Reasons Why You Should Avoid Betting on Stanley Black (SWK)

Stanley Black & Decker SWK failed to impress investors with its recent operational performance due to reduced retail and consumer demand, supply-chain disruptions and other challenges, which are likely to impact its earnings in the near term.

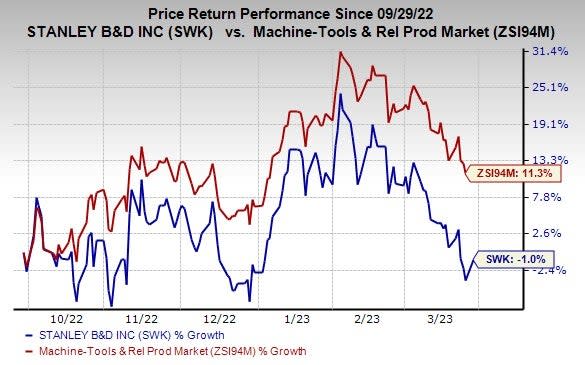

The current Zacks Rank #5 (Strong Sell) player has a market capitalization of $11.7 billion. Due to the above-mentioned woes, the stock has lost 1% against the industry’s 11.3% increase in the past six months.

Let’s discuss the factors that might continue to take a toll on the firm.

Weak Segmental Performance: Reduced retail and consumer demand and the resultant softness in volumes are affecting the Tools & Outdoor segment’s performance. Within the segment, the Power Tools division is experiencing weakness (revenues down 5% organically in 2022) due to reduced consumer spending as a result of an increase in interest rates. For 2023, SWK expects segmental organic revenues to decline in the low single digits with an approximately 5% decrease in volumes.

Supply-Chain Constraints and Steep Costs: Supply-chain restrictions, primarily due to semiconductor constraints, and logistics and input cost increases weighed on Stanley Black’s operations in 2022. These headwinds pose a threat to the bottom-line performance, despite an improvement in the supply chain and an anticipated decline in raw material costs. Evidently, in 2022, the company’s cost of sales jumped 24.3% year over year. Also, selling, general and administrative expenses climbed 5.5%.

Image Source: Zacks Investment Research

Forex Woes: Given its widespread presence in the international markets, Stanley Black is exposed to unfavorable foreign currency movements. In fourth-quarter 2022, foreign currency translation had a negative impact of 3% on sales.

Southbound Estimate Revision: In the past 60 days, the Zacks Consensus Estimate for 2023 earnings has been revised 80.1% downward.

Stocks to Consider

Some top-ranked companies are discussed below:

Deere & Company DE presently sports a Zacks Rank #1 (Strong Buy). DE’s earnings surprise in the last four quarters was 4.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

In the past 60 days, estimates for Deere & Company’s fiscal 2023 earnings have increased 8.6%. The stock has rallied 15.2% in the past six months.

Alamo Group Inc. ALG presently sports a Zacks Rank of 1. ALG’s earnings surprise in the last four quarters was 6.0%, on average.

In the past 60 days, estimates for Alamo’s fiscal 2023 earnings have increased 7.5%. The stock has gained 43.1% in the past six months.

A. O. Smith Corporation AOS presently carries a Zacks Rank #2 (Buy). AOS’ earnings surprise in the last four quarters was 3.2%, on average.

In the past 60 days, estimates for A. O. Smith’s fiscal 2023 earnings have increased 4.4%. The stock has gained 38.7% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance