Interest rate decision: Reserve Bank of Australia delivers last decision for 2019

The Reserve Bank of Australia (RBA) has left the official interest rate at 0.75 per cent in its final interest rate decision of the year, after a blockbuster month for property and a looming Christmas spending period.

Related story: RAPID RECOVERY: House prices gains largest in 16 years

Related story: The RBA has the tools to fix the economy, but is reluctant to use them

Related story: How the government is failing Newstart recipients – and the economy

RBA governor Philip Lowe’s official statement on monetary policy

At its meeting today, the Board decided to leave the cash rate unchanged at 0.75 per cent.

The outlook for the global economy remains reasonable. While the risks are still tilted to the downside, some of these risks have lessened recently. The US–China trade and technology disputes continue to affect international trade flows and investment as businesses scale back spending plans because of the uncertainty. At the same time, in most advanced economies unemployment rates are low and wages growth has picked up, although inflation remains low. In China, the authorities have taken steps to support the economy while continuing to address risks in the financial system.

Interest rates are very low around the world and a number of central banks have eased monetary policy over recent months in response to the downside risks and subdued inflation. Expectations of further monetary easing have generally been scaled back. Financial market sentiment has continued to improve and long-term government bond yields are around record lows in many countries, including Australia. Borrowing rates for both businesses and households are at historically low levels. The Australian dollar is at the lower end of its range over recent times.

After a soft patch in the second half of last year, the Australian economy appears to have reached a gentle turning point. The central scenario is for growth to pick up gradually to around 3 per cent in 2021. The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, the upswing in housing prices and a brighter outlook for the resources sector should all support growth. The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending. Other sources of uncertainty include the effects of the drought and the evolution of the housing construction cycle.

The unemployment rate has been steady at around 5¼ per cent over recent months. It is expected to remain around this level for some time, before gradually declining to a little below 5 per cent in 2021. Wages growth is subdued and is expected to remain at around its current rate for some time yet. A further gradual lift in wages growth would be a welcome development and is needed for inflation to be sustainably within the 2–3 per cent target range. Taken together, recent outcomes suggest that the Australian economy can sustain lower rates of unemployment and underemployment.

Inflation is expected to pick up, but to do so only gradually. In both headline and underlying terms, inflation is expected to be close to 2 per cent in 2020 and 2021.

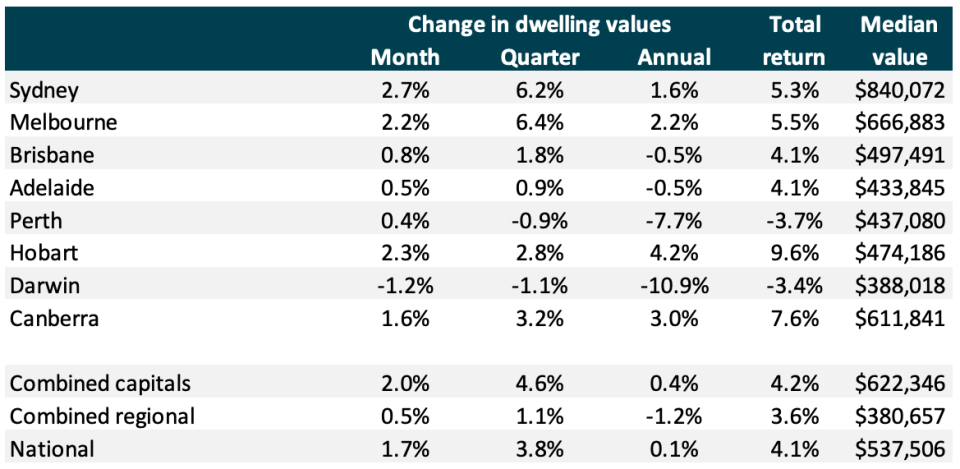

There are further signs of a turnaround in established housing markets. This is especially so in Sydney and Melbourne, but prices in some other markets have also increased recently. In contrast, new dwelling activity is still declining and growth in housing credit remains low. Demand for credit by investors is subdued and credit conditions, especially for small and medium-sized businesses, remain tight. Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.

The easing of monetary policy this year is supporting employment and income growth in Australia and a return of inflation to the medium-term target range. The lower cash rate has put downward pressure on the exchange rate, which is supporting activity across a range of industries. It has also boosted asset prices, which in time should lead to increased spending, including on residential construction. Lower mortgage rates are also boosting aggregate household disposable income, which, in time, will boost household spending.

Given these effects of lower interest rates and the long and variable lags in the transmission of monetary policy, the Board decided to hold the cash rate steady at this meeting while it continues to monitor developments, including in the labour market. The Board also agreed that due to both global and domestic factors, it was reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

Interest rate predictions

The decision to hold comes after the central bank pulled the trigger in October, June and July, and at a time of rapid growth in the Australian property market.

Over November, the Australian property market accelerated to etch its largest monthly growth since 2003, 1.7 per cent.

The RBA’s decision was also unsurprising to many economists who predicted the bank would wait to see how Christmas and New Year spending activity impacted the economy, before making another decision in February 2020.

“The RBA is in no rush to cut the cash rate a fourth time in 2019 given the length of time it takes for monetary policy stimulus to absorb into the economy,” Mortgage Choice’s Susan Mitchell said prior to the decision. She was one of the 32 of 33 commentators on Finder’s RBA interest rate panel to predict a hold verdict.

“The bank is likely to wait and see whether positive signs emerge from the economy before acting again. That being said, forecasts for wage growth, inflation and the labour market suggest that the Board may resort to cutting the cash rate once again in the new year.”

LJ Hooker’s Mathew Tiller agreed, noting the record-low levels the cash rate is at.

“Given the cash rate is already at record low levels and the lacklustre economic response to the recent rate cuts, the RBA will hold steady this month and reassess conditions in the new year before cutting rates further,” he said.

CUA’s Tim Moore also predicted the RBA would hold, but said it’s only a matter of time before the central bank cuts again.

“They are willing to wait and see the outcome from previous cuts, whilst giving the consumer time to digest the changes. Not a question of if but more so timing.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance