Reasons to Retain Cirrus Logic (CRUS) Stock in Your Portfolio

Cirrus Logic CRUS is benefiting from strong revenue growth across its high-performance mixed-signal and audio segment.

The company’s fiscal 2023 and 2024 revenues are anticipated to rise 2.1% and 8%, respectively.

CRUS outpaced estimates in all of the trailing four quarters, delivering an earnings surprise of 26%, on average.

In the last reported quarter, Cirrus Logic reported adjusted earnings of $1.12 per share, beating the Zacks Consensus Estimate by 31.8%. The bottom line surged 107% from the prior-year quarter’s 54 cents. Total revenues of $394 million surpassed the Zacks Consensus Estimate by 6.3% and increased 42% year over year.

For second-quarter 2023, the company projects revenues to be between $450 million and $490 million. The consensus mark for revenues is pegged at $470.7 million, suggesting an increase of 1% year over year.

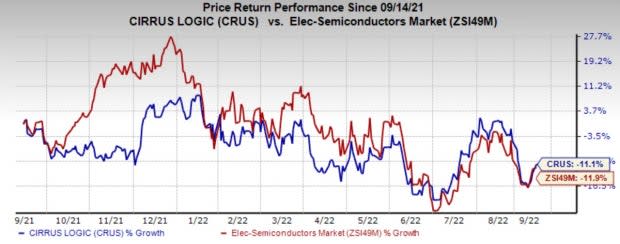

The stock is down 19.3% from its 52-week high level of $95.84 on Jan 12, 2022, making it relatively affordable for investors. CRUS has lost 11.1% in the past year against a 11.9% decline of the Zacks sub-industry.

Image Source: Zacks Investment Research

Strong Fundamentals

Headquarters in Austin, TX, Cirrus Logic is a fabless semiconductor supplier that develops, manufactures and markets analog, mixed-signal and audio DSP integrated circuits (ICs).

Cirrus Logic benefits from strong demand for high-performance mixed-signal content shipping for smartphones and fast-charging ICs. Customer engagement across its portfolio remains strong. Growth opportunities in voice biometrics and closed-loop controllers will likely be the key catalysts.

The increase in penetration of its audio solutions in smartphones is a positive. In the last few years, Cirrus Logic unveiled various products related to flagship and mid-tier smartphones and the emerging digital headset market. The products include audio codecs and DSPs, amplifiers, SoundClear embedded software, etc.

Cirrus Logic has a strong balance sheet. As of Jun 30, 2022, the company had cash and cash equivalents and marketing securities of $379.3 million, with no long-term debt.

In the fiscal first quarter, the company generated operating cash flows of $74.4 million. The company repurchased 724,871 shares worth $56.4 million in the quarter under review. As of Jun 25, 2022, the company has $136.1 million worth of shares under its existing share repurchase authorization. Share repurchases are a good way of enhancing shareholders’ wealth while boosting the company’s earnings.

However, the company's near-term prospects might be affected as global supply chain disruptions limit its ability to capitalize on opportunities arising from strong demand. Global macro-economic weakness, intensifying competition and adverse currency translations are added concerns for this Zacks Rank #3 (Hold) stock.

Stocks to Consider

Some better-ranked stocks from the broader technology space are Cadence Design Systems CDNS, Keysight Technologies KEYS and Arista Networks ANET. Arista and Cadence sport a Zacks Rank #1 (Strong Buy) while Keysight carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CDNS 2022 earnings is pegged at $4.11 per share, rising 5.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.7%.

Cadence’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 9.8%. Shares of CDNS have moved up 6.1% in the past year.

The Zacks Consensus Estimate for Keysight’s fiscal 2022 earnings is pegged at $7.47 per share, up 4.3% in the past 60 days. The long-term earnings growth rate is anticipated to be 11%.

Keysight’s earnings beat the Zacks Consensus Estimate in three of the preceding four quarters, the average being 9.3%. Shares of KEYS have lost 2.5% of their value in the past year.

The Zacks Consensus Estimate for Arista Network’s 2022 earnings is pegged at $4.04 per share, increasing 10.1% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.6%.

Arista Network’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.1%. Shares of ANET have increased 39.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance