Reasons to Retain Booz Allen (BAH) Stock in Your Portfolio

Booz Allen Hamilton Holding Corporation BAH has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

The company has an expected long-term (three to five years) EPS growth rate of 8.9%. Its earnings for fiscal 2023 and 2024 are anticipated to grow 5.9% and 9.4%, respectively, year over year.

Factors That Bode Well

Vision 2020 was Booz Allen’s transformation strategy for creating sustainable expansion. The strategy focused on getting closer to clients’ core missions, increasing the technical content of work, attracting and retaining talent from diverse areas of expertise, increasing innovation, creating a wide network of external partners and alliances, and expanding into commercial and international business. Its implementation has accelerated the company’s organic revenue growth, strengthened its profitability position, and fetched significant headcount and backlog growth.

Booz Allen’s next strategy, VoLT, focuses on integrating velocity, leadership and technology in the process of transformation. Key focus areas on the velocity front are increasing innovation, strengthening market position through mergers, acquisitions and partnerships, and client-centric decision-making. The leadership front involves initiatives to promptly utilize leadership in identifying client needs and scaling businesses. On the technology front, the company focuses on developing and expanding next-generation technology and solutions.

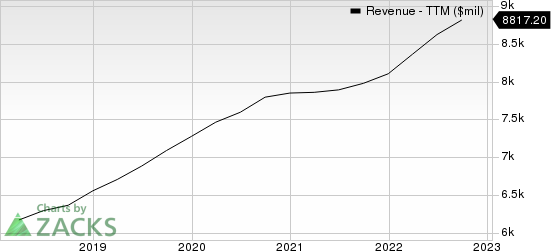

Booz Allen Hamilton Holding Corporation Revenue (TTM)

Booz Allen Hamilton Holding Corporation revenue-ttm | Booz Allen Hamilton Holding Corporation Quote

Booz Allen's current ratio (a measure of liquidity) at the end of second-quarter fiscal 2023 was 1.81, higher than the prior-year quarter’s 1.68. An increase in the current ratio bodes well, as it indicates that the company will have no problem meeting its short-term debt obligations.

Some Risks

Booz Allen has more long-term debt outstanding than cash. Cash and cash equivalent balance at the end of second-quarter fiscal 2023 was $757 million compared with the long-term debt level of $2.8 billion.

Zacks Rank and Stocks to Consider

Booz Allen currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are DocuSign, Inc. DOCU and Sprinklr, Inc. CXM.

DocuSign currently sports a Zacks Rank #1 (Strong Buy). DOCU has a long-term earnings growth expectation of 13.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DOCU delivered a trailing four-quarter earnings surprise of 6.6%, on average.

Sprinklr carries a Zacks Rank #2 (Buy) at present. CXM has a long-term earnings growth expectation of 30%.

Sprinklr delivered a trailing four-quarter earnings surprise of 102.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Sprinklr, Inc. (CXM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance