A Quick Analysis On GRC International Group's (LON:GRC) CEO Salary

This article will reflect on the compensation paid to Alan Calder who has served as CEO of GRC International Group plc (LON:GRC) since 2017. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for GRC International Group

Comparing GRC International Group plc's CEO Compensation With the industry

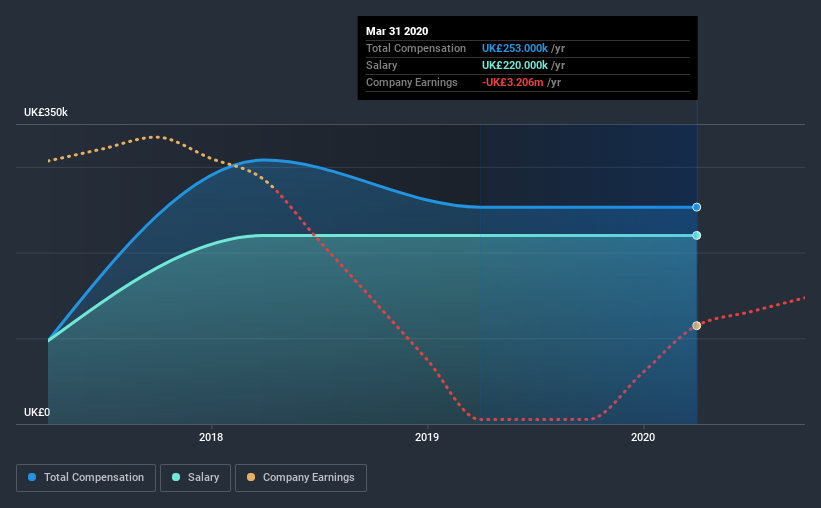

At the time of writing, our data shows that GRC International Group plc has a market capitalization of UK£25m, and reported total annual CEO compensation of UK£253k for the year to March 2020. That is, the compensation was roughly the same as last year. Notably, the salary which is UK£220.0k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under UK£143m, the reported median total CEO compensation was UK£252k. So it looks like GRC International Group compensates Alan Calder in line with the median for the industry. Furthermore, Alan Calder directly owns UK£7.5m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£220k | UK£220k | 87% |

Other | UK£33k | UK£33k | 13% |

Total Compensation | UK£253k | UK£253k | 100% |

On an industry level, around 67% of total compensation represents salary and 33% is other remuneration. GRC International Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

GRC International Group plc's Growth

Over the last three years, GRC International Group plc has shrunk its earnings per share by 43% per year. Its revenue is down 11% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has GRC International Group plc Been A Good Investment?

Given the total shareholder loss of 71% over three years, many shareholders in GRC International Group plc are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we noted earlier, GRC International Group pays its CEO in line with similar-sized companies belonging to the same industry. On the other hand, EPS growth and total shareholder return have been negative for the last three years. It's tough to call out the compensation as inappropriate, but shareholders might not favor a raise before company performance improves.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 5 warning signs for GRC International Group you should be aware of, and 2 of them are potentially serious.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance