Reasons to Add Masimo (MASI) Stock to Your Portfolio Now

Masimo Corporation MASI is well-poised for growth in the coming quarters, courtesy of its research and development (R&D) efforts. The optimism, led by a solid first-quarter 2024 performance and its solid product portfolio, is expected to contribute further. However, concerns regarding overdependence on its Signal Extraction Technology (SET) and macroeconomic issues persist.

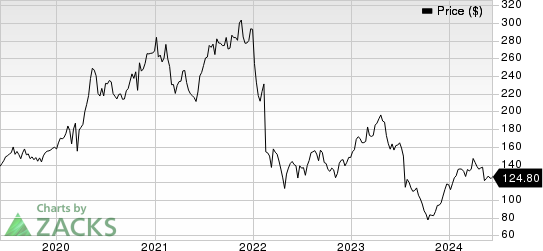

Over the past year, this Zacks Rank #2 (Buy) company’s shares have risen 6.4% against the industry’s 6.5% decline. The S&P 500 has witnessed 12.5% growth in the said time frame.

The renowned global provider of non-invasive monitoring systems has a market capitalization of $6.62 billion. The company projects 9.3% growth for 2025 and expects to maintain its strong performance going forward. Masimo’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 4.7%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Product Portfolio: We are optimistic about Masimo’s healthcare business, which develops, manufactures and markets a variety of non-invasive patient monitoring technologies, hospital automation and connectivity solutions, remote monitoring devices and consumer health products.

Last month, Masimo introduced White PerL, which is the latest from the Denon PerL product lines. In February, Masimo received the FDA’s clearance for MightySat Medical, making it the first and only FDA-cleared medical fingertip pulse oximeter available over-the-counter to consumers without a prescription.

Research and Product Development: We are upbeat about Masimo’s ongoing R&D efforts, which it believes are essential to its success. Its R&D efforts focus on continuing to enhance its technical expertise toward its existing product portfolios and expanding its technological leadership in each of the markets Masimo serves with innovations, among others. Additionally, the company continues to collaborate with Willow on R&D activities related to advancing rainbow technology and other technologies.

Strong Q1 Results: Masimo’s first-quarter 2024 results buoy optimism. Per management, shipments of non-invasive technology boards and instruments, excluding handheld and fingertip pulse oximeters, totaled 50,400 during the quarter. The company continues to gain market share, along with higher contracts with hospitals. Moreover, it expects to see improvement in shipments from the second quarter that are likely to cross 55,000. Shipments are expected to reach more than 60,000 in the second half of 2024. Management plans three product launches in 2024, namely Freedom, H1 and the next-generation version of its Root Connectivity platform.

Downsides

Overdependence on Masimo SET: MASI currently derives the majority of its revenues from its primary product offerings like the Masimo SET platform, Masimo rainbow SET platform and related products. Thus, the company’s business is highly dependent on the continued success and market acceptance of its primary product offerings.

Macroeconomic Concerns: Masimo’s consumer products are generally considered non-essential and discretionary. As such, many of these products can be especially sensitive to general downturns in the economy. Negative macroeconomic conditions such as high inflation, recession and decreasing consumer confidence can adversely impact the demand for these products, which, in turn, could affect Masimo’s business.

Estimate Trend

MASI has been witnessing a positive estimate revision trend for 2024. In the past 90 days, the Zacks Consensus Estimate for its earnings per share (EPS) has moved north 9.3% to $3.51.

The Zacks Consensus Estimate for the company’s second-quarter revenues is pegged at $488.2 million, implying a 13.6% decline from the year-ago quarter’s reported number.

Masimo Corporation Price

Masimo Corporation price | Masimo Corporation Quote

Other Key Picks

Some other top-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, currently carrying a Zacks Rank of 2, reported first-quarter 2024 adjusted EPS of $2.14, which beat the Zacks Consensus Estimate by 8.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $997.4 million outpaced the consensus mark by 2.6%. Align Technology’s shares have lost 9.2% year to date against the industry’s 1.4% growth.

Align Technology has a long-term growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average surprise being 5.92%.

Ecolab, carrying a Zacks Rank of 2 at present, reported first-quarter 2024 adjusted EPS of $1.34, which beat the Zacks Consensus Estimate by 0.75%. Ecolab’s shares have risen 18.7% year to date against the industry’s 20.1% decline.

Ecolab has a long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 1.30%.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. The company currently carries a Zacks Rank #2. Boston Scientific’s shares have risen 31.4% year to date compared with the industry’s 3% growth.

Boston Scientific has a long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 1.30%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance