Q1 Earnings Outperformers: Figs (NYSE:FIGS) And The Rest Of The Apparel, Accessories and Luxury Goods Stocks

Let's dig into the relative performance of Figs (NYSE:FIGS) and its peers as we unravel the now-completed Q1 apparel, accessories and luxury goods earnings season.

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel, accessories and luxury goods stocks we track reported an ok Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was 2.2% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the apparel, accessories and luxury goods stocks have fared somewhat better than others, they collectively declined, with share prices falling 2.1% on average since the previous earnings results.

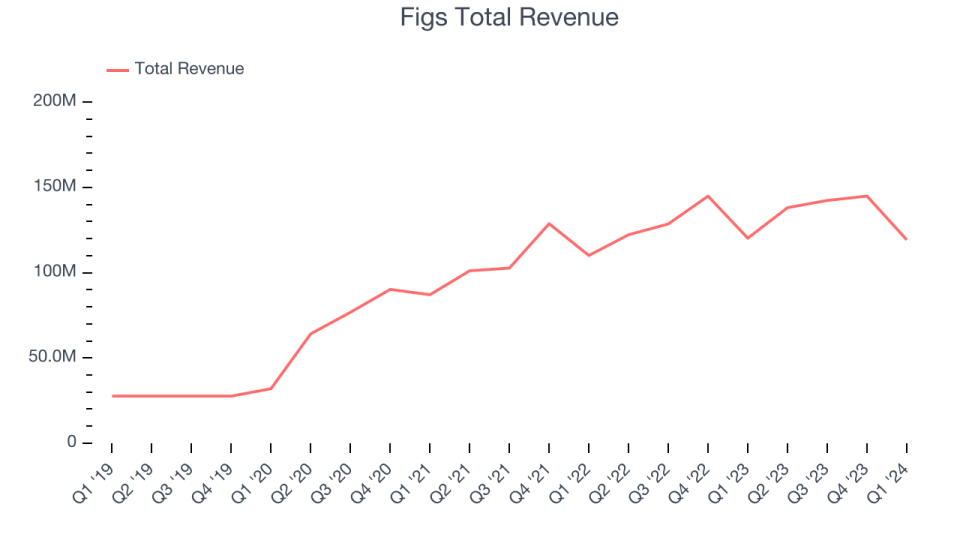

Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $119.3 million, down 0.8% year on year, topping analysts' expectations by 1.6%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates and a narrow beat of analysts' active customers estimates.

“Net revenues came in at the upper end of our expectations with adjusted EBITDA margin(1) exceeding our guidance. Importantly, we saw improved momentum in our business, particularly in repeat frequency trends, toward the end of the first quarter and into the second. This recent performance reflects strong engagement with our new product innovation and powerful storytelling campaigns as we returned to our roots,” said Trina Spear, Chief Executive Officer and Co-Founder.

The stock is down 0.5% since the results and currently trades at $5.6.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it's free.

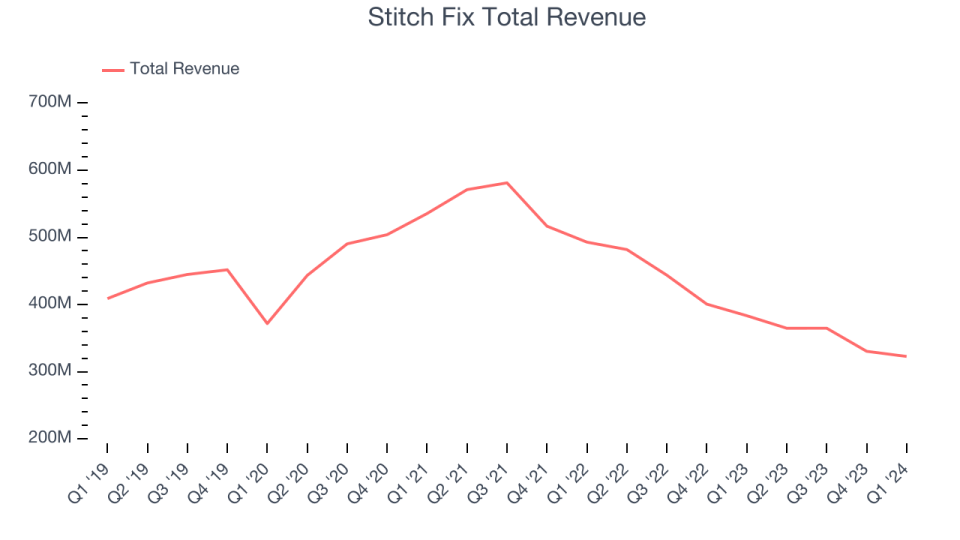

Best Q1: Stitch Fix (NASDAQ:SFIX)

One of the original subscription box companies, Stitch Fix (NASDAQ:SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

Stitch Fix reported revenues of $322.7 million, down 15.8% year on year, outperforming analysts' expectations by 5.4%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates and full-year revenue guidance exceeding analysts' expectations.

Stitch Fix scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 47% since the results and currently trades at $3.91.

Is now the time to buy Stitch Fix? Access our full analysis of the earnings results here, it's free.

ThredUp (NASDAQ:TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ:TDUP) is a leading online fashion resale marketplace that offers a wide selection of gently-used clothing and accessories.

ThredUp reported revenues of $79.59 million, up 4.8% year on year, falling short of analysts' expectations by 0.9%. It was a weak quarter for the company, with a miss of analysts' earnings estimates and revenue guidance for next quarter missing analysts' expectations.

ThredUp had the weakest full-year guidance update in the group. The stock is down 12.3% since the results and currently trades at $1.64.

Read our full analysis of ThredUp's results here.

Carter's (NYSE:CRI)

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE:CRI) is an American designer and marketer of children's apparel.

Carter's reported revenues of $661.5 million, down 4.9% year on year, surpassing analysts' expectations by 3.3%. It was a mixed quarter for the company, with underwhelming earnings guidance for the next quarter.

The stock is down 13.7% since the results and currently trades at $61.74.

Read our full, actionable report on Carter's here, it's free.

Under Armour (NYSE:UAA)

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE:UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

Under Armour reported revenues of $1.33 billion, down 4.7% year on year, in line with analysts' expectations. It was a slower quarter for the company, with underwhelming earnings guidance for the full year and a miss of analysts' constant currency revenue estimates.

The stock is down 5.7% since the results and currently trades at $6.4.

Read our full, actionable report on Under Armour here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance