Is Qutoutiao (NASDAQ:QTT) Weighed On By Its Debt Load?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Qutoutiao Inc. (NASDAQ:QTT) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Qutoutiao

What Is Qutoutiao's Debt?

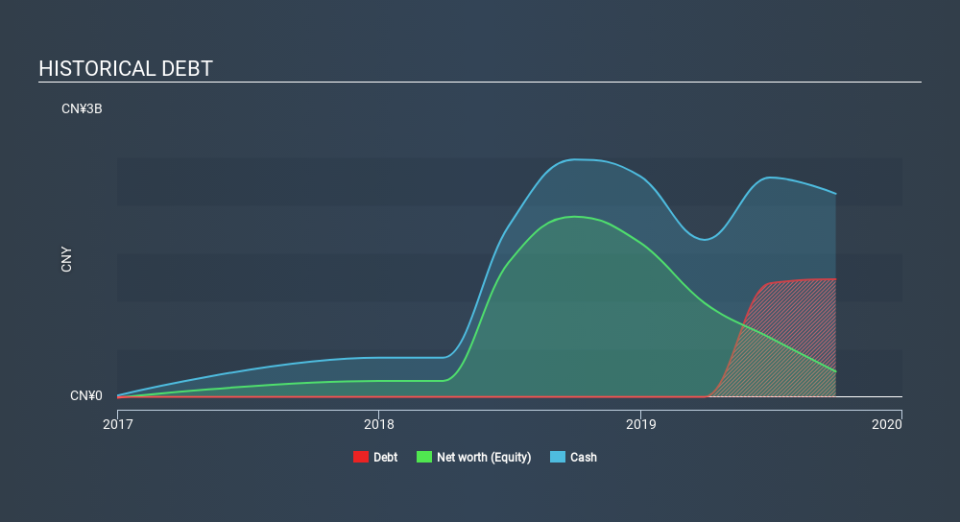

As you can see below, at the end of September 2019, Qutoutiao had CN¥1.23b of debt, up from none a year ago. Click the image for more detail. But on the other hand it also has CN¥2.12b in cash, leading to a CN¥893.6m net cash position.

How Healthy Is Qutoutiao's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Qutoutiao had liabilities of CN¥1.57b due within 12 months and liabilities of CN¥1.29b due beyond that. Offsetting these obligations, it had cash of CN¥2.12b as well as receivables valued at CN¥493.1m due within 12 months. So its liabilities total CN¥244.6m more than the combination of its cash and short-term receivables.

Given Qutoutiao has a market capitalization of CN¥8.98b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Qutoutiao boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Qutoutiao can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Qutoutiao wasn't profitable at an EBIT level, but managed to grow its revenue by 169%, to CN¥5.2b. So there's no doubt that shareholders are cheering for growth

So How Risky Is Qutoutiao?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Qutoutiao had negative earnings before interest and tax (EBIT), truth be told. Indeed, in that time it burnt through CN¥1.6b of cash and made a loss of CN¥2.5b. But at least it has CN¥893.6m on the balance sheet to spend on growth, near-term. The good news for shareholders is that Qutoutiao has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Qutoutiao (of which 1 is a bit concerning!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance