Recent ASML Sell-Off Is an Excellent Opportunity to Benefit From AI Tailwinds

ASML Holding NV (NASDAQ:ASML) is perhaps the most critical company due to the technology it possesses in the semiconductor supply chain. Indeed, the company's lithography equipment is essential for producing the high-performance chips necessary for artificial intelligence applications.

The Dutch company is headquartered and listed in the Netherlands and its American depositary receipt allows access to the U.S. investors. The stock has even been allocated a 98 out of 100 GF Score, which is fully justifiable, as we will see in this analysis.

Business overview

When analyzing a company, it is crucial to identify its moat, or competitive advantage, that will keep it ahead in the game. In the case of ASML, as with most tech companies, it is the monopolistic nature of its technology protected by patents. The company has the highest number of patents in machine learning followed by artificial intelligence and data science, according to Verdict.

The interesting part is the second quarter saw a spike in patenting activity by ASML, indicating it might soon reveal breakthrough innovations in the fields of artificial intelligence, machine learning and data science.

As a leading supplier of advanced lithography equipment, including deep ultraviolet and extreme ultraviolet systems, its cutting-edge technologies are essential for producing the high-performance chips necessary for AI applications. Companies like Nvidia (NASDAQ:NVDA) and Taiwan Semiconductor (NYSE:TSM) depend on ASML.

Further, the growth in AI demand is an amazing tailwind for ASML as chips powering generative AI applications depend on the company's technologies.

Stock performance

While the stock has had a strong performance overall, the past several weeks have been challenging for shareholders as the stock declined over 20% in the month of July alone on fears of a general slowdown in the semiconductor sector. Chip companies Taiwan Semiconductor and Nvidia also recorded double-digit declines.

When we zoom out on the chart, we can clearly see the picture has been rosy for existing shareholders over the long term.

The stock is up over 800% in the last 10 years and still up over 20% year to date despite the recent sell-off.

Financials and valuation

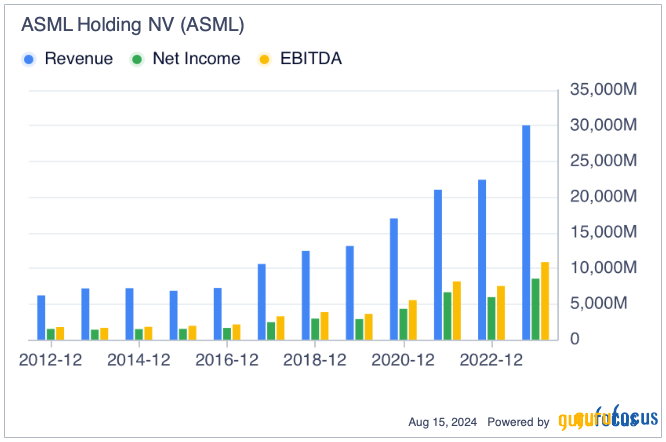

ASML has had impressive growth rates over a sustained period of time. Indeed, the company grew slightly over 18% per year in the past decade! Seven years recorded double-digit growth, while only three had (upper) single-digit growth rates.

This confirms that the stock is not a speculative asset; behind the share price action, there is tangible business expansion. The following chart is a great visual of the company's growing financials.

ASML additionally boasts a 48% return on equity, showing it is a high-margin and efficiently run business. Further, this indicates investments down the line will continue supporting high growth rates as the ROE remains high.

However, the recent sell-off was spurred by second-quarter results that confirmed the absence of growth this year. This has somewhat made shareholders panic that the years of growth are behind it. It is expected for the business to have a growth rate in the 0% to 1% range in 2024, which is highly abnormal and caused the valuation to contract.

CEO Peter Wennink blamed the results on a transition year due to macroeconomic uncertainty and China. Companies are ordering fewer chips as demand is weakening due to tight monetary policies across the globe, while at the same time trade restrictions and economic weakness in China significantly impact its business.

Although growth is expected to be flat this year, it is likely that ASML's growth rates will reaccelerate back into the double digits in the next few years (GuruFocus tables a 15% revenue growth rate and 23% earnings per share average for the next three years). Indeed, with the soon-to-start monetary easing of most major banks as the economies slow and with Chinese trade barriers lifting as the U.S. election approaches, it is widely expected that the entire semiconductor sector will return to growth next year. If the sector grows, ASML's orders will also pick up.

The art of investing is the art of catching falling knives. While ASML is not exactly a falling knife, its shares have definitely dropped sufficiently to price in market fears of a slowdown and unlock the potential upside growth surprise that an investor could expect in 2025.

The stock is currently trading at 30 times forward earnings, which is the median it has been trading around for a decade. Without multiples expanding (which usually happens when interest rates are lower), the stock should at least follow the aforementioned 23% earnings per share growth rate. This should theoretically put the stock back above the $1,000 level and, therefore, be in line with most Wall Street analysts' estimates of $1,000 to $1,100 per share (roughly 25% upside).

Risk factors

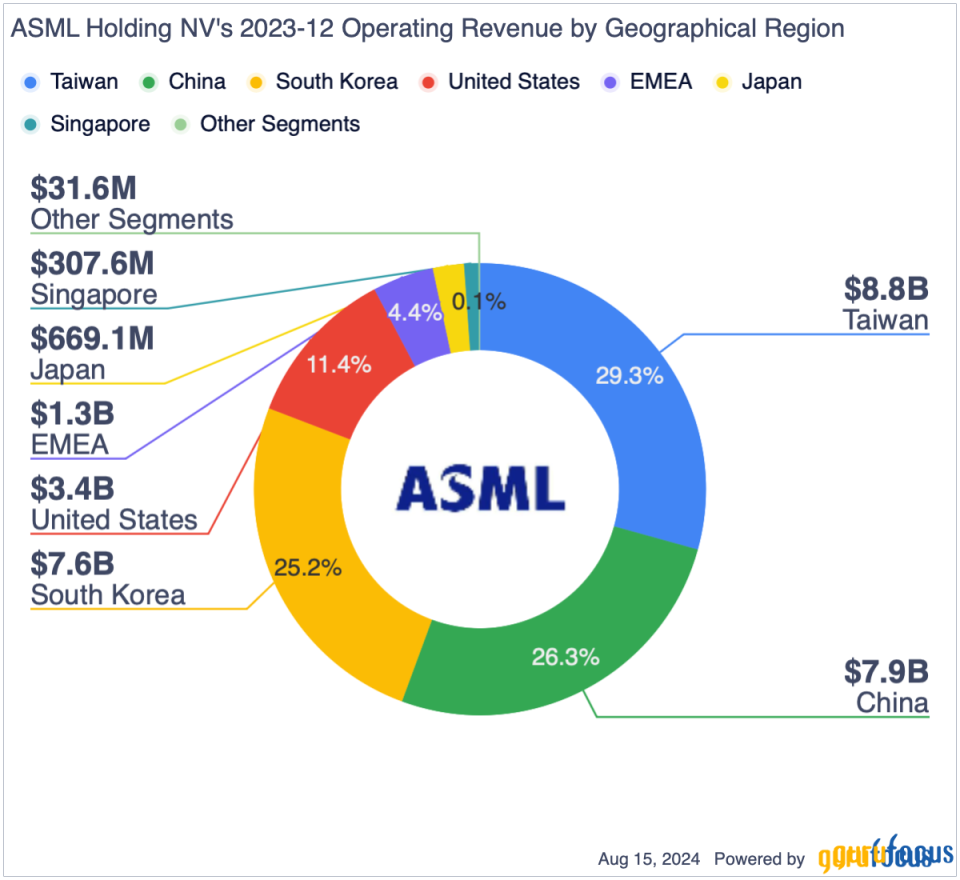

The key risk for the company is evident in the following chart.

More than half of ASML's revenue originates in Taiwan and China. The recurrent geopolitical tensions by U.S.-backed Taiwan and China cause some instability in the region, and even more so when it comes to critical semiconductor chips. With the prospect of new trade restrictions (and even trade wars), especially during and after a U.S. election year, poses some risk to the stock.

However, there are mitigants to this overconcentration risk in a geopolitically turbulent region of the world. The first is that it is likely that this risk is already priced into the stock, given that markets are fully aware of the critical role ASML is playing. While the U.S. government might pressure the Netherlands to restrict ASML from selling its systems to China (the Biden administration has publicly refuted the rumor), it is quite unlikely the country will stop. It would result in sacrificing half of its business and seriously endanger the importance the country has in the semiconductor sector.

The second mitigant is that no country in the world has any interest in further disruption of already weakened semiconductor supply chains; semiconductor chips power everything, from mobile devices to critical defense systems. Therefore, these geopolitical tensions should somewhat lead to a continued status quo and allow ASML to continue growing to at least the semiconductor market's growth rate. The segment is expected to grow by 10% per annum until 2029, with most of the growth coming from China.

Bottom line

The stock has recently sold off on fears of a global slowdown in chips demand. However, the medium and long-term prospects of the semiconductor segment remain unaltered given the importance of the chips in all electronic devices.

ASML's technologies are not only important for corporations like Taiwan Semiconductor and Nvidia, but also for countries like the U.S., Taiwan and China. This should continue providing the stock with tailwinds as demand and growth rates pick up again in 2025. The stock has approximately 25% upside in a conservative scenario without multiple expansion and is, therefore, an attractive semiconductor play within a diversified portfolio or within an AI-oriented investment strategy.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance