Raymond James (RJF) Q1 Earnings Top on Solid NII, Provisions Up

Raymond James’ RJF first-quarter fiscal 2023 (ended Dec 31) adjusted earnings of $2.29 per share surpassed the Zacks Consensus Estimate of $2.21. The bottom line was up 6% from the prior-year quarter.

Higher interest rates and a rise in loan demand acted as tailwinds, which led to a drastic surge in net interest income (NII). Further, the performance of the Private Client Group was robust. Also, the acquisitions over the past years supported the company’s financials to some extent. Further, expenses declined during the quarter.

Yet, a poor investment banking performance amid heightened geopolitical and macroeconomic ambiguities hurt the Capital Markets segment’s results. Also, RJF recorded bank loan provision for credit losses during the quarter on worsening macroeconomic outlook.

Net income available to common shareholders (GAAP basis) was $507 million, up 14% year over year.

Revenues Stable, Costs Down

Net revenues were $2.79 billion, relatively stable year over year. The top line, however, missed the Zacks Consensus Estimate of $2.87 billion.

Segment-wise, in the reported quarter, RJ Bank registered a surge of 178% from the prior year in net revenues. Also, the Private Client Group recorded 12% growth in net revenues. Capital Markets’ top line plunged 52%, while Asset Management’s net revenues fell 12%. Others recorded negative revenues of $296 million compared with negative revenues of $76 million in the prior-year quarter.

Non-interest expenses were down 4% to $2.13 billion. Also, RJF recorded a bank loan provision for credit losses of $14 million against a benefit of $11 million in the prior-year quarter.

As of Dec 31, 2022, client assets under administration were $1.17 trillion, down 7% from the end of the prior-year quarter. Financial assets under management were $185.9 billion, down 9%.

Strong Balance Sheet & Capital Ratios

As of Dec 31, 2022, Raymond James reported total assets of $77 billion, down 5% from the prior quarter. Total equity grew 4% sequentially to $9.7 billion.

Book value per share was $45.28, up from $41.45 as of Dec 31, 2021.

As of Dec 31, 2022, total capital ratio was 21.5% compared with 27% as of Dec 31, 2021. Tier 1 capital ratio was 20.3% compared with 25.9% as of December 2021-end.

Return on common equity (annualized basis) was 21.3% at the end of the reported quarter compared with 21.2% a year ago.

Share Repurchase Update

During the reported quarter, RJF repurchased 1.29 million shares for $138 million.

As of Jan 23, 2023, approximately $1.4 billion remained under the buyback authorization.

Our Take

Raymond James’ global diversification efforts, strategic acquisitions and higher rates are expected to keep supporting top-line growth. However, continuously elevated operating expenses, worsening operating backdrop and the volatile nature of capital markets businesses are near-term concerns.

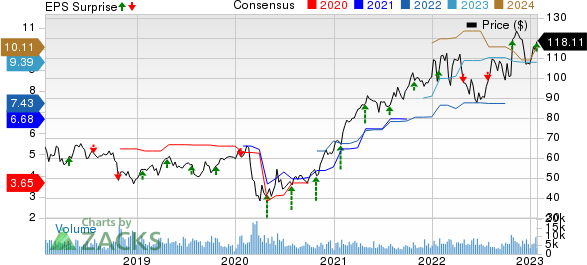

Raymond James Financial, Inc. Price, Consensus and EPS Surprise

Raymond James Financial, Inc. price-consensus-eps-surprise-chart | Raymond James Financial, Inc. Quote

Currently, Raymond James carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance Other Brokerage Firms

Charles Schwab’s SCHW fourth-quarter 2022 adjusted earnings of $1.07 per share missed the Zacks Consensus Estimate of $1.10. The bottom line, however, soared 24% from the prior-year quarter. Our estimate for adjusted earnings was $1.05 per share.

SCHW’s results benefited from higher rates, which led to a rise in NII. Thus, revenues witnessed an improvement despite higher volatility hurting trading income. Also, the absence of fee waivers and solid brokerage account numbers acted as tailwinds during the quarter. However, higher expenses were a headwind.

Interactive Brokers Group’s IBKR fourth-quarter 2022 adjusted earnings per share of $1.30 handily surpassed the Zacks Consensus Estimate of $1.16. The bottom line reflects a rise of 56.6% from the prior-year quarter.

Results were primarily aided by an improvement in revenues. Also, the capital position was strong. However, higher expenses and a fall in daily average revenue trades were headwinds for IBKR.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance