Reasons to Retain Stericycle (SRCL) in Your Portfolio Now

Stericycle SRCL stock has had an impressive run over the past year. Shares of the company have gained 29.7% compared with the 22.7% rally of the industry it belongs to and the 26.4% rise of the Zacks S&P 500 composite.

The company’s revenues for 2024 and 2025 are expected to increase 1.6% and 3.7%, respectively, year over year. Earnings are anticipated to grow 22.8% in 2024 and 16.5% in 2025. The company has an expected long-term (three to five years) earnings per share growth rate of 8%.

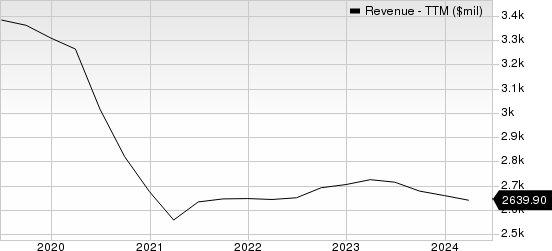

Stericycle, Inc. Revenue (TTM)

Stericycle, Inc. revenue-ttm | Stericycle, Inc. Quote

Factors That Auger Well

The services provided by Stericycle usually cannot be delayed and are required routinely. This facilitates the company to achieve a steady revenue flow. It has strong customer relationships, most of which include long-term contracts ranging from three to five years. This allows SRCL to maintain a 90% revenue retention rate. We anticipate revenues to grow 1.5%, 3.8% and 6.4% in 2024, 2025 and 2026, respectively.

Stericycle continues to grow on the back of acquisitions in the domestic and international markets. The recent acquisition of a Southeastern United States-regulated waste business is targeted toward portfolio optimization. The 2021 acquisition of a Midwest-based regulated waste business strengthened Stericycle's independent customer base in North America. SRCL's acquisitions are robust in multiple geographies and business lines.

A global acquisition strategy improves the customer base of the company by providing a long-term growth platform for selling multiple services. Stericycle is continuously on the lookout for strategic acquisitions that will increase its market share and expand its geographic base.

The company’s current ratio (a measure of liquidity) stood at 1.11 at the end of the first quarter of 2024, higher than 0.94 in the preceding quarter and 0.97 in the year-ago quarter. A current ratio of more than 1 indicates that SRCL will not have problems paying off its short-term obligations.

Risk

Stericycle operates in a highly competitive industry. The hindrances to entry into the regulated waste collection and disposal business are very low. In addition to the rising competition from large national companies, many small, regional and local companies compete in terms of pricing aggressively. This earlier compelled Stericycle to lower prices to elevate customer retention and acquisition. The threat of pricing pressure is expected to prevail in the future.

The company's earnings can be significantly affected if there is a consistent price reduction and an inability to increase prices. This forces us to be bearish on the stock to some extent.

Zacks Rank & Stocks to Consider

Stericycle currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are Kelly Services KELYA and Fiserv FI.

Kelly Services presently flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

KELYA has a long-term earnings growth expectation of 13%. It delivered a trailing four-quarter earnings surprise of 45.8%, on average.

Fiserv currently carries a Zacks Rank of 2 (Buy). It has a long-term earnings growth expectation of 14.3%.

FI delivered a trailing four-quarter earnings surprise of 2.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stericycle, Inc. (SRCL) : Free Stock Analysis Report

Kelly Services, Inc. (KELYA) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance