Q1 Ground Transportation Earnings: Covenant Logistics (NASDAQ:CVLG) Earns Top Marks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the ground transportation stocks, including Covenant Logistics (NASDAQ:CVLG) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 10 ground transportation stocks we track reported a mixed Q1; on average, revenues were in line with analyst consensus estimates. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, but ground transportation stocks have shown resilience, with share prices up 6.5% on average since the previous earnings results.

Best Q1: Covenant Logistics (NASDAQ:CVLG)

Started with 25 trucks and 50 trailers, Covenant Logistics (NASDAQ:CVLG) is a provider of expedited long haul freight services, offering a range of logistics solutions.

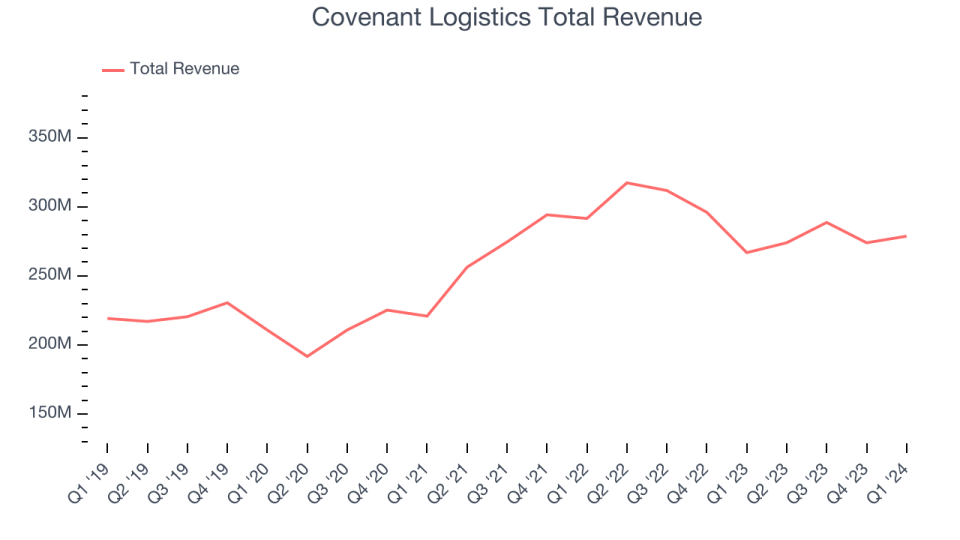

Covenant Logistics reported revenues of $278.8 million, up 4.5% year on year, in line with analysts' expectations. It was a very strong quarter for the company, with an impressive beat of analysts' Freight revenue revenue estimates and a decent beat of analysts' earnings estimates.

Chairman and Chief Executive Officer, David R. Parker, commented: “We are pleased to report first quarter earnings of $0.29 per diluted share and non-GAAP adjusted earnings of $0.84 per diluted share. The primary EPS adjustment excludes approximately $8.1 million in pre-tax acquisition related contingent consideration expense for the achievement of certain growth goals for the Lew Thompson & Son poultry feed and live haul business acquired in the second quarter of 2023.

The stock is up 11.8% since the results and currently trades at $49.23.

Is now the time to buy Covenant Logistics? Access our full analysis of the earnings results here, it's free.

Ryder System (NYSE:R)

Founded as a concrete hauling company, Ryder System (NYSE:R) provides comprehensive transportation and logistics services globally.

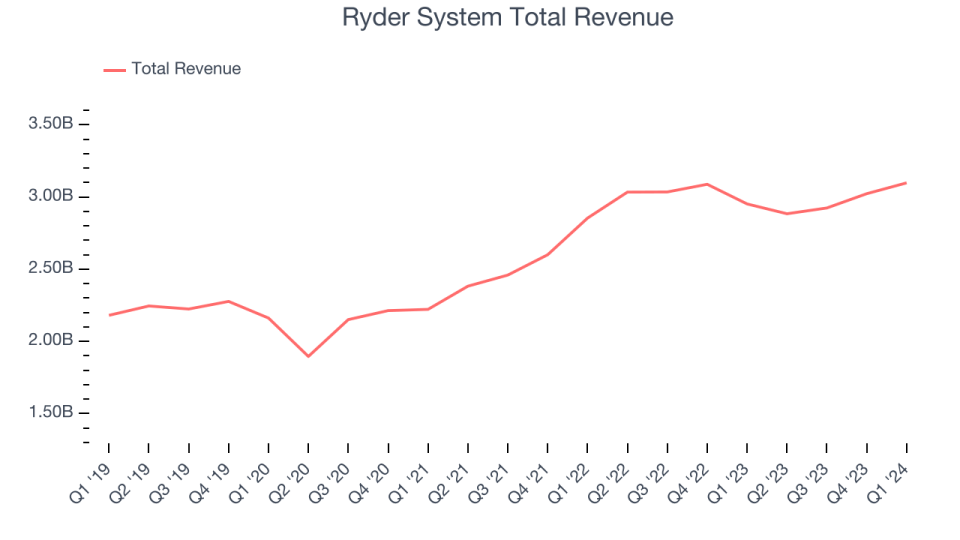

Ryder System reported revenues of $3.10 billion, up 4.9% year on year, outperforming analysts' expectations by 1.2%. It was a strong quarter for the company, with a decent beat of analysts' earnings.

The stock is up 13.1% since the results and currently trades at $123.14.

Is now the time to buy Ryder System? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Schneider National (NYSE:SNDR)

Established after the founder sold the family car, Schneider National (NYSE:SNDR) is a transportation and logistics company offering a portfolio of truckload, intermodal, and logistics solutions.

Schneider National reported revenues of $1.32 billion, down 7.7% year on year, falling short of analysts' expectations by 1.9%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is up 14% since the results and currently trades at $24.03.

Read our full analysis of Schneider National's results here.

Old Dominion Freight Line (NASDAQ:ODFL)

Founded by a husband and wife, Old Dominion Freight Line (NASDAQ:ODFL) specializes in less-than-truckload shipping services, offering logistical and supply chain management solutions.

Old Dominion Freight Line reported revenues of $1.46 billion, up 1.2% year on year, falling short of analysts' expectations by 0.8%. It was a slower quarter for the company, with a miss of analysts' volume and earnings estimates.

The stock is down 17.1% since the results and currently trades at $182.

Read our full, actionable report on Old Dominion Freight Line here, it's free.

Heartland Express (NASDAQ:HTLD)

Started as a hauler for Whirlpool washing machines, Heartland Express (NASDAQ:HTLD) is a transportation and logistics company specializing in truckload freight services.

Heartland Express reported revenues of $270.3 million, down 18.3% year on year, surpassing analysts' expectations by 2%. It was a weaker quarter for the company, with a miss of analysts' EPS estimates.

Heartland Express achieved the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 17.3% since the results and currently trades at $12.06.

Read our full, actionable report on Heartland Express here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance