RBC Bearings (ROLL) Q4 Earnings Meet Estimates, View Bleak

RBC Bearings Incorporated ROLL reported in-line earnings results for the fourth quarter of fiscal 2020 (ended Mar 28, 2020). However, revenues surpassed the consensus estimate by 1.71%.

The machinery company’s adjusted earnings in the reported quarter were $1.33 per share, in line with the Zacks Consensus Estimate. Also, earnings were in line with the year-ago reported number.

For fiscal 2020, the company’s adjusted earnings per share were $5.07, reflecting growth of 4.8% from the previous year.

Revenue Details

In the quarter under review, RBC Bearings’ revenues of $185.8 million reflected year-over-year growth of 2%. Organic sales in the quarter rose 0.1% year over year.

The company noted that commercial aerospace in the quarter were adversely impacted by the pandemic, while issues with Boeing 737 Max also played spoilsport. Despite this weakness, the company’s overall aerospace business experienced a 4.3% increase in revenues. In addition, the company’s business in industrial markets suffered due to the pandemic and recorded a 1.9% year-over-year decline in revenues.

Also, revenues surpassed the Zacks Consensus Estimate of $183 million.

Exiting the reported quarter, the company had backlog of $478.6 million, up 7.5% year over year.

RBC Bearings reports net sales under four heads/segments that are discussed below:

Revenues from Plain bearings totaled $93.9 million, up 6.8% year over year while the same from Roller bearings declined 13.2% year over year to $31.4 million. Ball bearings’ revenues of $20.6 million were up 5.9% year over year. Revenues from Engineered products summed $39.9 million, up 3.4% year over year.

For fiscal 2020, the company generated revenues of $727.5 million, suggesting year-over-year growth of 3.6%.

Margin Profile

In the reported quarter, RBC Bearings’ cost of sales inched up 0.1% year over year to $109.3 million, representing 58.8% of net sales compared with 59.9% a year ago. Adjusted gross profit improved 5.1% year over year to $76.7 million. Margin inched up 120 basis points (bps) to 41.3%.

Selling, general and administrative expenses of $31 million were up 5.2% year over year, accounting for 16.7% of net sales. Adjusted operating income grew 4.2% year over year to $43 million. Adjusted margin inched up 50 bps year over year at 23.1%. Interest expense, net, declined 51.3% year over year to $399 million in the quarter.

Effective tax rate was 21.4% in the quarter under review compared with 20.8% in the prior-year quarter.

Balance Sheet and Cash Flow

Exiting the fiscal fourth quarter, RBC Bearings had cash and cash equivalents of $103.3 million, up 71.2% from $60.3 million recorded at the end of the previous quarter. Long-term debt was $16.6 million, up 2.4% sequentially.

The company also noted that it has outstanding revolving credit facilities of $259.1 million.

In fiscal 2020, the company generated net cash of $155.6 million from operating activities, up 43.4% from $108.5 million a year ago. Capital spending of $37.3 million fell 9.8% year over year. The company repurchased shares worth $12.2 million, reflecting an increase from $5.2 million in the previous year.

During the fiscal year, the company repurchased shares worth $12.2 million, up from $5.2 million in the previous year.

Outlook

For fiscal 2021 (ending March 2021), RBC Bearings expects the pandemic to continue impacting its operations. It believes that commercial aerospace businesses — including OEM and aftermarket — will face headwinds while defense business will grow.

Meanwhile, the industrial businesses will suffer due to the pandemic in the first half of fiscal 2021 (ending September 2021) and demand might pick up thereafter.

For first-quarter fiscal 2020 (ending June 2021), the company predicts revenues of $150-$155 million, suggesting a decline from $182.7 million in the year-ago quarter.

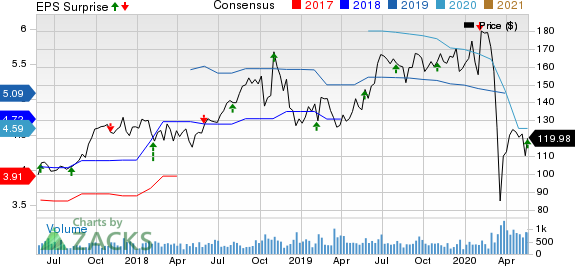

RBC Bearings Incorporated Price, Consensus and EPS Surprise

RBC Bearings Incorporated price-consensus-eps-surprise-chart | RBC Bearings Incorporated Quote

Zacks Rank & Stocks to Consider

RBC Bearings currently has a market capitalization of $2.9 billion and a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Zacks Industrial Products sector are Silgan Holdings Inc. SLGN, II-VI Incorporated IIVI and Broadwind Energy, Inc. BWEN. While both Silgan and II-VI currently sport a Zacks Rank #1 (Strong Buy), Broadwind Energy carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, earnings estimates for Silgan and II-VI have improved for the current year, while the same have been unchanged for Broadwind Energy. Further, earnings surprise for the last reported quarter was 16.33% for Silgan Holdings, 213.33% for II-VI and 200% for Broadwind Energy.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Silgan Holdings Inc. (SLGN) : Free Stock Analysis Report

IIVI Incorporated (IIVI) : Free Stock Analysis Report

RBC Bearings Incorporated (ROLL) : Free Stock Analysis Report

Broadwind Energy, Inc. (BWEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance