Aussie homeowners to pocket $54,856 from RBA’s 2019 rate cuts

The Morrison government and the Reserve Bank of Australia are working in overdrive to put money back in the pockets of Australians in a bid to boost consumer spending and thereby lift the economy.

After nearly two years of no changes in the official interest rate, the RBA’s rate cut in June and immediately again in July has overwhelmingly benefited borrowers and mortgage holders, though savers’ and retirees’ bank accounts and income source have suffered a blow.

Today, the board of the Reserve Bank has cut the cash rate again to 0.75 per cent, bringing even greater gains for borrowers.

Read now: Shock rate decision: Reserve Bank of Australia issues ‘death knell’ for country’s savers

Read now: Cash rate dropped to 0.75 per cent: Has your bank passed the October rate cut on?

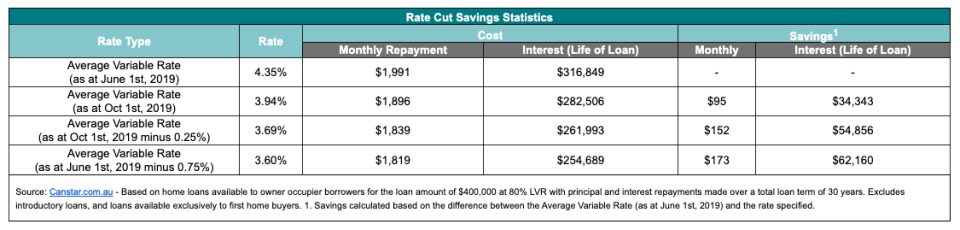

So much so, from the three rate cuts in 2019, the average homeowner can expect to save $54,856 over the course of their mortgage’s life span, according to Canstar’s research team.

Breaking it down

Before the rate cut in June, the average variable interest rate was 4.35 per cent.

Following the two cuts, the average variable has dropped by 0.41 per cent, meaning mortgage holders will save around $34,343 over the life of their loan (or $95 a month) based on these rates.

After the two rate cuts, average monthly repayments have fallen from $1,991 to $1,896.

Today’s third cut will generate even greater savings of $20,513 on top of the $34,343 from the first two cuts, coming to $54,856 over the loan’s life.

And if lenders were so generous as to pass on all three cuts in full, savings would climb to $62,160 over the life of the loan.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance