Should Regis Healthcare (ASX:REG) Be Disappointed With Their 28% Profit?

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Regis Healthcare Limited (ASX:REG) share price is up 28% in the last year, clearly besting the market return of around 12% (not including dividends). That's a solid performance by our standards! In contrast, the longer term returns are negative, since the share price is 20% lower than it was three years ago.

See our latest analysis for Regis Healthcare

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, Regis Healthcare actually shrank its EPS by 5.6%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Absent any improvement, we don't think a thirst for dividends is pushing up the Regis Healthcare's share price. It seems far more likely that the 8.9% boost to the revenue over the last year, is making the difference. Revenue growth often does precede earnings growth, so some investors might be willing to forgo profits today because they have their eyes fixed firmly on the future.

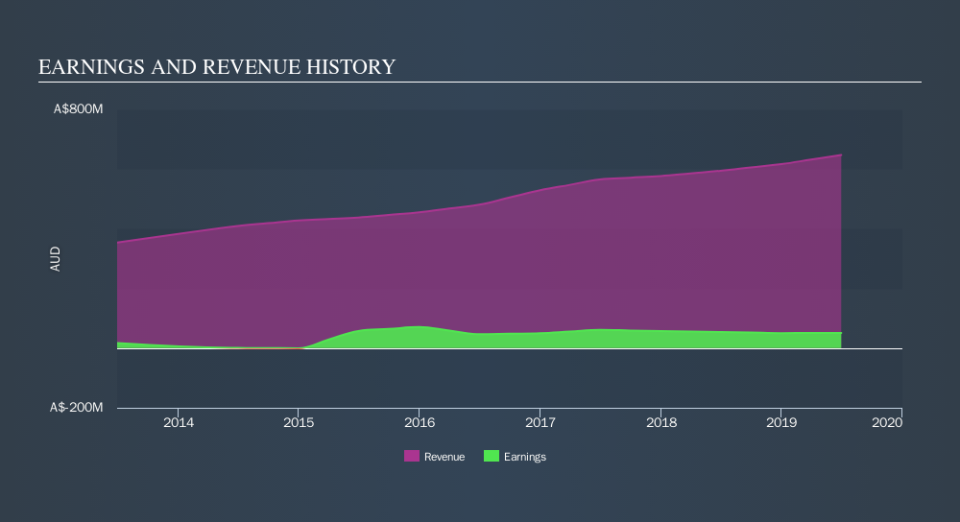

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Regis Healthcare's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Regis Healthcare the TSR over the last year was 35%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Regis Healthcare shareholders have received a total shareholder return of 35% over one year. That's including the dividend. Notably the five-year annualised TSR loss of 1.3% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Regis Healthcare may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance