RBA cuts cash rate to new record-low: Why don’t the banks pass the full cut on?

Yesterday, the Reserve Bank of Australia cut the official cash rate to a new record-low of 0.75 per cent after GDP grew just 1.4 per cent this year - the lowest growth since the Global Financial Crisis.

While in theory, homeowners with variable home loans will feel some relief on their mortgage repayments, in practice, the banks don’t often pass on the full cut.

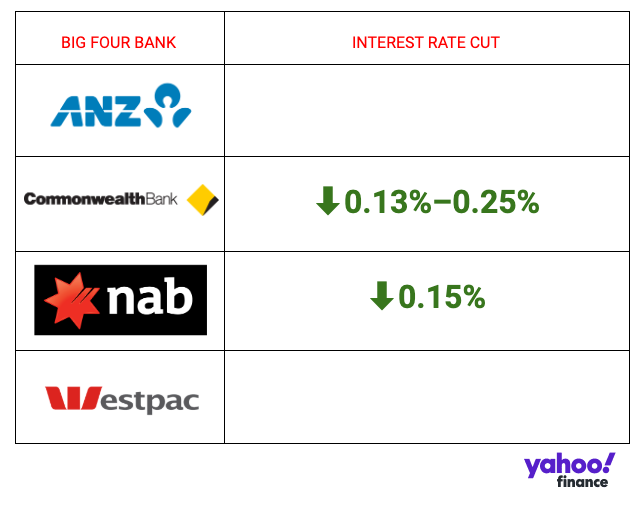

Since yesterday’s cut, just two of the big four banks have announced a rate cut to home loans: the Commonwealth Bank of Australia has dropped rates on owner-occupied homes by 0.13 per cent, while NAB has cut rates on owner-occupied homes to 0.15 per cent.

Also read: Cash rate dropped to 0.75 per cent: Has your bank passed the October rate cut on?

Also read: Shock rate decision: Reserve Bank of Australia issues ‘death knell’ for country’s savers

Westpac and ANZ have yet to announce a rate cut.

Treasurer Josh Frydenberg told Nine Network the banks ‘have a lot of explaining to do,’ with regards to not passing on the entire rate cut.

“Customers should vote with their feet,” he said.

But why don’t banks pass on the entire rate cut?

The rates that banks offer on loans to households and businesses are partly driven by the cost of their funding - or the cost of borrowing money from the wholesale market to lend to Aussies.

On top of that, the RBA stated rates are influenced by the risks that come with lending, like credit risks associated with loans, and competition in the financial sector.

Around half of banks’ funding (43 per cent) comes from deposits, and the remaining funding comes from borrowing money from other banks and investors, which is called ‘wholesale funding’.

In the years since the GFC, those wholesale funding costs increased because investors demanded a higher rate of return to reflect a higher degree of risk in lending their money, which is why lending rates have been high for the last few years.

The RBA said interest rates have since dropped in those wholesale markets, which means banks’ funding costs have gone down, and that decrease should be passed on to consumers.

But given the other half of banks’ funding comes from deposits, and banks aren’t making a lot of money on deposits given the low rates, they may be reluctant to do so.

In announcing its rate reduction, CBA stated it was “currently not feasible” to pass on the full rate reduction to consumers, and stated it needed to ‘balance the interests’ of its stakeholders.

In NAB’s announcement, chief customer officer Mike Baird said NAB largely relief on customer deposits in order to lend: “With the RBA cash rate at historic lows, the cost of deposits comes under pressure,”

AMP chief economist Shane Oliver said he didn’t expect banks to pass on the rate cut in full, with “increasing pressure on profit margins as an increasing proportion of deposit rates hit zero”.

“They are likely to pass on around 0.2 per cent on average,” Oliver said.

“This will take headline (standard variable) mortgage rates to their lowest since the early 1950s, and many of the mortgage rates borrowers actually pay to new record lows.”

Will the RBA cut rates further?

They may cut further, but Oliver said it’s “unlikely” they’ll cut to zero or negative “because it’s doubtful the banks would pass it on”.

“Negative rates would be bad for confidence and there is little evidence that negative rates in Europe and Japan have worked,” Oliver said.

“Rather once rate cuts are exhausted at 0.25 per cent the RBA would likely turn to other unconventional monetary policy measures if needed next year including quantitative easing.

“This is not our base case but the probability of it occurring is rising.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance