Q1 Hotels, Resorts and Cruise Lines Earnings: Playa Hotels & Resorts (NASDAQ:PLYA) Impresses

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the hotels, resorts and cruise lines industry, including Playa Hotels & Resorts (NASDAQ:PLYA) and its peers.

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 15 hotels, resorts and cruise lines stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 1.4%. while next quarter's revenue guidance was 0.8% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the hotels, resorts and cruise lines stocks have fared somewhat better than others, they collectively declined, with share prices falling 4.1% on average since the previous earnings results.

Best Q1: Playa Hotels & Resorts (NASDAQ:PLYA)

Sporting a roster of beachfront properties, Playa Hotels & Resorts (NASDAQ:PLYA) is an owner, operator, and developer of all-inclusive resorts in prime vacation destinations.

Playa Hotels & Resorts reported revenues of $300.6 million, up 9.8% year on year, topping analysts' expectations by 6.3%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings and operating margin estimates.

Playa Hotels & Resorts pulled off the biggest analyst estimates beat of the whole group. The stock is down 10% since the results and currently trades at $8.5.

Is now the time to buy Playa Hotels & Resorts? Access our full analysis of the earnings results here, it's free.

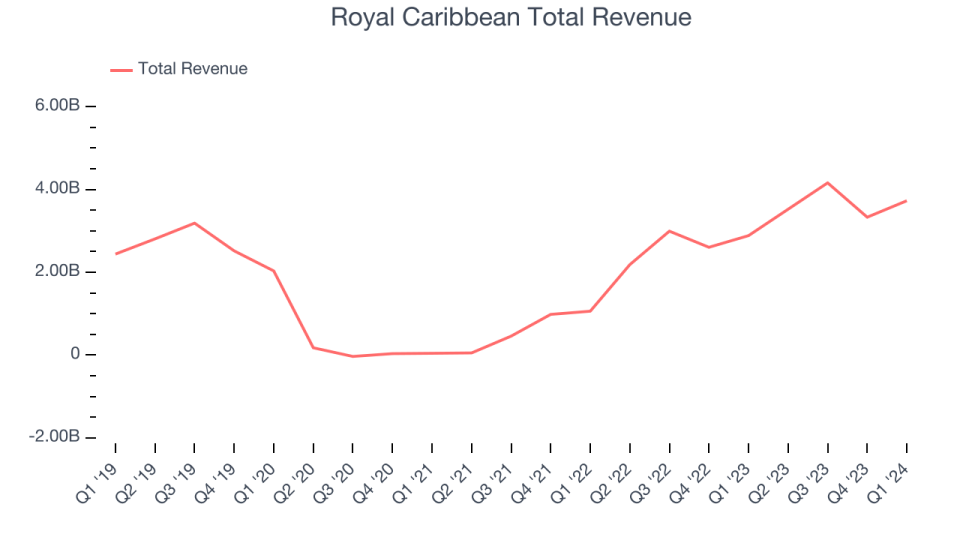

Royal Caribbean (NYSE:RCL)

Established in 1968, Royal Caribbean Cruises (NYSE:RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

Royal Caribbean reported revenues of $3.73 billion, up 29.2% year on year, outperforming analysts' expectations by 1.1%. It was a very strong quarter for the company, with optimistic earnings guidance for the next quarter and an impressive beat of analysts' earnings estimates.

Royal Caribbean scored the fastest revenue growth among its peers. The stock is up 10.5% since the results and currently trades at $151.06.

Is now the time to buy Royal Caribbean? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Choice Hotels (NYSE:CHH)

With almost 100% of its properties under franchise agreements, Choice Hotels (NYSE:CHH) is a hotel franchisor known for its diverse brand portfolio including Comfort Inn, Quality Inn, and Clarion.

Choice Hotels reported revenues of $331.9 million, down 0.3% year on year, falling short of analysts' expectations by 3.2%. It was a weak quarter for the company, with a miss of analysts' operating margin estimates and underwhelming earnings guidance for the full year.

Choice Hotels had the weakest performance against analyst estimates in the group. The stock is down 3.9% since the results and currently trades at $117.36.

Read our full analysis of Choice Hotels's results here.

Marriott Vacations (NYSE:VAC)

Spun off from Marriott International in 1984, Marriott Vacations (NYSE:VAC) is a vacation company providing leisure experiences for travelers around the world.

Marriott Vacations reported revenues of $1.20 billion, up 2.2% year on year, surpassing analysts' expectations by 1.9%. It was a mixed quarter for the company, with a miss of analysts' earnings estimates and underwhelming earnings guidance for the full year.

The stock is down 12.5% since the results and currently trades at $85.28.

Read our full, actionable report on Marriott Vacations here, it's free.

Norwegian Cruise Line (NYSE:NCLH)

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE:NCLH) is a premier global cruise company.

Norwegian Cruise Line reported revenues of $2.19 billion, up 20.3% year on year, falling short of analysts' expectations by 2%. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' operating margin estimates.

The stock is down 10.2% since the results and currently trades at $16.99.

Read our full, actionable report on Norwegian Cruise Line here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance