Quanta Services (PWR) Hits 52-Week High: What's Driving It?

Quanta Services, Inc. PWR crafts a new 52-week high of $181.83 on May 30, 2023. The stock pulled back to end the trading session at $181.17.

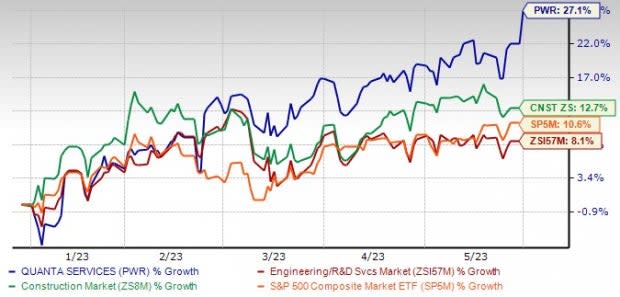

Notably, Quanta has gained 27.1% year to date, faring better than the Zacks Engineering - R and D Services industry and Zacks Construction sector’s 8.1% and 12.7% rallies, respectively. The stock has also outperformed the S&P 500 Index’s 10.6% rise.

The price surge was probably due to the news related to the debt ceiling bill. Notably, on May 30, the U.S. Congressional Budget Office said that it expects the debt-ceiling deal, agreed by House Republicans and President Joe Biden, will reduce budget deficits by about $1.5 trillion between 2023 and 2033. Although there will be a decline in discretionary outlays in the amount of $1.3 trillion over the 2024–2033 period, the bill will accelerate the permitting process for some energy projects.

Image Source: Zacks Investment Research

Meanwhile, Quanta continues to experience high demand for its infrastructure solutions that support energy-transition initiatives and increase reliability, safety and efficiency. Notably, project activity associated with renewable generation has been going strong and is expected to continue throughout the year.

Also, prospects of the Electric Power segment of Quanta remain robust, given customers’ investment in grid modernization programs intended to address the aging infrastructure, strengthen systems for resiliency against extreme weather conditions and support long-term economic growth. Quanta expects to generate $900 million of revenues from communication services, included in this segment, in 2023. It expects the operating income margin for the Electric Power segment, which has been dilutive to segment margins in the prior periods, to be within 10.7%-11.3% on a full-year basis.

Quanta remains uniquely positioned to capitalize on the megatrends and opportunities to lead the energy transition and enable technological development with initiatives such as electric vehicle charging infrastructure and undergrounding of electrical infrastructure gaining momentum.

However, this Zacks Rank #3 (Hold) company is vulnerable to supply-chain disruptions, regulatory challenges, and risks like project delays and stiff competition. Also, lower operating margins are concerning.

3 Better-Ranked Construction Stocks Hogging in the Limelight

Some better-ranked stocks, which warrant a look in the Construction sector, are:

Meritage Homes Corporation MTH: Meritage Homes’ strategic shift to a pure-play entry-level and first-move-up builder is expected to yield higher absorptions, aided by an improving community count growth trajectory.

Meritage Homes currently sports a Zacks Rank #1 (Strong Buy). Its shares have gained 28.4% this year. MTH has seen an upward estimate revision for 2023 and 2024 earnings by 19.6% and 18% over the past 30 days, respectively. Again, it carries an impressive VGM Score of A.

You can see the complete list of today’s Zacks #1 Rank stocks here.

PulteGroup Inc. PHM has been reaping benefits from the successful execution of strategic initiatives to boost profitability, with a focus on entry-level homes.

PulteGroup presently sports a Zacks Rank #1. The company's shares have jumped 46.5% year to date. The Zacks Consensus Estimate for its 2023 and 2024 earnings has been upwardly revised by 7.6% and 9.9%, respectively, over the past 30 days. Its earnings topped consensus estimate in three of the trailing four quarters and missed on one occasion, with the average surprise being 15.6%. Again, it carries an impressive VGM Score of A.

NVR Inc. NVR: The lot acquisition strategy helps the company to avoid financial requirements and risks associated with direct land ownership and land development. This strategy allows it to gain efficiencies and a competitive edge over its peers.

NVR currently flaunts a Zacks Rank #1. It has gained 21.9% this year. NVR has seen an upward estimate revision for 2023 and 2024 earnings over the past 30 days by 1.4% and 2.1%, respectively. Again, it carries an impressive VGM Score of B.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance