I Ran A Stock Scan For Earnings Growth And Eumundi Group (ASX:EBG) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Eumundi Group (ASX:EBG), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Eumundi Group

Eumundi Group's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. You can imagine, then, that it almost knocked my socks off when I realized that Eumundi Group grew its EPS from AU$0.023 to AU$0.12, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Eumundi Group is growing revenues, and EBIT margins improved by 7.1 percentage points to 14%, over the last year. That's great to see, on both counts.

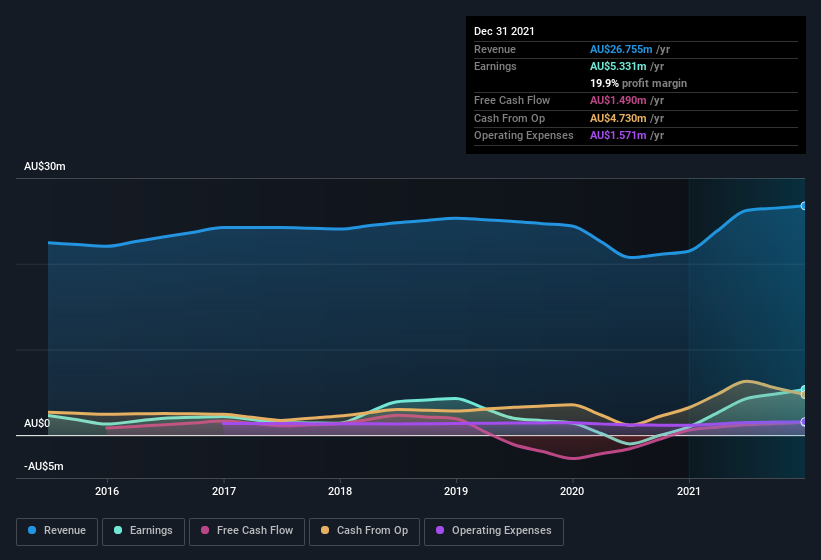

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Eumundi Group isn't a huge company, given its market capitalization of AU$46m. That makes it extra important to check on its balance sheet strength.

Are Eumundi Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first; I didn't see insiders sell Eumundi Group shares in the last year. But the really good news is that Steven Shoobridge spent AU$370k buying stock stock, at an average price of around AU$0.96. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

On top of the insider buying, we can also see that Eumundi Group insiders own a large chunk of the company. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about AU$30m riding on the stock, at current prices. That's nothing to sneeze at!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Suzanne Jacobi-Lee, is paid less than the median for similar sized companies. For companies with market capitalizations under AU$284m, like Eumundi Group, the median CEO pay is around AU$412k.

The Eumundi Group CEO received AU$238k in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Eumundi Group To Your Watchlist?

Eumundi Group's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Eumundi Group belongs on the top of your watchlist. It is worth noting though that we have found 5 warning signs for Eumundi Group (1 doesn't sit too well with us!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Eumundi Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance