Reasons Why Investors Should Invest in SAP Stock Right Now

SAP SE SAP appears to be a promising stock to add to the portfolio for tackling the current macroeconomic and geopolitical uncertainties and benefit from its healthy fundamentals and growth prospects.

Let’s look at the factors that make the stock an attractive pick:

Shares Outperformed: Wall Street is facing extreme volatility due to macroeconomic factors, such as rising inflation and interest rate hikes by the Federal Reserve, increased crude oil prices and lingering supply-chain woes.

The above-mentioned factors are taking a toll on major U.S. indices. In the past year, the S&P 500 has fallen 9%.

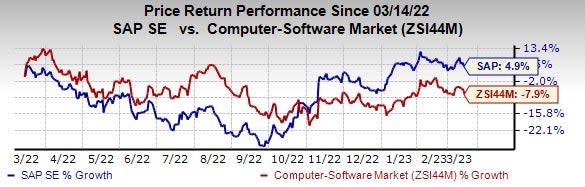

The stock is down 6.3% from its 52-week high level of $123.28 on Feb 2, 2023, making it relatively affordable for investors. SAP’s shares have increased 4.9% in the past year against a 7.9% plunge in the Zacks sub-industry.

Image Source: Zacks Investment Research

Solid Rank: SAP currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Upbeat Guidance: For 2023, SAP anticipates cloud revenues in the range of €15.3-€15.7 billion, suggesting an increase of 22-25% at constant currency (cc).

Cloud and software revenues are now expected to be between €28.2 billion and €28.7 billion, implying a 6-8% rise at cc.

The company continues to expect non-IFRS operating profit in the range of €8.8-€9.1 billion, indicating a rise of 10-13% at cc. Free cash flow is expected to be nearly €5 billion.

Robust Estimates: The Zacks Consensus Estimate for 2023 and 2024 earnings is pegged at $5.63 and $6.53, indicating year-over-year growth of 31.5% and 16%, respectively.

Revenues for 2023 and 2024 are estimated to be $33.68 billion and $36.13 billion, indicating year-over-year growth of 3.7% and 7.3%, respectively.

SAP delivered fourth-quarter 2022 non-IFRS earnings of €1 per share, down 46% from the year-ago quarter’s levels. The downside was caused by tougher year-over-year comparisons pertaining to the contribution from Sapphire Ventures.

Driven by strength in the cloud business, SAP reported total revenues, on a non-IFRS basis, of €8.436 billion, up 6% year over year (up 1% at cc).

Factors That Augurs Well

SAP is an independent software vendor and a leading provider of enterprise resource planning software. Its solutions are designed to cater to the needs of organizations ranging from small and medium businesses to large global enterprises. Per a report from Fortune Business Insights, the global enterprise resource planning software market is projected to grow from $49.28 billion in 2022 to $90.63 billion by 2029 at a CAGR of 9.1%.

SAP’s performance is being driven by continued strength in its cloud business (especially the new Rise with SAP solution) across all regions as well as momentum in SAP’s business technology platform, particularly the S/4HANA solutions.

In the last reported quarter, the Current cloud backlog — a key indicator of go-to-market success in cloud business — increased from 27% (up 24% at cc) to €12 billion. Also, SAP S/4HANA’s current cloud backlog was up 86% (up 82% at cc) year over year.

The company recently announced that it plans to conduct a targeted restructuring program in certain areas of the company. The goal of this program is to better align its operating models and go-to-market approach with its accelerated cloud transformation, as well as to strengthen its core business and improve overall process efficiency.

For 2024, the restructuring is expected to generate €300-€350 million in annual cost savings for SAP, which will be directed toward investments in strategic growth areas.

Recent Developments

In March, the company announced that it had entered into a collaboration with Silver Lake and Canada Pension Plan Investment Board to sell its stake in Qualtrics for approximately $7.7 billion. The potential sale would allow SAP to focus on its core cloud growth and profitability while allowing Qualtrics to continue its growth and leadership in the experience management category.

Prior to that, the company announced the next generation of its SAP Data Warehouse Cloud solution — SAP Datasphere. The solution is designed to aid data professionals in delivering quick access to vital business data across the organization's data landscape without compromising on business context and logic, added SAP.

In January, SAP and Lockheed Martin announced an expansion of their strategic relationship to enhance Lockheed Martin's OneLM Transformation Program (1LMX) using SAP's RISE with SAP solution for enterprise cloud capabilities.

Few Headwinds

Apart from its solid fundamentals, the company is prone to several risks. The company operates in a highly competitive and capital-intensive IT services market. This is likely to negatively impact the company’s performance. Continued softness in the software licenses and support business segment owing to customers shifting to cloud services is a major headwind.

Also, the volatile macroeconomic environment and unfavorable foreign currency movement are major concerns.

Other Stocks to Consider

Some other top-ranked stocks in the broader technology space are Arista Networks ANET, Perion Network PERI and Pegasystems PEGA, each presently sporting a Zacks Rank #1.

The Zacks Consensus Estimate for Arista Networks 2023 earnings is pegged at $5.79 per share, rising 11.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 23.1% in the past year.

The Zacks Consensus Estimate for Perion’s 2023 earnings is pegged at $2.69 per share, rising 16% in the past 60 days. The long-term earnings growth rate is anticipated to be 25%.

Perion’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 31.7%. Shares of PERI have increased 66% in the past year.

The Zacks Consensus Estimate for Pegasystems 2023 earnings is pegged at $1.31 per share, rising 111.3% in the past 60 days.

Pegasystems earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average surprise being 11.2%. Shares of the company have declined 40.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SAP SE (SAP) : Free Stock Analysis Report

Perion Network Ltd (PERI) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance