Q1 Rundown: Paychex (NASDAQ:PAYX) Vs Other HR Software Stocks

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Paychex (NASDAQ:PAYX) and its peers.

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

The 6 HR software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 0.7%. while next quarter's revenue guidance was 0.5% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and HR software stocks have had a rough stretch, with share prices down 14.6% on average since the previous earnings results.

Weakest Q1: Paychex (NASDAQ:PAYX)

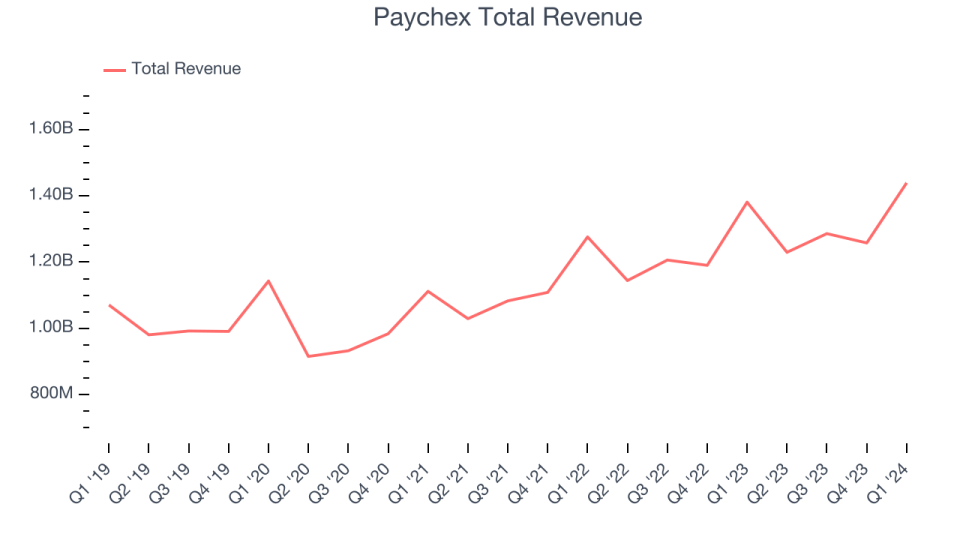

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

Paychex reported revenues of $1.44 billion, up 4.2% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company: Revenue unfortunately missed analysts' expectations, although EPS beat. With regards to the full year, revenue guidance missed expectations.

President and Chief Executive Officer , John Gibson said, "Total revenue growth in the third fiscal quarter reflected a lower contribution from our Employee Retention Tax Credit ("ERTC") Service as compared with the prior year period.

Paychex delivered the weakest performance against analyst estimates of the whole group. The stock is up 3.3% since the results and currently trades at $125.59.

Read our full report on Paychex here, it's free.

Best Q1: Dayforce (NYSE:DAY)

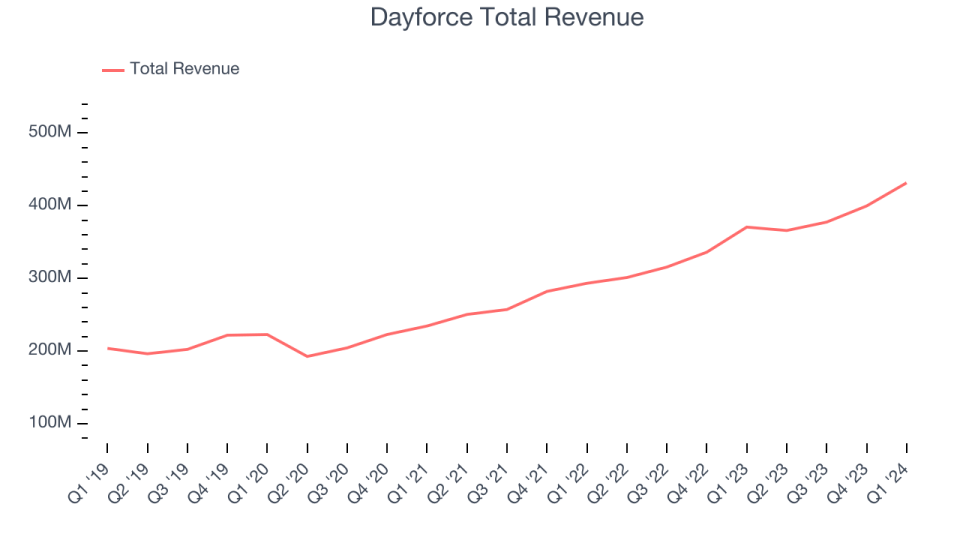

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE:DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Dayforce reported revenues of $431.5 million, up 16.4% year on year, outperforming analysts' expectations by 1.3%. It was a solid quarter for the company, with accelerating customer growth and a significant improvement in its gross margin.

The stock is down 19.9% since the results and currently trades at $49.16.

Is now the time to buy Dayforce? Access our full analysis of the earnings results here, it's free.

Paycor (NASDAQ:PYCR)

Found in 1990 in Cincinnati, Ohio, Paycor (NASDAQ: PYCR) provides software for small businesses to manage their payroll and HR needs in one place.

Paycor reported revenues of $187 million, up 15.8% year on year, in line with analysts' expectations. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and a miss of analysts' billings estimates.

Paycor had the weakest full-year guidance update in the group. The stock is down 35.6% since the results and currently trades at $11.27.

Read our full analysis of Paycor's results here.

Paycom (NYSE:PAYC)

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE:PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

Paycom reported revenues of $499.9 million, up 10.7% year on year, in line with analysts' expectations. It was a slower quarter for the company, with a decline in its gross margin.

The stock is down 24.3% since the results and currently trades at $141.06.

Read our full, actionable report on Paycom here, it's free.

Asure (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $31.65 million, down 4.3% year on year, surpassing analysts' expectations by 2%. It was a slower quarter for the company, with a miss of analysts' billings estimates.

Asure achieved the biggest analyst estimates beat and highest full-year guidance raise, but had the slowest revenue growth among its peers. The stock is down 0.6% since the results and currently trades at $7.89.

Read our full, actionable report on Asure here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance