RBC Bearings (ROLL) Q1 Earnings Top Estimates, Revenues Lag

RBC Bearings Incorporated ROLL reported better-than-expected results for the first quarter of fiscal 2020 (ended Jun 29, 2019), delivering a positive earnings surprise of 3.36%. This was the company’s fifth consecutive quarter of impressive results.

The machinery company’s adjusted earnings in the reported quarter were $1.23 per share, surpassing the Zacks Consensus Estimate of $1.19. Also, the bottom line rose 7% from the year-ago quarter’s number of $1.15 on healthy sales growth and margin improvement.

Organic Sales Drive Revenues

In the quarter under review, RBC Bearings’ revenues totaled $182.7 million, reflecting year-over-year growth of 3.8%. Organic sales in the quarter grew 6.5% year over year on healthy growth in aerospace markets.

However, the company’s revenues lagged the Zacks Consensus Estimate of $183 million by 0.23%.

Exiting the reported quarter, it had backlog of $459.4 million, up 9.6% year over year.

RBC Bearings reports net sales under four heads/segments. The segmental results are briefly discussed below:

Revenues from Plain bearings totaled $87.5 million, up 11.4% year over year, while that from Roller bearings grew 2.7% year over year to $36.9 million. Ball bearings’ revenues were $17.7 million, down 2% year over year. Revenues from Engineered products totaled $40.6 million, down 6.6% year over year.

Margins Improve Y/Y

In the reported quarter, RBC Bearings’ cost of sales grew 3.5% year over year to $112 million. It represented 61.3% of net sales versus 61.5% recorded in the year-ago quarter. Gross profit in the quarter rose 4.4% year over year to $70.7 million. Margin in the quarter grew 20 basis points (bps) to 38.7%.

Selling, general and administrative expenses of $30.1 million rose 1.7% year over year, and represented 16.5% of net sales versus 16.8% in the year-ago quarter. Operating income in the reported quarter grew 6.9% year over year to $38.5 million. Adjusted margin was 21.1% versus 20.5% in the year-ago quarter.

Effective tax rate was 19.3% in the quarter under review versus 17.4% in the year-ago quarter.

Balance Sheet and Cash Flow

Exiting the fiscal first quarter, RBC Bearings had cash and cash equivalents of $32.7 million, rising 9.5% from $29.9 million recorded at the previous quarter end. Total debt was $26.3 million, down 39.2% sequentially.

In the first quarter of fiscal 2020, the company generated net cash of $40.1 million from operating activities, up 18.6% from $33.8 million recorded in the year-ago comparable quarter. Capital spending totaled $12 million, rising 72.2% year over year.

During the quarter, the company repurchased shares worth $9.5 million.

Outlook

RBC Bearings anticipates net sales of $180-$180 million for the second quarter of fiscal 2019 (ending September 2019). The projection reflects growth of 4.1-5.3% from the year-ago quarter.

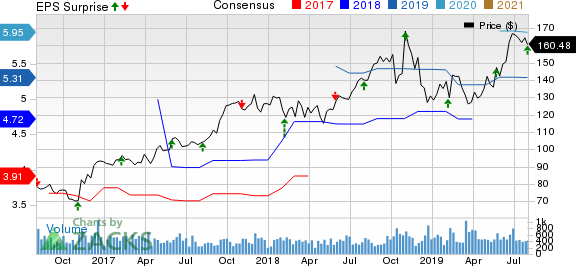

RBC Bearings Incorporated Price, Consensus and EPS Surprise

RBC Bearings Incorporated price-consensus-eps-surprise-chart | RBC Bearings Incorporated Quote

Zacks Rank & Stocks to Consider

With a market capitalization of approximately $4.1 billion, RBC Bearings currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industry are Roper Technologies, Inc. ROP, DXPE Enterprises, Inc. DXPE and Dover Corporation DOV. All these stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, earnings estimates for Rope and Dover have improved for the current year while remained stable for DXPE Enterprises. Further, average earnings surprise for the last four quarters was 6.92% for Roper, 48.47% for DXP Enterprises and 6.91% for Dover.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

RBC Bearings Incorporated (ROLL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance