Reasons Why You Should Retain Masimo (MASI) Stock for Now

Masimo Corporation MASI is well-poised for growth in the coming quarters, courtesy of its research and development (R&D) efforts. The optimism led by a solid fourth-quarter 2023 performance and its solid product portfolio are expected to contribute further. However, concerns regarding overdependence on its Signal Extraction Technology (SET) and macroeconomic concerns persist.

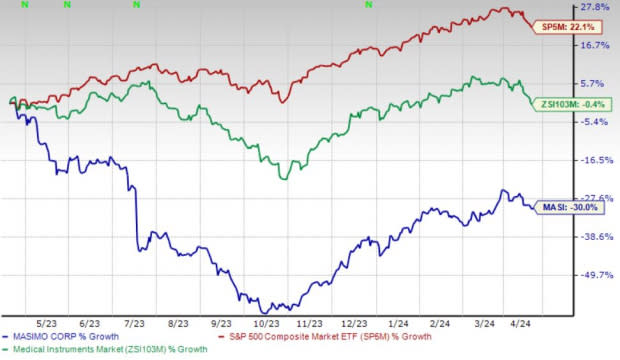

Over the past year, this Zacks Rank #3 (Hold) stock has lost 30% compared with the industry’s 0.4% decline. The S&P 500 has witnessed 22.1% growth in the said time frame.

The renowned global provider of non-invasive monitoring systems has a market capitalization of $7.19 billion. The company projects 8.8% growth for 2025 and expects to maintain its strong performance. Masimo’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 3.8%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Product Portfolio: We are optimistic about Masimo’s healthcare business, which develops, manufactures and markets a variety of non-invasive patient monitoring technologies, hospital automation and connectivity solutions, remote monitoring devices and consumer health products.

In February, Masimo received the FDA’s clearance for MightySat Medical, making it the first and only FDA-cleared medical fingertip pulse oximeter available Over-The-Counter direct to consumers without a prescription.

Research and Product Development: We are upbeat about Masimo’s ongoing R&D efforts, which it believes are essential to its success. Its R&D efforts focus on continuing to enhance its technical expertise toward its existing product portfolios and expanding its technological leadership in each of the markets Masimo serves with innovations, among others. Additionally, Masimo continues to collaborate with Willow on R&D activities related to advancing rainbow technology and other technologies.

Strong Q4 Results: Masimo’s fourth-quarter 2023 results buoy our optimism. Per management, the company gained from record contract wins in its healthcare business, important FDA clearances for innovative new products and strong growth in its hearables business. On the fourth-quarter earnings call, Masimo’s management confirmed that its hospital-at-home initiatives continued to gain traction with healthcare systems. Management also confirmed that the company has three product launches planned for 2024 — Freedom, H1 and the next-generation version of its Root Connectivity platform.

Downsides

Overdependence on Masimo SET: Masimo currently derives the majority of its revenues from its primary product offerings like the Masimo SET platform, Masimo rainbow SET platform and related products. Thus, the company’s business is highly dependent on the continued success and market acceptance of its primary product offerings.

Macroeconomic Concerns: Masimo’s consumer products are generally considered non-essential, discretionary products. As such, many of these products can be especially sensitive to general downturns in the economy. Negative macroeconomic conditions such as high inflation, recession and decreasing consumer confidence can adversely impact demand for these products, which could affect Masimo’s business.

Estimate Trend

Masimo has been witnessing a positive estimate revision trend for 2024. In the past 90 days, the Zacks Consensus Estimate for its earnings per share has moved north by 9.3% to $3.51.

The Zacks Consensus Estimate for the company’s first-quarter 2024 revenues is pegged at $488.2 million, suggesting a 13.6% decline from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Ecolab Inc. ECL and Cencora, Inc. COR.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 53.3% compared with the industry’s 9.6% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.4% against the industry’s 9.9% decline in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 43.2% compared with the industry’s 2.4% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance