Reasons to Retain Rollins (ROL) Stock in Your Portfolio

Rollins, Inc. ROL has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. Its earnings for 2022 and 2023 are expected to improve 7.4% and 7.8%, respectively, year over year.ROL’s shares have gained 5.2% in the past month.

Factors That Augur Well

This leading pest and termite control services provider is benefiting from strength in all of its business lines. The company’s revenues increased 10.3% year over year in the first quarter of 2022, with all its business lines – residential, commercial and termite – registering growth.

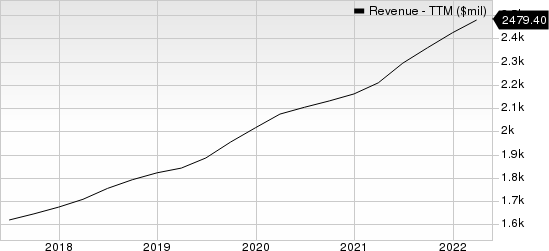

Rollins, Inc. Revenue (TTM)

Rollins, Inc. revenue-ttm | Rollins, Inc. Quote

Rollins believes in returning capital through dividends. Consistent dividend payment underscores the company's commitment to shareholders and underlines its business confidence. It paid dividends of $208.7 million, $160.5 million and $153.8 million in 2021, 2020 and 2019, respectively.

Rollins' current ratio (a measure of liquidity) was 1.03 at the end of first-quarter 2022, higher than the 0.72 recorded at the end of the fourth-quarter 2021 and the prior-year quarter’s 0.66. The gradually increasing current ratio bodes well for Rollins as it implies that the risk of default is less.

Some Risks

Rollins’ margin stayed pressed in the first quarter of 2021 due increase in labor- and fuel-related expenses. Adjusted EBITDA margin of 19.9% declined 116 basis points year over year.

Zacks Rank & Stocks to Consider

Rollins currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks Business Services sector are Avis Budget Group, Inc. CAR, Cross Country Healthcare CCRN and FactSet Research Systems Inc. FDS.

Avis Budget sports a Zacks Rank #1. The company has a long-term earnings growth expectation of 19.4%.

Avis Budget delivered a trailing four-quarter earnings surprise of 102%, on average.

Cross Country Healthcare sports a Zacks Rank #1. The company has a long-term earnings growth expectation of 6.9%.

Cross Country Healthcare delivered a trailing four-quarter earnings surprise of 29.2%, on average.

FactSet carries a Zacks Rank #2. The company has a long-term earnings growth expectation of 10%.

FactSet pulled off a trailing four-quarter earnings surprise of 6.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

FactSet Research Systems Inc. (FDS) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance