the year (which facilitates contact tracing and surveillance), broader availability of Gilead’s remdesivir, and potential targeted antibodies and vaccines by the end of the year in high-risk populations should allow visits to nonessential businesses like restaurants, salons, and retailers to recover to 30% below prepandemic levels by year-end, from a trough at around 65% below in March.

Our new base-case scenario assumes that less than 10% of the U.S. population is infected by the end of 2020, with a 0.7% death rate, as improving levels of testing help control the spread of the disease.

The recent emergency use authorization for Gilead’s (GILD) remdesivir in severely ill COVID-19 patients is a turning point, but efficacy to date does not look strong enough on its own to justify relaxing lockdowns. That said, we project $2 billion in peak sales in 2021, assuming an eventual U.S. price (after donated supplies) of around $500 per treatment.

Vaccine progress has accelerated from an already rapid pace: Moderna (MRNA), Johnson & Johnson (JNJ), Pfizer (PFE), and AstraZeneca (AZN) could all receive emergency use authorizations by the end of the year. Assuming that at least two succeed, potential broad availability (billions of doses) would allow near-normal distancing measures by mid-2021.

U.S. daily diagnoses have generally flattened between 20,000 and 30,000 per day since March 30, but we think this is primarily due to increases in testing availability and that actual new cases are probably trending down.

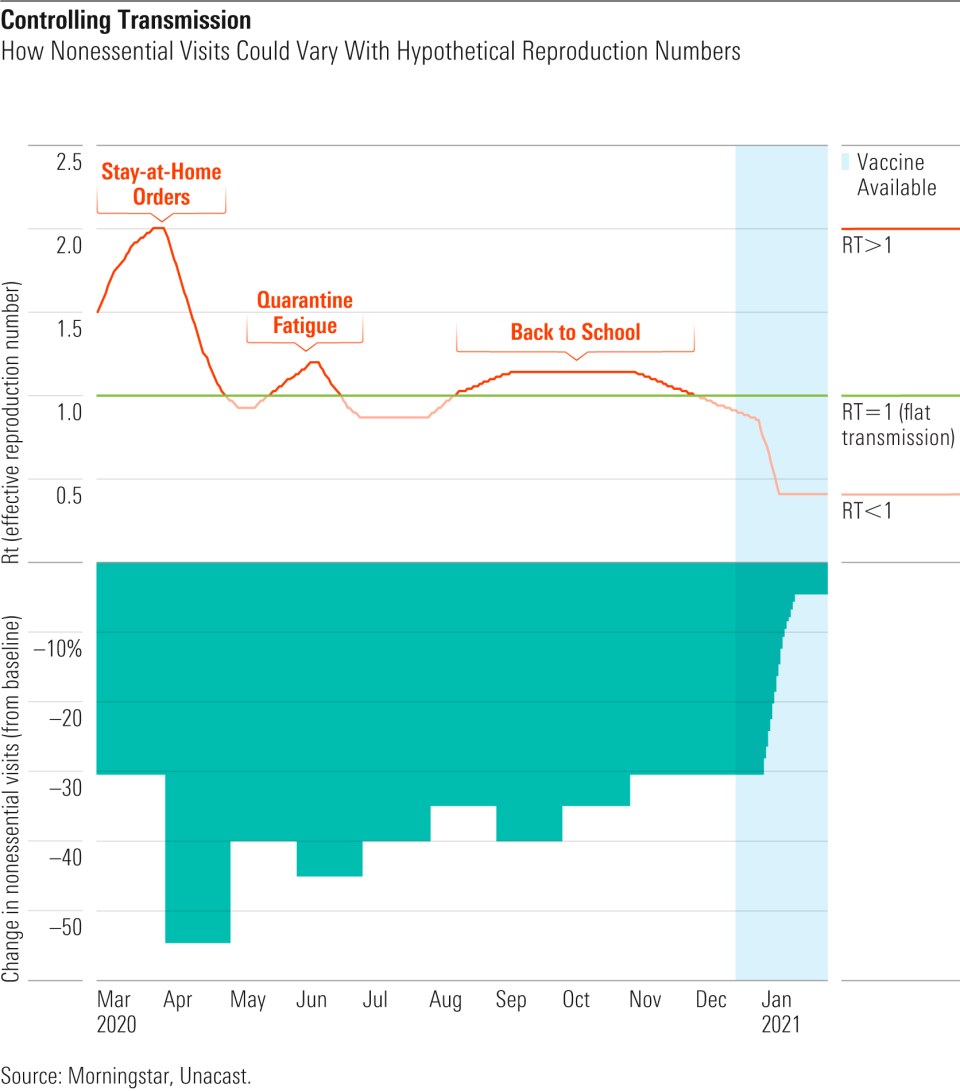

We assume that there could be some intermittent reclosures in certain parts of the country if the effective reproduction number Rt (transmission rate) climbs above 1, which is why we assume a step-up in cases in June (after the initial relaxing is taken too far) and September (as children return to school).

Morningstar’s Coronavirus Analysis: Narrowing Our Three Scenarios

With new cases declining in New York and several states seeing continuing small (if sometimes increasing) numbers of infections, many states are entering May in a position to begin considering how to relax their lockdowns and overcome the economic shutdown. Federal guidelines on social distancing that were put in place in mid-March faded at the end of April, so each state is likely to become a slightly different experiment in how to emerge from lockdown, with varying results depending on strategy, speed of reopening, and buy-in (or lockdown fatigue) from residents. Resurgences in several countries like Singapore, Hong Kong, and Germany serve as cautionary tales on moving too quickly. There are also many factors that could sway outcomes that are largely beyond a state’s control, at least in the near term, such as population density, climate, demographics, and quality of healthcare facilities. We’ve combined our understanding of tools to fight transmission and lethality of the virus--from simple interventions, like wearing masks, to the most complex, such as developing vaccines--to update our scenario analysis for the emergence of the United States from lockdown. While we think strategies will vary by state, we keep most of our analysis at the overall country level for simplicity.

Our first report in early March focused on understanding the lethality and spread of the new virus and its potential economic impact in the context of past pandemics. Once it became clear that the U.S. was willing to move to more severe stay-at-home measures and lock down part of the economy to mitigate the disease following disasters in countries like Italy, which were only slightly ahead of our timeline, our second report dived deeper into the potential waves of transmission depending on the month-by-month extent of social distancing, nonessential-business closures, and pharmaceutical progress, and how this could hit GDP on an industry-by-industry basis.

As we enter May, we’re faced with the challenge of estimating when nonessential businesses will be allowed to reopen and to what extent this will translate to reality--some business owners could opt to stay closed longer. It also remains unclear what demand will be like, as shoppers may continue to distance despite reopenings (roughly 70% of respondents in a recent national poll opposed such reopenings) or, conversely, travel from other states to shop because of continuing lockdown in their home state. If businesses reopen and shoppers return, there’s also uncertainty around whether reopening is sustainable and will actually speed the economic recovery; a COVID-19 resurgence could require reopenings to be reversed by the fall. With reopening, diagnostics are becoming more critical than ever, as wider availability will allow us to isolate infected patients earlier, perform effective contact tracing, and perform heavier testing in areas with larger outbreaks. We have a variety of tools that we can combine to limit transmission as we reopen, but we think finding the right balance will take time as well as trial and error.

We’re also at a critical point in drug and vaccine development, as drug data has left us with limited options in the near term but high potential in the long run, and vaccine progress has been impressive. Preliminary data offers a mixed view on whether we will have access to drugs or vaccines later this year that could begin to make a dent in transmission and allow for wider, more sustainable reopening. Based on recent data, Gilead’s remdesivir looks useful in severely ill hospitalized patients, and as an antiviral it is likely to be useful in earlier-stage patients as well (further data is expected later in May); IL-6 inhibitors like Roche’s (RHHBY) Actemra and Regeneron (REGN)/Sanofi’s (SNY) Kevzara are more likely to work in patients who are already in critical condition (on ventilators), if they work at all (recent data on Kevzara was discouraging); and the use of malaria drugs chloroquine/hydroxychloroquine will be sharply limited by efficacy concerns and cardiac side effects.

While we have yet to see data on vaccines, continuation of phase 1 Moderna studies at higher doses is a good sign for safety; trials would have halted if there were safety issues so far. We’re encouraged by the announcement at several vaccine developers of recent collaborations, funding arrangements, rapid acceleration in manufacturing, and parallel mid- to late-stage trials. We also think it’s increasingly likely that the Food and Drug Administration will be receptive to a smaller data set before vaccine approval in high-risk patients if we are still facing the pandemic as we approach the end of the year--as we expect we will be.

We’re Wary of Assuming Asia’s Successful Containment Can Translate to U.S.

Uncertainty surrounding key assumptions and some improbable simplifying assumptions can make models of the spread of COVID-19 quite variable. Until early May, the frequently cited model from the Institute for Health Metrics and Evaluation assumed perfect compliance with social distancing measures until it is safe to relax restrictions (until contained) and did not attempt to predict a second wave; it only showed projections through July. As of April 29, IHME projected that roughly 72,000 Americans would die from COVID-19 through July, well below our base-case assumption of 187,000. These IHME projections were based on the shape of case curves in other countries, not epidemiological analysis of what is happening with transmission of the virus in the U.S. We saw this as too optimistic, based on China’s rapid action and South Korea’s massive testing rollout.

As of May 4, IHME has significantly changed its method of modeling the outbreak, however, and now uses a hybrid model that incorporates a more traditional method of epidemiological modeling known as a SEIR (susceptible, exposed, infected, resistant) model. This new model also incorporates assumptions of a second wave based on metrics like mobility, temperature, testing rates, and population density. The new analysis assumes a total of more than 134,000 deaths in the U.S. this year, much more in line with our new base-case estimates.

While SEIR models are the gold standard, the uncertainty around key variables in the middle of an outbreak can lead to dramatically different predictions, even with seemingly small changes in assumptions. One SEIR model, developed for The New York Times, results in a range of outcomes even with many concrete inputs. For example, an economic shutdown from mid-March through the end of April, with some standard assumptions on death rate (1%), hospitalization rates (10%), and contagiousness (reproduction number, or R0, equal to 2.5), can result in U.S. deaths ranging from roughly 40,000 to 1.3 million this year, depending on where our assumptions fall on the spectrum included within the “moderate” portion of intervention level and “medium” impact of warmer weather on the transmission of the virus. The Center for American Progress used this model to show that we need to use aggressive distancing for 45 days (through mid-May) to keep deaths around 140,000 for the year and 60 days (through end of May) if we want to completely suppress the virus through November. However, it pointed out that the distancing we have used has not been uniform across states, so our actions can’t be compared to China’s lockdown.

Several factors lead us to believe that even though we can suppress the virus and prevent the spread from rising above a dangerous threshold, the U.S. and many Western European countries won’t be able to contain it like a handful of other countries, including South Korea and China, have. First, we didn’t see national orders, as we are more decentralized than Asian countries, and states generally waited until cases started to rise to issue lockdowns. The U.S. also did not appear as agile in assisting affected cities, as other Chinese cities assisted Wuhan. Lax standards likely mean a longer epidemic in the U.S. than other countries and more infections. The U.S. also doesn’t have the isolation rooms that China built during the outbreak or that Singapore prepared after SARS in 2002-03 (necessary for containing the virus among hospitalized patients). Wuhan was hit hard and not only locked down, but it also built makeshift hospitals and quarantine centers and enforced strict quarantines for everyone who was sick and even those who were exposed, involving family separation that seems unlikely for Western society. The U.S. is also more exposed demographically than China, with a higher percentage of the population over the age of 65 and leading rates of diabetes and obesity that might boost the percentage of cases that are high-risk and require hospitalization. The ability of Americans to follow orders may not be as high as in Asia, and impatience with the economic shutdown in the face of ballooning unemployment (and likely warmer weather) has led to some opposition to stay-at-home orders and protests in state capitals and other cities.

Our Base Case Assumes Some Trial and Error With Reopening, as States Remain Nimble

Our base case assumes that cases at least level off before most states begin to relax social distancing measures. We assume that we may struggle with additional waves of the illness going into summer and fall, but rapid reimplementation of a higher level of restrictions will prevent the healthcare system from being overwhelmed. Overall, our new analysis predicts a faster ramp in diagnostics based on the faster-than-anticipated ramp in April. There were also slightly fewer diagnosed cases in April than we had anticipated, but based on the recent relatively flat diagnoses, we’re not assuming as steep of a drop-off as we head into summer, particularly given that quarantine fatigue is leading to more relaxed social distancing even in states that still have stay-at-home orders.

We assume that there will be a second wave in the fall due to the resumption of school, cooler weather, or both. However, this will be muted by improved diagnostics capacity (allowing better testing of workers and contact tracing and more rapid isolation of infected), treatments like remdesivir (reducing deaths in hospitalized patients), and vaccines that could be available for the highest-risk populations (starting with healthcare workers). Even if diagnostic and contact tracing capabilities are not where experts say they should be, we think there will be enough other tools in place that prospects for a massive surge in cases are much less likely.

Nonessential-Business Visits to Remain Depressed Throughout 2020

While essential businesses have stayed open during the pandemic, many nonessential businesses have closed with state lockdowns, and economic recovery will depend on how quickly these businesses can return to normal. Nonessential businesses that have been most affected by the pandemic (uniformly nonexempted by states) have a relatively high ratio of social interactions per unit of GDP and include businesses such as restaurants, hotels, offices, retailers, gyms, and salons.

A key question going forward is, What change in nonessential visits could allow for sustained control of the virus? Research for the University of California, Berkeley and the Massachusetts Institute of Technology, based on Google Mobility reports as well as growth rates for the virus before the lockdown, estimate that mobility could rise to 30% below the prior baseline in a best case in San Francisco, rather than current levels 60% below baseline, without triggering a resurgence. This would require continued surveillance for changes in prevalence and the agility to reverse relaxed distancing measures quickly if prevalence begins to rise, but mobility levels could rise even higher if diagnostics capacity and contact tracing are implemented on a wide scale, as we expect they will be.

We think widespread availability of a vaccine or curative treatment regimen will probably be necessary to completely remove our social distancing measures. Regardless of state policies on relaxing restrictions on businesses, we assume that consumer behavior changes should result in a 30% reduction in nonessential visits from baseline by the end of the year. Mobility data from Unacast indicates that nonessential visits declined dramatically in late March in the U.S., falling as low as 65% below the prior baseline before beginning to increase in mid-April. We assume that there could be some intermittent reclosures in certain parts of the country, which is why we assume falling visits again in June (after the initial relaxing is taken too far) and September (as children return to school). Beyond September, treatment and vaccine availability will improve, but we could also be entering flu season, which could strain our healthcare system and make extra capacity for COVID-19 patients more scarce, although social distancing should help reduce the spread of the flu as well. We don’t assume anything as severe as the initial lockdown and still assume a trend line toward more normal nonessential visit patterns.

Epidemiologists use reproduction numbers to measure the contagiousness of a virus. The natural (unimpeded) reproduction number for SARS-CoV-2 is probably higher than 2, but societies can change the R number with interventions, yielding a lower effective reproduction number, or Rt. If this number falls below 1, then each infected person goes on to infect fewer than one other person, meaning that the outbreak will fade. Rt is below 1 in most states at this point. We expect that Rt could rise above 1 again in the U.S. as many states reopen in the name of starting the economic recovery, but that states will react rapidly to bring the virus back under control. By 2021, we think a vaccine will be available, which should dramatically reduce Rt to a level that would allow more normal nonessential visits.

Base-Case Fatality Rate of 0.7% to Stay Relatively Steady Throughout 2020

Our assumed fatality rates for the rest of the year are slightly higher on average than our prior analysis. In the near term, fatality rates are assumed to be lower than our prior estimates, based on fatality levels we saw in April. In the long term, however, we don’t assume the same steep drop as in our prior analysis, based on several treatment updates since our last report. This includes the consensus on safety issues with chloroquine, discouraging initial data from a study of Regeneron/Sanofi’s Kevzara, and incremental (but apparently real) impact of remdesivir on duration of COVID-19. Remdesivir’s efficacy so far is impressive and looks likely to reduce mortality rates from COVID-19. However, these improvements fall short of what we considered necessary for our former base-case scenario, which assumed that efficacy would be strong enough on its own to allow wider relaxing of lockdown measures.

Our projections through the end of 2020 have testing rates increasing to 800,000 per day, in line with many proposed guidelines but also within the realm of feasibility. We think that roughly 8% of the population will have been infected by the end of the year and that 0.7% of infected patients will die, resulting in 187,000 deaths in the U.S. this year from COVID-19. While nonessential visits hit a trough at 65% below prepandemic levels at the end of March, according to data from Unacast, this had recovered to only a 45% decline at the end of April. We expect levels could vary as states reopen and potentially add back restrictions if new cases increase, but we do expect the trend to increase closer to normal throughout the year, reaching a 30% reduction from prepandemic levels by the end of 2020.

While reported cases and deaths give a roughly 5% fatality rate (known as a case fatality rate), the infection fatality rate (based on the number infected) is probably much lower. Our 0.7% assumption is in line with New York City’s 0.8% rate, which was based on a combination of confirmed and probable COVID-19 deaths in the city (numerator) and positive antibody tests on samples of the population to estimate the potential number infected (denominator). But both numerator and denominator are uncertain here, as we are clearly not diagnosing all cases of the disease, seroprevalence studies are prone to error, and we are probably not properly attributing excess deaths to the virus. For example, the death toll in 14 European countries from coronavirus was recently estimated to be 60% higher than reported, based on higher-than-normal death rates during this time of year. Also, a widely criticized seroprevalence (antibody testing) survey in Santa Clara County, California, predicted a less than 0.2% infection fatality rate.

Bull and Bear Cases Cover a Broader Spectrum of Prudence and Impatience

In our base- and bull-case scenarios, we assume that gradually relaxing measures will allow us to find a level that will keep cases steady and prevent spikes. Our bullish scenario assumes that cases fall for 14 days, in accordance with federal guidelines, before significant levels of reopening, allowing each state to gradually reduce restrictions without seeing additional waves. In the bull case, our improvements in diagnostics and contact tracing, as well as increased access to treatments and vaccines, are all stretched over a smaller infected population, making it easier to suppress the virus. The key assumption here is that states are patient enough to wait to relax restrictions and don’t relax them too quickly.

In a worst-case scenario, eager governors allow significant reopening and return to work before diagnosed cases begin to decline and positive rates on diagnostic tests fall below 10%, which we think would put states at risk for overwhelming healthcare systems this summer or fall, leading to a potential lockdown/reopening roller coaster that makes it difficult for businesses to regain footing. In this scenario, Americans would also be willing to return to former habits as the lockdown ends. We also assume slightly slower progress with improving diagnostics capacity throughout the year, making it harder to trace new cases as we see a resurgence in the fall.

States Have Responsibility to Guide Reopening, but Many Unlikely to Follow White House Criteria

The White House issued guidelines to help states determine when to reopen, and to what extent, including a decline in flu- or COVID-like illnesses for 14 days; a decline in diagnosed cases for 14 days; a decline in positive tests as a percentage of total tests for 14 days (with a flat or increasing testing rate); all hospitals operating without crisis care; and at-risk healthcare worker diagnostic and antibody testing. Additionally, the government suggests that upon reopening, people should practice good hygiene (including masks in public), and employers should implement best practices (like social distancing and temperature checks). States should have the ability to diagnose, contact trace, handle a surge in the need for personal protective equipment for healthcare providers, and implement plans to protect people from exposure and mitigate outbreaks by moving to an earlier phase.

However, several issues with the White House guidelines could make it more difficult for states to reopen successfully. There is no benchmark for the diagnostic testing capacity needed to show an accurate measure of decline. Importantly, there is no guidance on what to do if there is a resurgence in cases.

Ideally, we would wait until there were only minimal cases outstanding in each state (IHME’s very conservative guidance is roughly one total case per 1 million residents) before reopening, as this would ensure that current diagnostics supply is sufficient to test those who are infected and that we have enough public health workers to trace contacts of anyone who becomes infected. But with some states starting to reopen because of economic problems even as cases continue to increase, a conservative scenario is unlikely to be the first choice, making containment much more difficult. The key will be trying to find the right balance of restrictions that will prevent us from overwhelming hospitals with severe cases of COVID-19 but also breathe some life back into struggling businesses.

First, looking at the U.S. position overall, new daily diagnoses have been volatile recently but are generally indicating a stable trend. However, this is during a time of strong expansion in diagnostic testing. If there were an equal number of actual new cases of COVID-19 each day, then expanding testing should lead to a proportional increase in diagnosed cases. Therefore, it appears that actual new cases are probably trending down. This can also be assessed using the positive rate (percentage of tests that come back positive), which has been trending down since mid-April. This signifies that we are improving the bandwidth of our testing.

At the state level, many states are in the processing of reopening or have released plans to reopen later in May. Many states that acted quickly prevented larger outbreaks and are able to begin reopening faster than others. For example, Ohio canceled a fitness expo in Columbus on March 4, before there were any cases in the state, and has kept its cases below those in neighboring states. In mid-April, director Robert Redfield of the U.S. Centers for Disease Control and Prevention said that up to 20 states have seen limited impact from the virus and could reopen May 1, and several have begun reopening in a meaningful way.

That said, we think some states could be reopening prematurely, with red flags including increasing cases, cumulative positive rates above 10% (not testing enough people), a trend to increasing positive rates (either increasing cases, or testing fewer people, either of which is concerning), and reopening dates that look aggressive based on the combination of these measures. Several states in the Midwest (Nebraska, Iowa, Kansas, Minnesota, and Michigan) and the South (Louisiana, Mississippi, and Virginia) have concerning trends, as do Arizona and smaller states in the Northeast, like Delaware and Vermont. We’re less concerned about states that are seeing increases in cases if they are also increasing testing and either maintaining or shrinking their positive rate, although stable situations can quickly turn into accelerating spread if restrictions are lifted too rapidly.

What it means to reopen varies widely by state, and it remains unclear what combination of changes is key to maintaining control of the virus. Some researchers are using cellphone data to track how concentrated shoppers are in certain stores and how long they spend in them; shops with many customers and long stay times would have higher rates of transmission. Others are attempting to balance these risks with the benefits of each type of location to be reopened. However, we expect reopening to be a process of trial and error.

Regardless of population density, we think states have reason to be concerned and need to carefully reduce restrictions. For example, rural states are particularly vulnerable because many have older and sicker populations, and more than half of the counties in the U.S. have no intensive care beds, although lower population density and warmer, humid air arriving in parts of the country appear to have slowed transmission, in combination with social distancing, so far. Rural areas may see more of a benefit from warmer weather, but according to PolicyLab, weather alone has not been sufficient to stop resurgences in bigger cities. In Cook County (Chicago), PolicyLab predicts that we need to maintain at least 50% social distancing (relative to prepandemic levels) if we want to reopen by May 15 and at least 33% social distancing if we reopen June 1. While crowded cities do see higher risk of spreading the disease, they also see increased risk of severe illness, as people are more likely to be exposed to higher levels of the virus initially, from multiple sources (this has been tied to the severity of illness during the Spanish flu in 1918-19 as well).

Relaxing the Lockdown: Tools and Proposed Plans Largely Combine Diagnostics, Contact Tracing, and Flexible Social Distancing

In the absence of a curative treatment or vaccine, our efforts are focused on nonpharmaceutical interventions. Most of these methods have benefits and drawbacks, and the key will be finding the right combination that keeps the virus from spreading but also allows the fastest path to beginning an economic recovery.

At the start of the pandemic, there were a handful of analyses on how we could try to prevent a catastrophic wave of infections from overwhelming our healthcare systems. A March 2020 analysis by Imperial College discussed how basic mitigation policies--like isolating infected people and using social distancing to protect high-risk individuals--would be insufficient to prevent what most countries would consider a catastrophic scenario and instead presented an idea that adds school closures and a 75% reduction in contact rates for the entire population to suppress the virus. This method could be applied intermittently based on hospital statistics, like ICU admissions or death rates, and could be adjusted based on local outbreaks.

Since then, several independent proposals have been published that seek to combine the tools we have at our disposal and to build the tools that are lacking, to find the right way to reopen our society. We think that the most extreme call for millions of tests per day is unrealistic and that we are much more likely to see success by combining multiple methods, such as diagnostics, surveillance of high-risk populations, manual and technology-enabled contact tracing, and continued social distancing on some level, with the option of reverting to stricter social distancing if infections or hospitalizations rise.

Europe’s Relaxation Challenges Offer Preview of U.S. Summer

In our last report, we highlighted that China’s aggressive containment policies and South Korea’s rapid testing and contact tracing technologies allowed them to stop the outbreaks in their countries while cases were still rising rapidly in the West. However, the picture today is slightly different, with Western Europe appearing to have more success in slowing the spread of COVID-19 while the U.S. continues to grow, as declines in New York City are more than countered by increases in the rest of the country.

Europe is starting to relax restrictions in small ways, and we’re just beginning to see some information from countries like Denmark and Germany that relaxing (limited) measures is leading to higher rates of spread. Denmark opened primary schools April 15 but then saw the reproduction number (measuring contagiousness of the virus) edge closer to 1, from 0.6 to 0.9, meaning that the country may be more limited in relaxing other measures if it wants to keep the virus under control and prevent transmission from widening. Germany reopened small businesses on April 20 and schools on May 4, although bars and restaurants will stay closed and large gatherings are still banned through August. Masks are strongly recommended, and social distancing and bans on gatherings of more than two people from different households will remain in effect for the foreseeable future. Germany was similar in its lockdown to the U.S., as neither implemented full economic shutdowns (factories remained operational in both countries, unlike in France, Spain, and Italy). Germans were also warned to stay home as much as possible on April 28, as the reproduction rate had increased from 0.7 to 1 with recent relaxation measures.

Other European countries are still phasing in their reopening or remain under lockdown. Spain began to ease restrictions on April 13, although only those who cannot work from home are returning to the workplace. Schools, bars, restaurants, and hotels in Spain are still closed, and outdoor exercise is still banned. Italy allowed certain small shops to open in April, with rolling openings like manufacturing and construction, more freedom of movement in parks (May 4), and opening of more shops and museums (May 18), restaurants and bars (June 1), and schools (September). France is on lockdown until mid-May. Some smaller countries that saw smaller initial hits are also removing some restrictions as long as cases stay stable; Austria opened small shops April 14 and larger stores and malls May 1, but masks are required in enclosed public spaces.

This article was written by Karen Anderson, CFA© and Healthcare Strategist at Morningstar, a research partner for Yahoo Finance Premium.

Karen and Preston Caldwell, Equity Analyst at Morningstar, discussed the long-term economic impact of the global shutdown in a special Yahoo Finance Premium webinar on Tuesday, May 19 at 12pm ET. Watch the recording here.

Karen Andersen does not own shares in any of the securities mentioned above. Find out about Morningstar’s editorial policies.

Additional Morningstar research is available in Yahoo Finance Premium. Start your free trial today.*

Yahoo Finance

Yahoo Finance