Putin’s Wartime Central Banker Tells Him What He Doesn’t Want to Hear

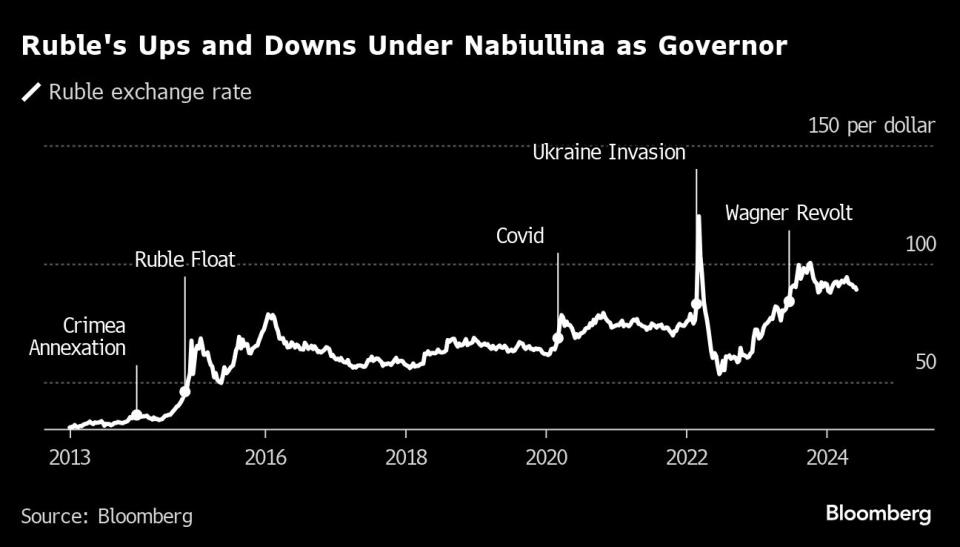

(Bloomberg) -- Russian President Vladimir Putin has cycled through ministers and battlefield generals since he first invaded Ukraine a decade ago. Through it all, one constant has been Elvira Nabiullina, a central bank governor he can’t do without.

Most Read from Bloomberg

Real Estate Investors Are Wiped Out in Bets Fueled by Wall Street Loans

Billionaire-Friendly Modi Humbled by Indians Who Make $4 a Day

Her bond with Putin, and whether it can endure for longer, may well come to define the economy that emerges from the largest armed conflict in Europe since World War II.

From early after Russia’s full-scale invasion began in February 2022, she adopted a monochrome attire in public, setting aside the brooches she used to telegraph clues to the market. It was her starting act of what passes for dissent in wartime Russia, one followed by an attempt to quit and then a slow-motion rupture over several key policies backed by Putin and his government.

A couple of years into her third term, Nabiullina has carved out room for nonconformism in a Russian establishment fixated on loyalty above all else. And as a renewed cabinet — anchored by some of her biggest critics — takes charge, Nabiullina remains an anomaly Putin is keen to protect.

Oleg Vyugin, a former top Bank of Russia official who’s known Nabiullina for over 20 years, says Putin views her as a straight talker untainted by corruption — with results to show for years punctuated by crises.

“Elvira has the exclusive right to tell the president what he doesn’t like,” Vyugin said. “She can talk openly about the situation and he accepts it.”

Now in her second decade at the helm of an institution that’s long been among the most independent in modern Russia, Nabiullina, 60, is months away from becoming its longest-serving governor and remains as one of only a handful of Russian women in positions of power.

Putin values and trusts Nabiullina’s counsel, seeing her presence as a matter of balancing out the president’s economic team, according to people familiar with the matter.

Other top technocrats with a say over economic policy are far more in sync with the warmongering of the Russian leader. Finance Minister Anton Siluanov speaks of molding the budget for “the task of ensuring victory,” while Maxim Oreshkin — Putin’s former economic aide recently promoted to Kremlin deputy chief of staff — now casts the war as a “global conflict with the West over Ukraine.”

A colleague who’s a senior government official describes Nabiullina as a principled idealist still playing by the book when the old rules of the game no longer apply.

For months, Nabiullina has sounded the alarm over spillovers into the economy from labor shortages caused by the war and a budget swollen by record defense spending.

The central bank also opposed tougher capital controls requiring exporters to sell their foreign earnings on the domestic market for rubles. Nabiullina alone didn’t sign off on a draft decree to reimpose the measures that Putin then approved and enacted over her objections late last year, according to people familiar with the situation.

And as authorities moved to seize shares from minority investors of the Solikamsk magnesium plant, a rare earth metals producer, the central bank lodged an appeal in May over a precedent-setting court decision that approved the confiscation.

Explaining the intervention in the case to which the central bank isn’t a party, Nabiullina seemed oblivious to the war tearing lives apart.

“We are concerned,” she said, “in the most serious way because protecting the rights of investors, protecting bona fide purchasers of shares through organized trading is the cornerstone of investor confidence in the financial market, in the stock market and trust in general.”

After the 2022 invasion of Ukraine, a joke made the rounds among Russian officials about the two big surprises that awaited Putin when the war began: his army was so useless it couldn’t deliver victory despite long preparation; and his technocrats were so smart that they kept the economy from crashing despite getting no warning of what was to come.

Interviews with officials and people who know Nabiullina reveal a person who developed tunnel vision around the economy as the war rages on. But as she explained behind the scenes after the fighting began, preventing an implosion at home served another purpose, too.

Economic collapse would mean even greater domestic repression and could create political chaos akin to what she saw in Russia after the Soviet Union’s breakup in the 1990s, Nabiullina said at the time. It was the central bank’s mission to avert that scenario: a government in financial dire straits wouldn’t hesitate to stamp out what’s left of freedom in Russia, she told colleagues.

Some of that sentiment spilled into public view less than a week after the war began. In a leaked video to the central bank’s staff, Nabiullina said “all of us would have wanted for this not to happen.” Describing an economic situation she called “extreme,” she pleaded to avoid “political debates” that “only burn our energy, which we need to do our job.”

What happened next hewed closely to a fire-fighting approach used by Nabiullina in crises past — though the central bank had to restrict the movement of capital abroad and gave up interventions in defense of the ruble after sanctions immobilized around $300 billion, or about half of its reserves.

A steep interest-rate hike and restrictions on foreign-exchange transactions staunched outflows and doused a financial panic. Soon windfall energy earnings flooded into government coffers and defense production shifted into high gear. A double-digit crash in the economy that some feared instead turned into a drop of barely over 1%, followed by a quick rebound.

“Emergency coordinated actions of the government and the central bank relieved the consequences of Western sanctions,” said Olga Belenkaya, an economist at Finam in Moscow. They “complemented each other and generally saved the economy,” she said.

Nabiullina has been on the Russian leader’s radar since 2006, when his hometown of St. Petersburg hosted a summit of Group of Eight leaders in what was perhaps a peak moment of global acceptance that Putin craved at the time. Russia lost its seat in the club of major industrial powers eight years later after invading and annexing Crimea from Ukraine.

During a short stretch working at a think tank in between government jobs, Nabiullina was responsible for preparing the agenda of the G-8 event that focused on themes such as energy independence. The program, which also featured the heads of major emerging nations like China and Brazil, ended up resonating internationally, and Putin took notice.

A year later, Putin picked Nabiullina as economy minister, and she stayed in the job after Dmitry Medvedev became president the following year. When Putin returned to the presidency in 2012, she joined him in the Kremlin as an economic aide and a year later became his surprise pick to take over the central bank.

Nabiullina — whose current term ends in 2027 — is safe in her role for the foreseeable future, especially given Putin’s track record of avoiding personnel purges that could be seen as destabilizing or made under pressure, said the people, who requested anonymity to speak about deliberations that aren’t public. Putin let her predecessor go early but waited with the decision for almost a year after installing a new government in 2012.

That doesn’t mean Nabiullina’s views will carry the day — and it certainly hasn’t made her immune to criticism.

Oreshkin has long engaged in public sparring with her, and Prime Minister Mikhail Mishustin regularly lobs complaints. Lawmakers and Russia’s biggest business group fault her for policies they consider excessively restrictive or erring too much on the side of fighting inflation.

Even before the invasion, Russian officials sneered at Nabiullina for an approach to monetary policy that focused on inflation above all else.

But few have done more to sanction-proof the Russian economy before the conflict or to contain the financial shock after it.

And she’s been known to toe the line. When Rosneft PJSC — headed by close Putin ally Igor Sechin — urgently needed $7 billion to repay a loan in 2014, Nabiullina received what was perceived as a request from Putin to help the state oil giant, according to people with knowledge of the matter.

The governor agreed out of concern Rosneft’s possible failure to make the payment could provoke a small financial crisis, they said. It’s an episode that stained her reputation more than any other before the war and has been blamed for crashing the ruble in December that year.

“She is a member of Putin’s team who clearly fulfills her role, but she has a greater degree of freedom than the government,” Vyugin said. “She also has the ability to be independent on account of her character. She can be relied on.”

Whatever follows, Putin’s aggression toward Ukraine — starting with the annexation of Crimea in 2014 — will probably serve as bookends to her time in the job.

Now sanctioned by the US, the UK and others for keeping the war economy on the rails, Nabiullina presided over a central bank that amassed one of the world’s biggest stockpiles of foreign currency and gold, culled lenders deemed mismanaged or under-capitalized, and brought inflation to the lowest in Russia’s post-Soviet history.

After the first waves of sanctions over Ukraine a decade ago, Nabiullina helped set up Russia’s own alternative to the SWIFT financial-messaging service and dumped US Treasuries from reserves.

And through it all, she basked in the praise of investors and counterparts abroad. In 2018, European Central Bank chief Christine Lagarde, a fellow opera-lover then in charge of the International Monetary Fund, likened Nabiullina’s qualities to those of a great conductor.

The music she churns out now isn’t to everyone’s liking — but Nabiullina is playing to an audience of one, even as she’s been unafraid to strike a cacophonous note.

But as the conflict warps the economy, Nabiullina may increasingly find herself on the sidelines and overruled by the man who has the last word. Sergey Dubinin, Russia’s central bank governor from 1995 to 1998, said he doubts “the further success of anti-inflationary policies” as now pursued by policymakers.

“We see that military spending is increasing every year, and this situation is very difficult for the central bank to control,” he said. “This is a kind of new reality for the coming decades.”

Most Read from Bloomberg Businessweek

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance