REGENXBIO (RGNX) DMD Gene Therapy Gets Orphan Drug Status

REGENXBIO Inc. RGNX announced that the FDA has granted orphan-drug designation to its pre-clinical stage, one-time gene therapy, RGX-202, as a potential treatment for Duchenne muscular dystrophy (DMD). The company plans to submit an investigational new drug application (“IND”) to the FDA to support the initiation of a clinical-study on the candidate by the end of 2021.

RGX-202 has been designed using REGENXBIO's proprietary NAV AAV8 vector to deliver optimized microdystrophin transgene with a goal to develop a targeted therapy for improved resistance to muscle damage associated with DMD.

The orphan drug designation is granted by the FDA to a drug or biologic intended to treat a rare disease or condition, which generally includes a disease or condition that affects fewer than 200,000 individuals in the United States. The orphan drug designation also includes incentives including tax credits for clinical testing, prescription drug user fee exemptions and a seven-year marketing exclusivity in the event of regulatory approval.

REGENXBIO is also developing a commercial-scale cGMP material of RGX-202, which will be used in the clinical development of RGX-202. The company’s internal cGMP facility is expected to support the production of up to 2000 liters of the investigational gene therapy.

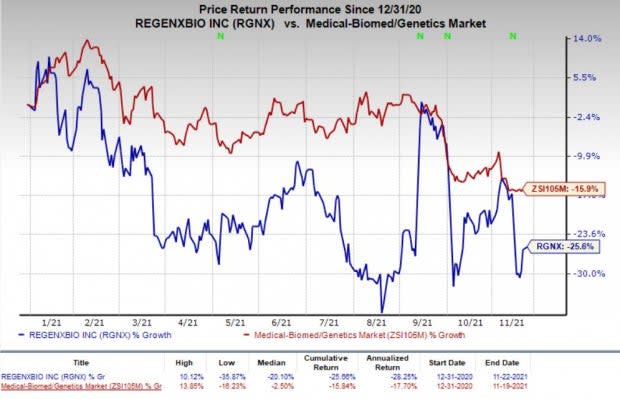

Shares of the company have declined 25.6% so far this year compared with the industry’s decrease of 15.9%.

Image Source: Zacks Investment Research

We note that Sarepta Therapeutics SRPT is a leading player in the field of DMD therapeutics. Sarepta is the only company with three FDA-approved DMD drugs in its commercial portfolio.

Moreover, Sarepta recently initiated the first pivotal study on a gene therapy targeting DMD. It is developing a micro-dystrophin-encoding gene therapy candidate, SRP-9001, in a phase II/III study.

Solid Biosciences SLDB is another company engaged in the development of a gene therapy targeting DMD.

Solid Biosciences is developing its lead pipeline candidate, SGT-001, in a phase I/II study, IGNITE-DMD. The study was put on clinical hold last year. Solid Biosciences made changes to the study design to enhance patient safety and improvements to its manufacturing process. The company resumed the study in February this year after FDA removed the clinical hold following the changes to the study design.

Although REGENXBIO is yet to start a clinical study on its DMD gene therapy candidate and a successful development is most likely to take several years, the company will likely have a hard time gaining market share in the DMD segment.

Apart from RGX-202, REGENXBIO is also developing several other gene therapy candidates targeting rare diseases. The company is developing its lead pipeline candidate, RGX-314, as a potential treatment for wet AMD and diabetic retinopathy.

Earlier this year, REGENXBIO entered into a collaboration with pharma giant AbbVie ABBV to co-develop and co-commercialize RGX-314.

Per the agreement terms, REGENXBIO will receive $370 million as an upfront payment from AbbVie. AbbVie will also pay potential milestone payments up to $1.38 billion. Following the collaboration, both REGENXBIO and AbbVie will share costs for future studies on RGX-314.

REGENXBIO Inc. Price

REGENXBIO Inc. price | REGENXBIO Inc. Quote

Zacks Rank

REGENXBIO currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

REGENXBIO Inc. (RGNX) : Free Stock Analysis Report

Solid Biosciences Inc. (SLDB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance