Reasons to Add WEC Energy (WEC) to Your Portfolio Right Now

WEC Energy Group Inc.’s WEC ongoing investments in infrastructure projects, focus on clean energy, the development of LNG facilities and an expanding customer base will continue to boost demand and drive its financial performance.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projection & Surprise History

The Zacks Consensus Estimate for 2022 earnings has moved up by 1.4% in the past 60 days to $4.37 per share. The Zacks Consensus Estimate for 2023 earnings has moved up by 0.2% in the past 60 days to $4.59 per share.

WEC Energy delivered an average earnings surprise of 8.6% in the last four quarters.

WEC’s long-term (three to five years) earnings growth is projected at 6.1%.

Dividend

WEC Energy has a long history of dividend payment and has paid dividends to shareholders consecutively since 1988. WEC Energy aims at increasing the dividend rate annually in the range of 6-7%, subject to the approval of the board of directors. WEC has been raising annual dividends consecutively since 2010. The new dividend for 2022 is $2.91 per share, which represents a 7.4% increase from 2021.

Currently, the company has a dividend yield of 3.2% compared with the Zacks S&P 500 composite's average of 1.8%.

Stable Investments & Emissions Reduction

WEC Energy is investing in a cost-effective zero-carbon generation like solar and wind. In the 2022-2026 period, the company projects capital expenditure of $17.7 billion and plans to invest $5.4 billion in renewable assets to expand the clean power generation portfolio. WEC Energy plans to invest $3.4 billion in the electric delivery business in the 2022-2026 period to make it more resilient. Systematic investments in infrastructure projects will help the company cater to the rising demand from the expanding customer base.

WEC Energy is also focused on replacing older-generation facilities with zero carbon-emitting renewable and natural gas-based generation by 2025. WEC intends to become net carbon neutral by 2050. Further, WEC Energy expects to trim methane emissions by 100% from the 2011 levels by 2030. The company has retired 1,800 megawatts (MW) of coal-fired plants since 2018 and aims at removing another 1,600 MW of fossil-fueled generation by 2025. In addition to these near-term coal retirement plans, WEC Energy aims to cease the use of coal as an energy source by 2035.

Return on Equity

Return on Equity (“ROE”) indicates how efficiently a company is utilizing shareholders’ funds in the business to generate returns. At present, WEC’s ROE is 12.2%, higher than the industry average of 10.4%, which indicates that the company is utilizing its funds more effectively than its industry peers.

Debt Position

The Debt to Capital of WEC Energy at the end of the first quarter of 2022 was 56.9% compared with the industry average of 58%. This indicates that the company is using comparatively lower debts to manage the business compared with peers.

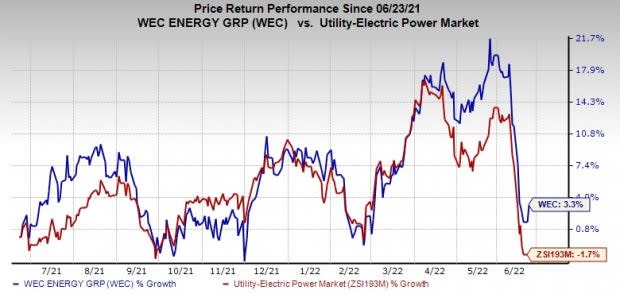

Price Performance

In the past year, WEC Energy has rallied 3.3% against the industry’s decline of 1.7%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other similar-ranked stocks from the same industry include American Electric Power AEP, Eversource Energy ES and Hawaiian Electric Industries HE.

The long-term earnings growth of American Electric Power, Eversource Energy and Hawaiian Electric Industries is projected at 6.2%, 6.2% and 3.2%, respectively.

American Electric Power, Eversource Energy and Hawaiian Electric Industries have a dividend yield of 3.5%, 3.2% and 3.6%, respectively, better than the Zacks S&P 500 composite's average of 1.8%.

AEP, ES and HE delivered an average earnings surprise of 2.4%, 0.1% and 30.8%, respectively, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance