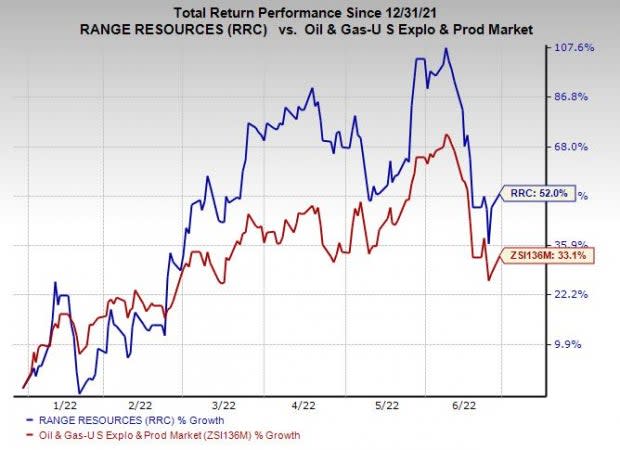

Range Resources (RRC) Surges 52% YTD: What's Driving It?

Range Resources Corporation’s RRC shares have jumped 52% year to date compared with 33.1% growth of the composite stocks belonging to the industry.

The Zacks Rank #1 (Strong Buy) company, with a market cap of more than $7 billion, has witnessed a rise in the Zacks Consensus Estimate for 2022 and 2023 earnings per share in the past 60 days.

Image Source: Zacks Investment Research

Let's delve deeper into the factors behind the stock’s price appreciation.

Factors Favoring the Stock

The price of natural gas has skyrocketed almost 77% so far this year. The massive improvement in the commodity price is a boon for Range Resources’ operations since it is a leading producer of natural gas and natural gas liquids in the United States.

Apart from geopolitical uncertainties resulting from Russia’s invasion of Ukraine, a remarkable turnaround in the energy industry has been prompted by a demand spike due to the reopening of economies and a rebound in activity. As most of its production comprises natural gas, Range Resources is well-positioned to capitalize on the mounting clean energy demand.

In the prolific Appalachian Basin, the company has a strong focus on stacked-pay gas projects. RRC has a multi-decade inventory of premium drilling locations in the Marcellus shale play of the Appalachian basin, which are likely to provide production for several decades. It has 3,100 undrilled wells in the region. Of the total, 2,600 wells are liquid-rich, while the rest has a natural gas majority. Also, the company has the lowest emission intensity among the upstream companies in the United States.

For 2022, Range Resources expects total production of 2.12-2.16 billion cubic feet equivalent per day (Bcfe/d), the mid-point of which suggests an improvement from 2.13 Bcfe/d reported last year. Higher production is expected to boost the company’s bottom line. Notably, the upstream energy firm expects the free cash flow to exceed $1.4 billion in 2022, which could be the highest among Appalachian players.

Range Resources has a strong focus on returning capital to shareholders. The company has reinstated its regular quarterly cash dividend, expected to start in the second half of this year. Range Resources anticipated its annual dividend rate at 32 cents per share. Also, RRC’s board of directors authorized a $500-million share repurchase program, which is likely to be funded with its free cash flow generation.

Thus, the Range Resources stock appears to be a solid bet now, based on the strong fundamentals and compelling business prospects.

Other Key Picks

Investors interested in the energy sector can look at the following companies that also presently flaunt a Zacks Rank #1. You can see the complete list of today's Zacks #1 Rank stocks here.

Imperial Oil Limited IMO is one of the largest integrated oil companies in Canada. IMO’s debt-to-capitalization of 18.9% is quite conservative versus 32.1% for the sub-industry to which it belongs.

Imperial Oil remains strongly committed to returning money to investors via dividends. The company’s board of directors approved a hike in quarterly dividend payment. The new payout of 34 Canadian cents is 26% above the prior dividend. Further, Imperial Oil revised its existing share repurchase policy to buy up to 4% of outstanding common shares.

Phillips 66 PSX is the leading player in each of its operations like refining, chemicals and midstream in terms of size, efficiency and strengths. Precisely, it has an oil and gas pipeline network of 22,000 miles, which is expected to increase in the coming days.

Phillips 66 has hiked its quarterly dividend to 97 cents per share, representing an increase of 5% from the prior quarter. With the recent resumption of the stock repurchase program, the increment in the quarterly dividend represents Phillips 66’s strong focus on returning capital to stockholders. Since the company’s inception in 2012, this has resulted in its 11th annual dividend hike. This has resulted in an 18% compound annual growth rate.

Petrobras PBR is one of the largest publicly-traded Latin American oil companies, which dominates Brazil’s oil and gas sector. PBR produces most of Brazil’s crude oil and natural gas and accounts for almost the entire refining capacity of the country.

Petrobras, burdened with a huge debt load, has laid strong emphasis on debt reduction in its recent five-year business management plan (2022-2026) to strengthen its credit rating. As the company focuses on regaining its financial footing by selling assets and curtailing debt load, it has successfully managed to lower gross debt below its 2022 target of $60 billion in the third quarter of 2021, well ahead of time. Post the latest quarterly earnings results, the figure is pegged at $58.6 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Imperial Oil Limited (IMO) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance