Q1 Earnings Outperformers: Agilysys (NASDAQ:AGYS) And The Rest Of The Vertical Software Stocks

Let's dig into the relative performance of Agilysys (NASDAQ:AGYS) and its peers as we unravel the now-completed Q1 vertical software earnings season.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 16 vertical software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 0.9%. while next quarter's revenue guidance was 2.3% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and vertical software stocks have held roughly steady amidst all this, with share prices up 0.1% on average since the previous earnings results.

Agilysys (NASDAQ:AGYS)

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

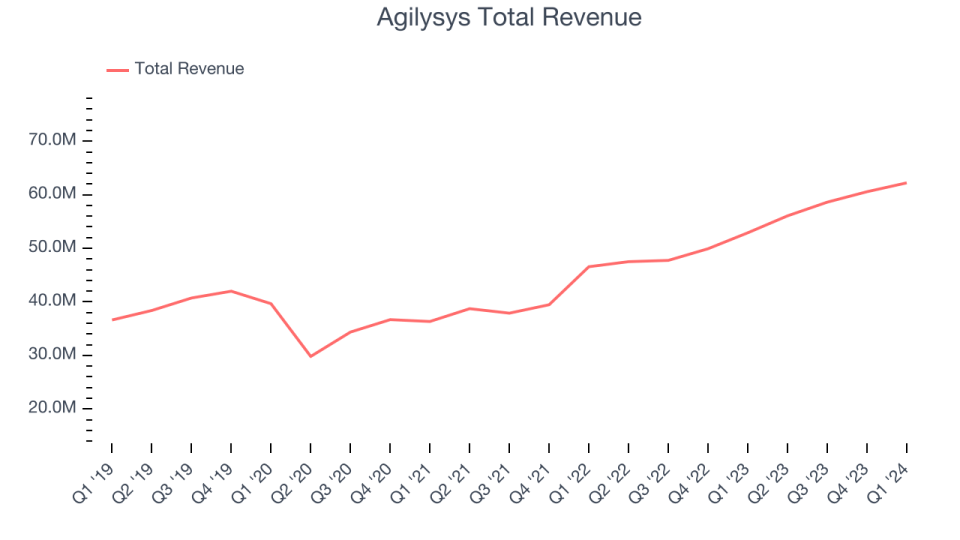

Agilysys reported revenues of $62.22 million, up 17.6% year on year, in line with analysts' expectations. It was an ok quarter for the company, with management forecasting decent growth but a decline in its gross margin.

Ramesh Srinivasan, President and CEO of Agilysys, commented, “We are pleased to report our ninth consecutive record revenue quarter and another record fiscal year with respect to overall revenue and profitability. The final fiscal year results were significantly better than our expectations at the beginning of the year and at the high end of revised increased expectations during the year.

The stock is up 16.4% since the results and currently trades at $93.5.

Is now the time to buy Agilysys? Access our full analysis of the earnings results here, it's free.

Best Q1: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point-of-sale (POS) hardware, software, and payments solutions for restaurants.

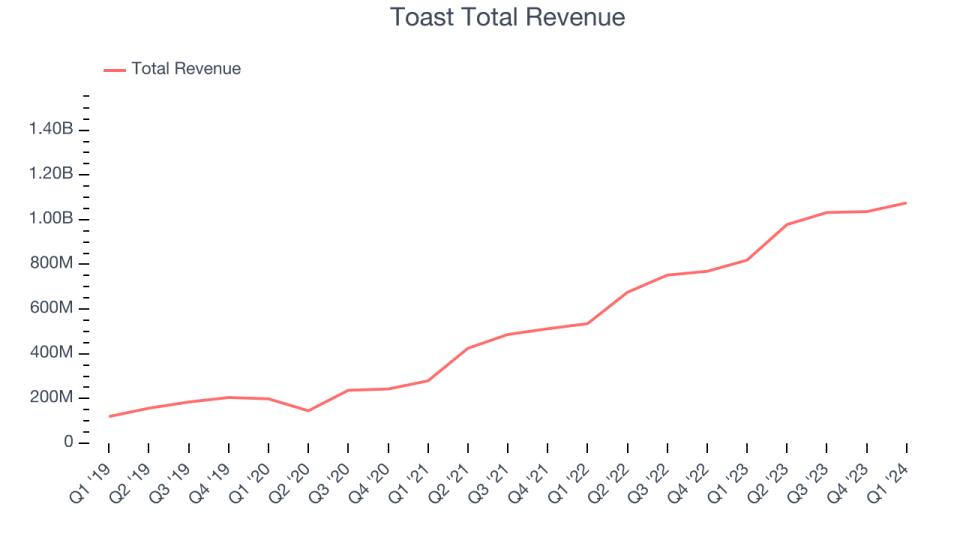

Toast reported revenues of $1.08 billion, up 31.3% year on year, outperforming analysts' expectations by 3.3%. It was a very strong quarter for the company, with a significant improvement in its gross margin and a solid beat of analysts' billings estimates.

Toast achieved the fastest revenue growth among its peers. The stock is up 7.4% since the results and currently trades at $25.49.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Weakest Q1: ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $466.6 million, down 8.4% year on year, falling short of analysts' expectations by 15.9%. It was a weak quarter for the company, with a decline in its gross margin and a miss of analysts' average contract value estimates.

ANSYS had the weakest performance against analyst estimates in the group. The stock is up 1.1% since the results and currently trades at $324.88.

Read our full analysis of ANSYS's results here.

Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Upstart reported revenues of $127.8 million, up 24.2% year on year, surpassing analysts' expectations by 2.4%. It was a slower quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its gross margin.

The stock is down 10.6% since the results and currently trades at $21.87.

Read our full, actionable report on Upstart here, it's free.

Olo (NYSE:OLO)

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Olo reported revenues of $66.51 million, up 27.3% year on year, surpassing analysts' expectations by 3.5%. It was a very strong quarter for the company, with an impressive beat of analysts' GMV (gross merchandise value) estimates and a solid beat of analysts' billings estimates.

Olo scored the highest full-year guidance raise among its peers. The stock is down 4.7% since the results and currently trades at $4.48.

Read our full, actionable report on Olo here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance