HomeBuilder: The Aussie regions where it’s easiest to score the subsidy

Australians living in south-east Melbourne will have the easiest time scoring the $25,000 HomeBuilder subsidy, new research analysing the requirements has revealed.

Also read: How to get the $25,000 HomeBuilder grant

Also read: Warnings PM's $25k rescue plan could 'saddle' Aussies with debt

Also read: Govt hands $25,000 to home buyers, owners

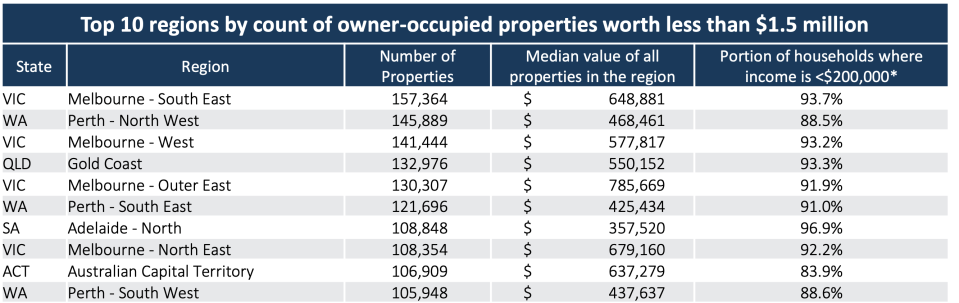

That region, which extends from Mount Waverley to Bunyip, has 157,364 properties with a median value of $648,881 and 93.7 per cent of households have an income of less than $200,000, CoreLogic research reported on Thursday.

That’s based on the regions with the highest number of owner-occupied houses worth less than $1.5 million.

The second region where it’s easiest to access the subsidy is north-west Perth. There, the 145,889 properties have a median price of $468,461 and 88.5 per cent of household incomes fall below the $200,000 cap.

“Even where dwellings fall well below the $1.5 million threshold for a renovation grant, many of these owner occupiers will not take up the homebuilder incentive for renovations,” CoreLogic head of research Australia, Eliza Owen, said.

“CoreLogic estimates there are about 4.4 million owner-occupied properties across Australia with a high confidence valuation below $1.5 million, but the federal government estimates the scheme may only support about 7,000 renovations.”

That’s due in part to the income cap of the scheme and the high cost of the value of eligible renovations.

In order to qualify for HomeBuilder, renovations must be worth between $150,000 and $750,000.

“For areas where dwelling prices and incomes are relatively low, this may lead to owners over-capitalising on renovations, where they cannot recoup the cost of upgrades to the property,” Owen added.

Top 10 regions where owner-occupied homes are worth less than $1.5 million

Owen noted that four of the top 10 regions were in Melbourne, most on the fringe of the metropolitan area.

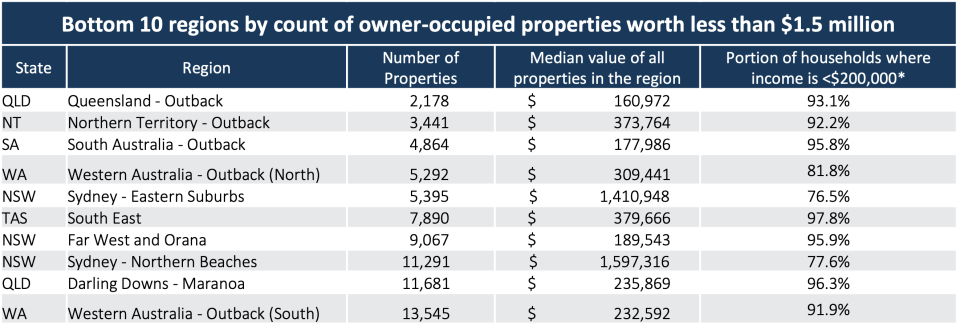

Bottom 10 regions where owner-occupied homes are worth less than $1.5 million

Conversely, the bottom 10 list is made up of high-value areas like the northern beaches and the eastern suburbs of Sydney, and outback areas where there aren’t many houses.

The HomeBuilder plan has been heavily criticised since it was announced, with shadow housing minister Jason Clare describing the package as “incredibly disappointing”.

“They talked about renovation rescue and how you’re going to be able to renovate your kitchen and renovate your bathroom. It turns out it’s all rubbish, there’s not many battlers in the suburbs of Australia that have got a lazy $150,000 to renovate their kitchen or their bathroom,” he said.

Australian Council of Social Services chief executive Dr Cassandra Goldie also said it was poorly targeted.

“It will largely benefit those on middle and higher incomes undertaking costly renovations, without any related social or environmental benefits,” she said.

“The risk is that it will saddle people with huge debts that they may not end up being able to afford, especially given the uncertainty of the job market.”

Join the Women’s Money Movement on LinkedIn and follow Yahoo Finance Australia on Facebook, Twitter and Instagram.

Yahoo Finance

Yahoo Finance